Exhibit 10.27

FINAL

NORTHWEST PARK

OFFICE LEASE

BY AND BETWEEN

NWP BUILDING 27 LLC

(AS LANDLORD)

AND

DESKTOP METAL, INC.

(AS TENANT)

FOR PREMISES AT

63 THIRD AVENUE

BURLINGTON, MASSACHUSETTS

|

TABLE OF CONTENTS |

|

TABLE OF CONTENTS |

2 |

|

ARTICLE 1 REFERENCE DATA |

4 |

|

|

1.1 |

SUBJECT REFERRED TO |

4 |

|

|

1.2 |

EXHIBITS |

5 |

|

ARTICLE 2 PREMISES AND TERM |

7 |

|

|

2.1 |

PREMISES |

7 |

|

|

2.2 |

TERM |

7 |

|

|

2.3 |

EXTENSION OPTION |

7 |

|

|

2.4 |

RIGHT OF FIRST OFFER |

9 |

|

ARTICLE 3 IMPROVEMENTS |

10 |

|

|

|

|

|

3.1 |

LANDLORD’S WORK |

10 |

|

|

3.2 |

TENANT’S WORK |

11 |

|

|

3.3 |

MECHANIC’S LIENS |

12 |

|

|

3.4 |

TI ALLOWANCE |

12 |

|

ARTICLE 4 RENT |

14 |

|

|

|

|

|

4.1 |

THE FIXED RENT |

14 |

|

|

4.2 |

ADDITIONAL RENT |

15 |

|

|

|

4.2.1 |

Real Estate Taxes |

15 |

|

|

|

4.2.2 |

Personal Property Taxes |

16 |

|

|

|

4.2.3 |

Operating Costs |

16 |

|

|

|

4.2.4 |

Insurance |

19 |

|

|

|

4.2.5 |

Utilities |

21 |

|

|

4.3 |

LATE PAYMENT OF RENT |

21 |

|

|

4.4 |

LETTER OF CREDIT |

22 |

|

|

|

|

|

|

|

|

ARTICLE 5 LANDLORD’S COVENANTS |

24 |

|

|

5.1 |

AFFIRMATIVE COVENANTS |

|

24 |

|

|

|

5.1.1 |

Heat and Air-Conditioning |

24 |

|

|

|

5.1.2 |

Electricity |

24 |

|

|

|

5.1.3 |

WATER |

24 |

|

|

|

5.1.4 |

Fire Alarm |

24 |

|

|

|

5.1.5 |

Repairs |

24 |

|

|

|

5.1.6 |

Landscaping; Snow Removal; Trash Removal |

24 |

|

|

5.2 |

INTERRUPTION |

|

24 |

|

|

5.3 |

OUTSIDE SERVICES |

|

25 |

|

|

|

|

|

|

|

ARTICLE 6 TENANT’S ADDITIONAL COVENANTS |

|

25 |

|

|

|

|

|

|

|

|

6.1 |

AFFIRMATIVE COVENANTS |

|

25 |

|

|

|

6.1.1 |

Perform Obligations |

25 |

|

|

|

6.1.2 |

Use |

25 |

|

|

|

6.1.3 |

Repair and Maintenance |

26 |

|

|

|

6.1.4 |

Compliance with Law |

26 |

|

|

|

6.1.5 |

Indemnification |

26 |

|

|

|

6.1.6 |

Landlord’s Right to Enter |

27 |

|

|

|

6.1.7 |

Personal Property at Tenant’s Risk |

27 |

|

|

|

6.1.8 |

Payment of Landlord’s Cost of Enforcement |

27 |

|

|

|

6.1.9 |

Yield Up |

27 |

|

|

|

6.1.10 |

Rules and Regulations |

28 |

|

|

|

6.1.11 |

Estoppel Certificate |

29 |

|

|

|

6.1.12 |

Landlord’s Expenses Re Consents |

29 |

|

|

6.2 |

NEGATIVE COVENANTS |

|

29 |

|

|

|

6.2.1 |

Assignment and Subletting |

29 |

|

|

|

6.2.2 |

Nuisance |

32 |

|

|

|

6.2.3 |

INTENTIONALLY OMITTED |

32 |

|

|

|

6.2.4 |

Floor Load; Heavy Equipment |

32 |

|

|

|

|

|

|

|

|

2

|

|

|

6.2.5 |

Installation, Alterations or Additions |

32 |

|

|

|

6.2.6 |

Abandonment |

35 |

|

|

|

6.2.7 |

Signs |

35 |

|

|

|

6.2.8 |

Parkingand Storage |

36 |

|

ARTICLE 7 CASUALTY OR TAKING |

36 |

|

|

|

|

7.1 |

TERMINATION |

36 |

|

7.2 |

RESTORATION |

36 |

|

7.3 |

AWARD |

36 |

|

8.1 |

EVENTS OF DEFAULT |

37 |

|

8.2 |

REMEDIES |

37 |

|

8.3 |

REMEDIES CUMULATIVE |

38 |

|

8.4 |

LANDLORD’S RIGHT TO CURE DEFAULTS |

38 |

|

8.5 |

EFFECT OF WAIVERS OF DEFAULT |

38 |

|

8.6 |

No WAIVER, ETC. |

38 |

|

8.7 |

No ACCORD AND SATISFACTION |

39 |

|

ARTICLE 9 RIGHTS OF MORTGAGE HOLDERS |

39 |

|

9.1 |

RIGHTS OF MORTGAGE HOLDERS |

39 |

|

9.2 |

LEASE SUPERIOR OR SUBORDINATE TO MORTGAGES |

39 |

|

ARTICLE 10 MISCELLANEOUS PROVISIONS |

40 |

|

10.1 |

NOTICES FROM ONE PARTY TO THE OTHER |

40 |

|

10.2 |

QUIET ENJOYMENT |

40 |

|

10.3 |

LEASE NOT TO BE RECORDED |

40 |

|

10.4 |

LIMITATION OF LANDLORD’S LIABILITY |

40 |

|

10.5 |

FORCE MAJEURE |

40 |

|

10.6 |

LANDLORD’S DEFAULT |

41 |

|

10.7 |

BROKERAGE |

41 |

|

10.8 |

APPLICABLE LAW AND CONSTRUCTION; MERGER; JURY TRIAL |

41 |

|

10.9 |

CONSENTS |

41 |

|

10.10 |

AUTHORITY |

41 |

|

10.11 |

COUNTERPARTS |

41 |

|

10.12 |

USA PATRIOT ACT |

42 |

|

10.13 |

EXECUTION AND DELIVERY |

42 |

|

10.14 |

ATTORNEY’S FEES |

42 |

|

ARTICLE 11 HAZARDOUS MATERIALS |

42 |

|

|

|

|

11.1 |

No RELEASES OF HAZARDOUS MATERIALS |

42 |

|

11.2 |

NOTICES OF RELEASE OF HAZARDOUS MATERIALS |

43 |

|

11.3 |

LANDLORD’S RIGHT TO INSPECT |

43 |

|

11.4 |

LANDLORD’S RIGHT TO AUDIT |

43 |

|

11.5 |

TENANT AUDIT |

43 |

|

11.6 |

REMEDIATION |

43 |

|

11.7 |

TENANT’S REPORTING REQUIREMENTS; MANAGEMENT AND SAFETY PLAN |

43 |

|

11.8 |

INDEMNIFICATION |

44 |

3

NORTHWEST PARK

OFFICE LEASE

ARTICLE 1

Reference Data

1.1 Subject Referred To.

Each reference in this Lease to any of the following subjects shall be construed to incorporate the data stated for that subject in this Section 1.1.

|

Date of this Lease: |

August 23, 2016 |

|

|

|

|

Building: |

The single-story building containing |

|

|

approximately 60,633 rentable square feet |

|

|

of floor area located in Northwest Park in |

|

|

Burlington, Massachusetts (hereinafter |

|

|

referred to as the “Park”) situated on a |

|

|

parcel of land known as 63 Third Avenue |

|

|

(the Building and such parcel of land |

|

|

hereinafter being collectively referred to as |

|

|

the “Property”). |

|

|

|

|

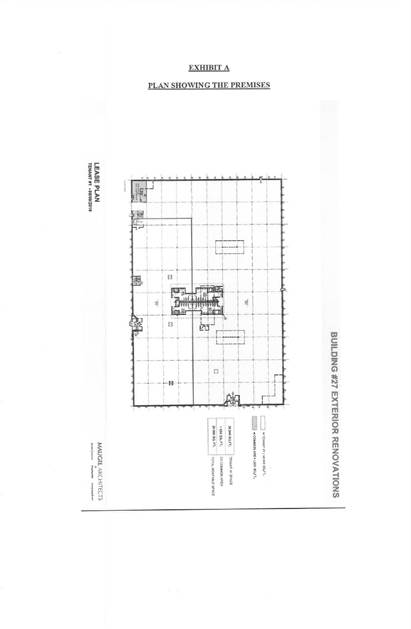

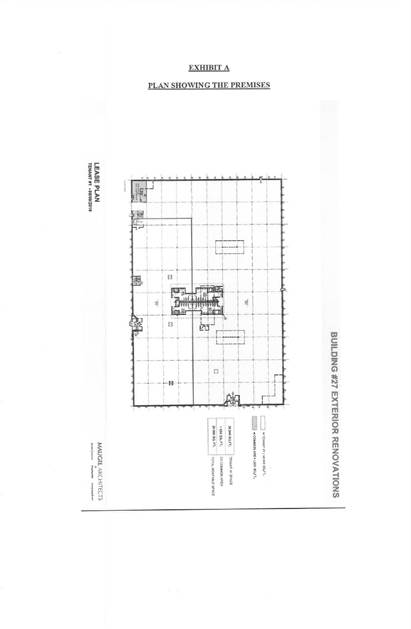

Premises: |

A portion of the Building, substantially as |

|

|

shown on Exhibit A attached hereto. |

|

Rentable Floor |

|

|

Area of Premises: |

Approximately 39,500 rsf |

|

|

|

|

Landlord: |

NWP Building 27 LLC, a Massachusetts |

|

|

limited liability company |

|

|

|

|

Original Notice |

c/o Nordblom Management Company, Inc. |

|

Address of Landlord: |

71 Third Avenue |

|

|

Burlington, Massachusetts 01803 |

|

|

|

|

Tenant: |

Desktop Metal, Inc., a Delaware corporation |

|

|

|

|

Original Notice |

Prior to the Commencement Date: |

|

Address of Tenant: |

29 Hartwell Avenue |

|

|

Lexington, MA 02421 |

|

|

|

|

|

Following the Commencement Date: |

|

|

63 Third Avenue |

|

|

Burlington, MA 01803 |

|

|

|

|

Commencement Date: |

The Date of this Lease |

|

|

|

|

Rent Commencement Date: |

The date that is the earlier of (a) the date |

|

|

that is sixty (60) days following the date |

|

|

that Landlord’s Work is Substantially |

|

|

Completed, and (b) April 1, 2017 (subject to |

|

|

the terms of Section 3.1) |

|

|

|

|

Expiration Date: |

The last day of the Partial Lease Year (as |

|

|

defined in Section 2.2) |

|

|

|

|

Initial Landlord’s Work Target Date: |

November 7, 2016 |

|

|

|

|

Remaining Landlord’s Work Target Date: |

February 7, 2017 |

4

|

TI Allowance: |

$1,382,500.00 |

|

|

|

|

Annual Fixed Rent Rate: |

Commencement Date — |

|

|

Rent Commencement Date: $0.00 |

|

|

|

|

|

Lease Year 1: $552,996.00 |

|

|

Lease Year 2: $572,748.00 |

|

|

Lease Year 3: $592,500.00 |

|

|

Lease Year 4: $612,252.00 |

|

|

Lease Year 5: $632,004.00 |

|

|

Lease Year 6: $651,756.00 |

|

|

Lease Year 7: $671,496.00 |

|

|

Partial Lease |

|

|

Year: $671,496.00(1) |

|

|

|

|

Monthly Fixed Rent Rate: |

Commencement Date — |

|

|

Rent Commencement Date: $0.00 |

|

|

|

|

|

Lease Year 1: $46,083.00 |

|

|

Lease Year 2: $47,729.00 |

|

|

Lease Year 3: $49,375.00 |

|

|

Lease Year 4: $51,021.00 |

|

|

Lease Year 5: $52,667.00 |

|

|

Lease Year 6: $54,313.00 |

|

|

Lease Year 7: $55,958.00 |

|

|

Partial Lease |

|

|

Year: $55,958.00 |

|

|

|

|

Letter of Credit Amount: |

$612,252.00 (subject to reduction as |

|

|

provided for in subsection 4.4.1) |

|

|

|

|

Tenant’s Percentage: |

The ratio of the Rentable Floor Area of the |

|

|

Premises to the total rentable area of the |

|

|

Building, which shall initially be deemed to |

|

|

be 65.15%. |

|

Initial Estimate of |

|

|

Tenant’s Percentage of |

|

|

Taxes for the Tax Year: |

$75,050.00 |

|

|

|

|

Initial Estimate of |

|

|

Tenant’s Percentage of |

|

|

Operating Costs for the |

|

|

Landlord’s Fiscal Year: |

$137,460.00 |

|

|

|

|

Permitted Uses: |

General office, research and development |

|

|

and light manufacturing (to the extent |

|

|

permitted by all applicable laws and codes) |

|

|

|

|

Public Liability Insurance Limits: |

|

|

|

|

|

Commercial General Liability: |

$1,000,000 per occurrence |

|

|

$2,000,000 general aggregate |

|

|

|

|

Commercial Excess Liability and/or |

$5,000,000 general aggregate |

|

Umbrella: |

$5,000,000 per occurrence |

(1) This an annualized rate based on the rate in effect for the Partial Lease Year.

5

1.2 Exhibits.

The Exhibits listed below in this section are incorporated in this Lease by reference and are to be construed as a part of this Lease.

EXHIBIT A Plan showing the Premises

EXHIBIT B Initial Landlord’s Work

EXHIBIT C Remaining Landlord’s Work

EXHIBIT D Work Change Order

EXHIBIT E Rules and Regulations

EXHIBIT E-1 Construction Rules and Regulations

EXHIBIT F Form Tenant Estoppel Certificate

EXHIBIT G Landlord’s Consent and Waiver

EXHIBIT H Form Letter of Credit

EXHIBIT I Initial List of Hazardous Materials and Chemicals

6

ARTICLE 2

Premises and Term

2.1 Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to and with the benefit of the terms, covenants, conditions and provisions of this Lease, the Premises, excluding the roof, exterior faces of exterior walls, the common stairways, stairwells, and pipes, ducts, conduits, wires, and appurtenant fixtures serving exclusively or in common other parts of the Building (and any areas, such as the space above the ceiling or in the walls, that may contain such pipes, ducts, conduits, wires or appurtenant fixtures), and if Tenant’s space includes less than the entire rentable area of any floor, excluding the central core area of such floor.

Tenant shall have, as appurtenant to the Premises, rights to use in common, subject to reasonable rules of general applicability to tenants of the Building from time to time made by Landlord of which Tenant is given notice: (a) the common walkways and driveways necessary for access to the Building, and (b) the common parking areas serving the Building.

Tenant shall be permitted to use, on a non-exclusive basis, up to one hundred and fifty (150) parking spaces in the parking area serving the Building (subject to reduction pursuant to subsection 6.2.4.1).

Landlord reserves the right from time to time, without unreasonable interference with use of the Premises: (a) to install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Building, or either, pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises or Building, (b) to alter or relocate any other common facility, (c) to make any repairs and replacements to the Premises which Landlord may deem necessary, and (d) in connection with any excavation made upon adjacent land of Landlord or others, to enter, and to license others to enter, upon the Premises to do such work as the person causing such excavation deems necessary to preserve the wall of the Building from injury or damage and to support the same.

2.2 Term. TO HAVE AND TO HOLD for an original term (the “Original Term”) beginning on the Commencement Date, which shall be the Date of this Lease, and ending on the Expiration Date, unless sooner terminated as hereinafter provided.

The term “Lease Year” as used herein shall mean a period of twelve (12) consecutive full calendar months. The first Lease Year shall begin on the Rent Commencement Date if the Rent Commencement Date is the first day of a calendar month; if not, then the first Lease Year shall commence on the Rent Commencement Date and terminate on the last day of the twelfth (12th) full calendar month after the Rent Commencement Date. Each succeeding Lease Year shall commence upon the anniversary date of the first Lease Year. The term “Partial Lease Year” as used herein shall mean the first (1st) two (2) full calendar months of the eighth (8th) Lease Year. The Partial Lease Year shall begin on the first day following the end of the seventh (7th) Lease Year.

2.3 Extension Option. A. Tenant shall have the option (the “Extension Option”) to extend the Term of this Lease for one additional period of five (5) years, to begin immediately upon the expiration of the Original Term of this Lease (the “Extended Term”), provided that each of the following conditions has been satisfied:

(i) As of the date of the Extension Notice (defined below) and as of the commencement of the Extended Term, Tenant shall not be in default and shall not have previously been in default of its obligations under this Lease beyond any applicable grace period;

(ii) Tenant shall have had net income for the 12-month period immediately preceding the date of the Extension Notice and for the 12-month period immediately preceding the commencement of the Extended Term; and

7

(iii) Simultaneously with the delivery of the Extension Notice and also at the commencement of the Extended Term, Tenant shall have delivered to Landlord an audited statement, prepared by Tenant’s accountant using generally accepted accounting principles, evidencing such net income during the fiscal year(s) of Tenant ending closest to the date of the Extension Notice and closest to the commencement of the Extended Term, as appropriate (provided in each case neither fiscal year has ended earlier than four (4) months prior to the date of the Extension Notice/commencement of the Extended Term, as applicable), together with financial statements (which may be unaudited, but which shall be certified by Tenant’s Chief Financial Officer) demonstrating that Tenant has continued to have a net income for any periods from the date of such audited statements until the date of the Extension Notice/commencement of the Extended Term, as applicable.

B. All of the terms, covenants and provisions of this Lease shall apply to the Extended Term except that the Annual Fixed Rent Rate for such extension period shall be the market rate at the commencement of the Extended Term (“Market Rate”), as designated by Landlord. If Tenant shall elect to exercise this Extension Option, it shall do so by giving Landlord written notice (the “Extension Notice”) of its intention to do so not later than one (1) year prior to the expiration of the Original Term of this Lease, time being of the essence thereof. If timely and properly Tenant gives such notice and satisfies the conditions specified above, the extension of this Lease shall be automatically effected without the execution of any additional documents. The Original Term and the Extended Term are hereinafter collectively called the “Term” or the “term”.

C. Not later than thirty (30) days following the giving of Tenant’s Extension Notice, Landlord shall notify Tenant of Landlord’s determination of the Market Rate for the Extended Term. Within fifteen (15) days after Landlord gives Tenant Landlord’s determination of the Market Rate, Tenant shall notify Landlord whether Tenant accepts or disputes such rate. If Tenant disagrees with Landlord’s determination, then Landlord and Tenant shall commence negotiations to agree upon the Market Rate. In any event, the Annual Fixed Rent Rate for the Extended Term shall not be less than the Annual Fixed Rent Rate in effect immediately prior to the Extended Term. If Landlord and Tenant are unable to reach agreement on the Market Rate within thirty (30) days after the date on which Landlord first gave Tenant Landlord’s proposal for the Market Rate, then the Market Rate shall be determined as provided below.

D. If Landlord and Tenant are unable to agree on the Market Rate by the end of said thirty (30)-day period, then within five (5) days thereafter, Landlord and Tenant shall each simultaneously submit to the other in a sealed envelope its good faith estimate of the Market Rate. If the higher of such estimates is not more than one hundred five percent (105%) of the other estimate, then the Market Rate shall be the average of the two estimates. If the matter is not resolved by the exchange of estimates, then Market Rate shall be determined by an independent arbitrator as set forth below.

E. Within seven (7) days after the exchange of estimates, the parties shall select, as an arbitrator, a mutually acceptable commercial real estate broker or appraiser licensed in the Commonwealth of Massachusetts specializing in the field of commercial office leasing in the Burlington, Massachusetts area, having no less than ten (10) years’ experience (an “Approved Arbitrator”). If the parties cannot agree on such person, then within a second period of seven (7) days, each shall select one Approved Arbitrator and the two appointed Arbitrators shall, within five (5) days, select a third Approved Arbitrator who shall be the final decision-maker (the “Final Arbitrator”). If one party shall fail to timely make such appointment, then the person chosen by the other party shall be the sole arbitrator. Once the Final Arbitrator has been selected as provided for above, then, as soon thereafter as practicable, but in any case within fourteen (14) days after his or her appointment, the arbitrator shall determine the Market Rate by selecting either the Landlord’s estimate of Market Rate or the Tenant’s estimate of Market Rate. Such arbitrator must choose the proposed Market Rate that he/she determines is closest to the actual market rental rate for the Premises. There shall be no discovery or similar proceedings. The arbitrator’s decision as to which estimate shall be the Market Rate for the Extended Term shall be rendered in writing to both Landlord and Tenant and shall be final and binding upon them and shall be the Annual Fixed Rent Rate for the Extended Term. The costs of the Final Arbitrator will be equally divided between Landlord and

8

Tenant. Any fees of any Approved Arbitrator or counsel engaged by Landlord or Tenant, however, shall be borne by the party that retained such Approved Arbitrator or counsel. If the dispute between the parties as to a market rate has not been resolved before the commencement of the Extended Term, then Tenant shall pay Fixed Rent under the Lease based upon the market rate designated by Landlord until either the agreement of the parties as to the market rate, or the decision of the Final Arbitrator, as the case may be, at which time Tenant shall pay any underpayment of Fixed Rent to Landlord, or Landlord shall refund any overpayment of Fixed Rent to Tenant.

F. Once the Market Rate has been determined, the parties shall promptly execute an amendment to this Lease setting forth the Fixed Rent for the Premises during the Extended Term.

G. Tenant’s rights to extend pursuant to this Section 2.3 are personal to the initial named Tenant, Desktop Metal, Inc., and may not be assigned under any circumstances except to a Permitted Transferee (as defined in Section 6.2.1).

H. With respect to any assignment or subletting during the Original Term of this Lease, such assignment shall not include the right granted to Tenant under this Section 2.3 hereinabove to extend the Term, and such sublease shall be for a term expiring no later than the Expiration Date.

2.4 Right of First Offer. During the Original Term of this Lease, Tenant shall have a one-time right of first offer to lease the ROFO Space (hereinafter defined) as it becomes available for lease after the Date of this Lease, subject to the terms and conditions contained below.

(B) “ROFO Space” shall mean all or a portion of the remaining 21,133 rentable square feet of tenant space in the Building. Tenant’s rights under this Section 2.4 shall arise only after the expiration of any lease for the ROFO Space entered into after the Date of this Lease.

(C) If the ROFO Space becomes available to lease as tenant space during the Original Term of this Lease, then prior to marketing such space, other than to the then tenant thereof, Landlord shall first notify Tenant in writing of the opportunity to lease the ROFO Space, on the condition that (i) the initial Tenant named herein, Desktop Metal, Inc., occupies the entire Premises, (ii) Tenant is not in default of its obligations under this Lease at the time the ROFO Space becomes available, and has not previously been in monetary default beyond the expiration of any applicable grace period under this Lease, and (iii) Tenant shall have had net income for the 12-month period immediately preceding the date of Landlord’s Preliminary ROFO Notice (as defined below).

(D) Within fifteen (15) days after Landlord’s written notification (“Landlord’s Preliminary ROFO Notice”), Tenant shall provide written notice to Landlord indicating whether it is interested in the possibility of leasing such ROFO Space. In the event that Tenant is interested in the possibility of leasing such ROFO Space, then simultaneously with the delivery of such written notice Tenant shall also deliver to Landlord an audited statement, prepared by Tenant’s accountant using generally accepted accounting principles, evidencing such net income during the period specified in clause (C)(iii) hereinabove. If Tenant timely so indicates its interest in the offered space, and satisfies the condition precedent set forth in subparagraph (C), then Landlord shall notify Tenant in writing (“Landlord’s Offer Notice”) specifying the terms on which Landlord intends to offer to lease the ROFO Space to the general market except that the term of the ROFO Space will be coterminous with the then remaining portion of the Term of this Lease. Landlord’s Offer Notice shall identify the ROFO Space and the terms of the offer in reasonable detail and shall include Landlord’s determination of the Market Rate (as such term is defined in Section 2.3) for the ROFO Space, which shall in no event be less than the then Annual Fixed Rent Rate in effect as of the commencement of the term with respect to the subject ROFO Space. Tenant shall within ten (10) days after the date of Landlord’s Offer Notice either accept or decline such offer in writing.

(E) If Tenant has accepted Landlord’s offer but believes that Landlord’s Offer Notice does not reflect the Market Rate, Tenant shall so notify Landlord stating in detail Tenant’s

9

estimate of Market Rate. If the parties are unable to agree upon the Market Rate within thirty (30) days after the date of Landlord’s Offer Notice, then the Market Rate shall be determined as set forth in subparagraph (F) below. If Tenant has declined Landlord’s offer (or if the offer is deemed rejected by Tenant’s failure timely to accept), then Landlord shall be free to offer the subject ROFO Space to the general market and Tenant shall have no further right under this Section 2.4 to lease the ROFO Space.

(F) If Tenant timely elects to lease such space, then the space shall, without further action by the parties, be leased by Tenant on the terms and conditions set forth in the Landlord’s Offer Notice, subject to arbitration of the Market Rate if necessary, and otherwise on all of the other terms and conditions of this Lease. If Landlord and Tenant cannot agree on the Market Rate for any ROFO Space, their dispute shall be resolved by a procedure similar to that set forth in Section 2.3 (D), (E) and (F)of this Lease, and the result thereof shall be binding on Landlord and Tenant. When implementing the procedure set forth in said Section 2.3(D), (E) and (F), the phrase “Extended Term” used therein shall be deemed to mean the applicable ROFO term.

(G) If there are twenty-four (24) or fewer months remaining in the Original Term at the time of any Landlord’s Offer Notice, Landlord shall have the option to require Tenant to concurrently exercise its Extension Option for the Extended Term as a prerequisite for accepting the ROFO Space. The Annual Fixed Rent Rate for the entire Premises, including the ROFO Space, during the Extended Term will be determined in the same manner as set forth in Section 2.3 (B) for determining the Annual Fixed Rent Rate during the Extended Term. If Tenant declines to exercise its option to extend the Lease for the Extended Term, then Tenant shall be deemed to have rejected Landlord’s offer for the subject ROFO Space and Landlord will be free to offer such space to the general market and Tenant shall have no further right under this Section 2.4 to lease the ROFO Space.

(H) This right of first offer is personal to Desktop Metal, Inc., and may not be assigned to any other party, except to a Permitted Transferee.

ARTICLE 3

Improvements

3.1 Landlord’s Work. Landlord shall, at Landlord’s expense, cause to be performed the work required by Exhibits B and C (collectively, “Landlord’s Work”). The first portion of Landlord’s Work is as set forth on Exhibit B attached to this Lease (the “Initial Landlord’s Work”). The second portion of Landlord’s Work is as set forth on Exhibit C attached to this Lease (the “Remaining Landlord’s Work”). Landlord shall commence Landlord’s Work following the Date of this Lease with the understanding that Landlord shall diligently attend to those components of the Initial Landlord’s Work as necessary to meet the Initial Landlord’s Work Target Date stated in Section 1.1 above in order for Tenant to commence Tenant’s Work (defined below). Landlord s Work shall be done in a good and workmanlike manner employing good materials and so as to conform to all applicable building laws. Tenant agrees that Landlord may make any changes in such work which may become reasonably necessary or advisable without approval of Tenant, provided written notice is promptly given to Tenant. It is the intent of the parties that Tenant may commence Tenant’s Work (as defined below) while Landlord is performing the Initial Landlord’s Work, with the understanding that all portions of Landlord’s Work (both the Initial Landlord’s Work and the Remaining Landlord’s Work) and Tenant’s Work can be performed simultaneously, it being agreed that Tenant and Landlord shall reasonably cooperate with each other to facilitate such work. Tenant wishes to move into that portion of the Premises that Tenant intends to use as laboratory space (the “Lab Space”) by December 31, 2016. Provided that the same will not delay the Substantial Completion of Landlord’s Work (or any component thereof), Landlord intends to cooperate with Tenant’s efforts to obtain a temporary certificate of occupancy for the Lab Space to enable Tenant to occupy the Lab Space on such date.

Landlord agrees that Tenant may make changes in Landlord’s Work to request upgrades to certain components with the approval of Landlord (which approval shall not be unreasonably withheld, conditioned or delayed taking into account time constraints for the completion of Landlord’s Work, and otherwise utilizing the standards set forth in Section 6.2.5 regarding Landlord’s approval of alterations) and the execution by

10

Landlord and Tenant of a Work Change Order, in the form attached hereto as Exhibit D. Tenant shall be responsible for all costs associated with such change orders or upgrades, including but not limited to any engineering or other professional fees associated with such items.

The terms “Substantially Completed”, “Substantial Completion” or any permutation thereof as used herein shall mean that the applicable portion of Landlord’s Work (i.e. the Initial Landlord’s Work and/or the Remaining Landlord’s Work) has been completed with the exception of minor items which can be fully completed without material interference with Tenant and other items which because of the season or weather or the nature of the item are not practicable to do at the time, provided that none of said items is necessary to make the Premises tenantable for the Permitted Uses. However, if Landlord is delayed from Substantially Completing any portion of Landlord’s Work (i.e. the Initial Landlord’s Work and/or the Remaining Landlord’s Work) because of a Tenant Delay (defined in Section 3.2 below), then such portion of Landlord’s Work shall be deemed to be “Substantially Completed” on the date that such work would have been Substantially Completed but for such Tenant Delay (but Landlord shall not be relieved of the obligation to actually complete Landlord’s Work).

Provided the Lease is fully executed on or before August 23, 2016, then, subject to Force Majeure events (defined in Section 10.5 hereof) and any Tenant Delay, Landlord shall use diligence to cause (a) the Initial Landlord’s Work to be Substantially Completed by the Initial Landlord’s Work Target Date, and (b) the Remaining Landlord’s Work to be Substantially Completed by the Remaining Landlord’s Work Target Date. In the event that the entirety of Landlord’s Work (both Initial Landlord’s Work and the Remaining Landlord’s Work) is not Substantially Completed by February 7, 2017, for any reason other than a Tenant Delay or Force Majeure event, then the Rent Commencement Date shall be extended by one (1) day for each day of delay thereafter until the entirety of Landlord’s Work is Substantially Completed (or is deemed Substantially Completed, as set forth above).

3.2 Tenant’s Work. A. Except for Landlord’s Work under Section 3.1 above, all work that is deemed necessary or desirable by Tenant to prepare the Premises for Tenants use and occupancy shall be performed by Tenant, at its expense, and in accordance with plans and specifications approved in advance by Landlord pursuant to paragraph C below (such approved work is referred to herein as “Tenant’s Work”). Following the Substantial Completion of the Initial Landlord’s Work, Tenant’s Work shall be undertaken in accordance with all of the terms and conditions of this Lease, including but not limited to subsection 6.2.5 and the Construction Rules and Regulations attached hereto as Exhibit E-l.

B. All subcontractors selected by Tenant for the performance of Tenant’s Work shall first be approved by Landlord in writing (which may be done via e-mail), such approval not to be unreasonably withheld, conditioned or delayed (it being agreed that Landlord shall have the right to restrict certain subcontractors from any bid lists), with such approval or disapproval to be given within five (5) business days from request. Tenant shall use Unispace as both its general contractor and architect (“Tenant’s general contractor and “Tenant’s architect”, as applicable), and R.W Sullivan as its engineer (“Tenant s engineer”) unless, in each case, Tenant receives Landlord’s consent to use another general contractor, architect or engineer. Notwithstanding anything to the contrary contained herein. Tenant shall use Landlord’s roofing contractor for any work that involves penetration of the roof.

C. All contractors employed by Tenant shall carry the insurance coverages required under Section 4.2.4.6 below, and Tenant shall submit certificates evidencing such coverage to Landlord prior to the commencement of Tenant’s Work. All Tenant’s Work shall be performed in good and workmanlike manner in accordance with all applicable requirements and laws of the applicable authorities having jurisdiction of the Premises and in compliance with all of the requirements of subsection 6.2.5 of this Lease. Prior to applying for any building permit, Tenant shall submit to Landlord complete architectural, electrical and mechanical construction drawings, plans and specifications (“Tenant’s Plans”) necessary for the Tenant’s Work. Tenant’s Plans shall be prepared by Tenant’s architect and Tenant’s engineer, and all costs and expenses of preparing Tenants Plans

11

shall be Tenant’s sole responsibility. Landlord shall approve or disapprove in writing of any plans submitted within five (5) business days of receipt thereof. Landlord shall not unreasonably withhold or condition such consent. If any of such plans are disapproved by Landlord, Landlord shall provide Tenant with specific reasons for such disapproval, and the foregoing submission process shall be repeated until all such plans have been approved by Landlord (except that for each subsequent iteration of Tenant’s Plans, such five (5) business day period shall be reduced to three (3) business days). Tenant hereby acknowledges and agrees that Landlord’s review of, and Landlord’s granting of its approval to, any plans and specifications submitted to it under this Lease shall not constitute or be deemed to constitute a judgment, representation or agreement by Landlord that such plans and specifications comply with the requirements of any legal authorities or that such plans and specifications will be approved by the Town of Burlington. Following Landlord’s approval of Tenant’s Plans, Tenant shall provide Landlord with a copy of the construction contract and its total budget for the hard and soft costs for the construction of Tenant’s Work (the “Total Costs”). Tenant shall pay any and all out-of-pocket third party fees and expenses incurred by Landlord in connection with review of Tenant’s Plans.

D. The phrase, “Tenant Delay”, shall be defined as any delay in the completion of Landlord’s Work actually caused by (i) special work, upgrades or long lead-time items for which Landlord identifies a specified period of delay, and in either instance Tenant does not withdraw or alter such special work, upgrade, long lead-time item which avoids such delay, (ii) any changes to any plans made by Tenant, or any Work Change Order requested by Tenant, in any case for which Landlord identifies a specified period of delay at the time of its approval and for which Tenant does not withdraw such change to avoid delay, (iii) the delay of Tenant or its architects and engineers in providing or approving any plans, specifications, pricing or estimates or giving authorizations or supplying information reasonably required by Landlord or its general contractor within five (5) business days after request therefor, (v) any failure by any contractors employed by Tenant including, without limitation, contractors furnishing telecommunications, data processing or other service or equipment directly to Tenant (and not via Landlord’s contractors) to comply with the agreed-upon timetables for coordination of the parties’ respective components of work, as established at on-site progress meetings between Landlord’s representative and Tenant’s representative, (vi) any failure to comply with this Article 3, or any material interference with the performance of Landlord’s Work by Tenant or any of its agents, employees, architects, engineers or contractors (including but not limited to delays caused by the acts or omissions of Tenant or such parties), (vii) any failure of Tenant to pay for any Work Change Order or upgrade to Landlord’s Work within required time periods or (viii) Tenant’s delay in delivering the Original Letter of Credit required pursuant to Section 4.4.

3.3 Mechanic’s Liens. Tenant hereby indemnifies Landlord against liability for any and all mechanic’s and other liens filed in connection with Tenant’s Work. Tenant, at its expense, shall procure the discharge of, or bond over, all such liens within ten (10) business days after receipt of notice of the filing of any such lien against the Premises. If Tenant shall fail to cause any such lien to be discharged or bonded over within the period aforesaid, then, in addition to any other right or remedy, Landlord may, but shall not be obligated to, discharge the same either by paying the amount claimed to be due or by deposit or bonding proceedings, and in any such event Landlord shall be entitled, if it elects, to compel the prosecution of an action for the foreclosure of such lien and to pay the amount of the judgment in favor of the lien or with interest, costs and allowances. Any amount so paid by Landlord, and all costs and expenses reasonably incurred by Landlord in connection therewith, shall constitute Additional Rent and, at Landlord’s election, shall be deducted from the TI Allowance or paid by Tenant to Landlord on demand.

3.4 TI Allowance. (A) Landlord shall provide Tenant with an amount equal to the TI Allowance to be used for the construction of Tenant’s Work. The TI Allowance shall be used by Tenant for hard and soft construction costs in connection with Tenant’s Work, including architectural, engineering and construction management costs. Landlord shall disburse the TI Allowance in three (3) installments, as follows:

12

(i) Upon completion of fifty percent (50%) of the Tenant’s Work, Landlord shall disburse the first (1st) installment of the TI Allowance (the “First Installment”) in an amount up to forty percent (40%) of the TI Allowance evidenced by paid invoices from Tenant’s general contractor and other direct contractors and subcontractors (“Paid Invoices”) providing servicers or supplying materials for the Tenant’s Work. Upon completion of one hundred percent (100%) of the Tenant’s Work, Landlord shall disburse the second (2nd) installment of the TI Allowance (the “Second Installment”) in an amount up to fifty percent (50%) of the TI Allowance evidenced by Paid Invoices, but in no event shall the sum of the First Installment and the Second Installment be greater than $1,244,250.00. The First Installment and the Second Installment shall be payable within thirty (30) days after Landlord’s receipt of all of the following documentation to Landlord’s reasonable satisfaction:

a. a conditional lien waiver for the current requisition from Tenant’s general contractor, subcontractors and suppliers performing work or providing materials to date (waiving any and all liens and rights of liens of any type through the date of the request for the applicable installment of the TI Allowance),

b. a requisition for payment from Tenant’s architect in the form of AIA Document G702 for all work for which disbursement is being requisitioned,

c. the submission by Tenant of a written statement from Tenant’s architect or engineer stating (a) whether there has been any change in the Total Costs (and if so, what the updated Total Costs are), and (b) that the Tenant’s Work for which payment is being requisitioned has been completed in accordance with the approved Tenant’s Plans,

d. copies of paid invoices from Tenant’s general contractor, major subcontractors and supplies evidencing such hard construction costs of the Tenant’s Work for which disbursement is being requisitioned; and, as applicable, copies of paid invoices from Tenant’s architects/engineers/project managers, and any other party providing services or supplying materials, evidencing the soft costs for which disbursement is being requested, and any other information or documentation reasonably requested by Landlord, and

e. with respect to the Second Installment, unconditional lien waivers for past payments from Tenant’s general contractor and all subcontractors and suppliers,

(ii) Landlord shall disburse the third (3rd) and final installment of the TI Allowance in an amount equal to the remaining ten percent (10%) of the TI Allowance within thirty (30) days after Landlord’s receipt of all of the following documentation, to Landlord’s reasonable satisfaction:

a. An unconditional final waiver of lien from Tenant’s general contractor and from all subcontractors and suppliers,

b. one (1) set of “as-built” plans for the Tenant’s Work in CAD File and PDF format,

c. copies of paid invoices from Tenant’s general contractor, major subcontractors and suppliers evidencing such costs of the Tenant’s Work for which disbursement is being requisitioned;

13

and, as applicable, copies of paid invoices from Tenant’s architects/engineers/project managers, and any other party providing services or supplying materials, evidencing the costs for which disbursement is being requested, and a copy of the final (as opposed to temporary) certificate of occupancy for the Premises issued by the Town of Burlington and any other information or documentation reasonably requested by Landlord.

Any portion of the TI Allowance that is not used or claimed on or before July 31, 2017 shall accrue to Landlord. If the final actual cost of the Tenant’s Work shall be in excess of the TI Allowance, then the entire amount of such excess cost shall be paid solely by Tenant and Landlord shall be under no obligation to pay any such excess.

If any disbursement of the TI Allowance is not timely paid by Landlord (and provided Tenant has delivered to Landlord all documentation required and satisfied all the conditions under this Section 3.4 and Landlord has not notified Tenant that Landlord reasonably disputes the accuracy or completeness of the applicable funding request), then provided Tenant is not in default under this Lease, Tenant may deliver a second notice (an “Offset Notice”) to Landlord, which notice shall specify the funding request that has not been timely paid and state conspicuously in bold type and in all capital letters at the top of the first page of such notice and on the envelope containing such notice “THIS IS A TIME SENSITIVE OFFSET NOTICE AND LANDLORD SHALL BE DEEMED TO ACCEPT SUCH OFFSET IF IT FAILS TO RESPOND TO THIS SECOND REQUEST FOR DISBURSEMENT WITHIN FIVE (5) BUSINESS DAYS AFTER RECEIPT” and if Tenant shall deliver such second notice to Landlord as aforesaid and Landlord fails to disburse the amount of the TI Allowance expressly referenced in the Offset Notice, subject to Landlord’s right to dispute such funding request as herein provided, within such five (5) business day period, then Tenant shall have the right to have such unpaid amount of the TI Allowance credited against the next installment(s) of Fixed Rent thereafter due under this Lease provided, however, notwithstanding any provision herein to the contrary, in no event shall the aggregate amount of all offsets permitted hereunder in any month ever exceed twenty percent (20%) of any monthly installment of Fixed Rent. Within the thirty (30) day period following receipt of a funding request or within the additional 5-Business Day period described above. Landlord may dispute in good faith the funding request by written notice to Tenant setting forth the basis upon which Landlord disputes the accuracy or completeness of any funding request. If Landlord disputes the accuracy or completeness of any funding request, Landlord and Tenant shall reasonably cooperate with each other to resolve such dispute as expeditiously as possible, but Landlord will have no obligation to disburse any disputed amount of such funding request and Tenant will not have any right to credit or offset the disputed amount of the funding request against the Fixed Rent until the dispute has been resolved.

ARTICLE 4

Rent

4.1 The Fixed Rent. (a) Commencing on the Rent Commencement Date, Tenant covenants and agrees to pay rent to Landlord, by electronic fund transfer (or by such other method, as set forth below, or to such other person or entity as Landlord may by notice in writing to Tenant from time to time direct), at the Annual Fixed Rent Rate, in equal installments at the Monthly Fixed Rent Rate (which is l/12th of the Annual Fixed Rent Rate), in advance, without notice or demand, and without setoff, abatement, suspension, deferment, reduction or deduction, except as otherwise expressly provided herein, on the first day of each calendar month included in the term; and for any portion of a calendar month following the Rent Commencement Date, at the rate for the first Lease Year payable in advance for such portion. The term “Additional Rent shall mean all sums other than Fixed Rent that are payable to Landlord under this Lease, including, without limitation all Operating Costs, Taxes, late charges, and interest.

14

(b) It is the intention of the parties hereto that the obligations of Tenant hereunder shall be separate and independent covenants and agreements, that the Annual Fixed Rent, the Additional Rent and all other sums payable by Tenant to Landlord shall continue to be payable in all events and that the obligations of Tenant hereunder shall continue unaffected, unless the requirement to pay or perform the same shall have been abated or terminated pursuant to an express provision of this Lease.

(c) If Landlord shall give notice to Tenant that all rent and/or other payments due hereunder are to be made to Landlord by check, or by any other commercially reasonable means, Tenant shall make all such payments as shall be due after receipt of said notice by means as designated by Landlord, with such payments to be made to such address and to such person or entity as is specified by Landlord.

4.2 Additional Rent. Commencing on the Rent Commencement Date, Tenant covenants and agrees to pay, as Additional Rent, insurance costs, utility charges, personal property taxes and its pro rata share of taxes and operating costs with respect to the Premises as provided in this Section 4.2 as follows:

4.2.1 Real Estate Taxes. Tenant covenants to pay to Landlord, as Additional Rent, for each tax period partially or wholly included in the term, Tenant s Percentage of Taxes (as hereinafter defined). Tenant shall remit to Landlord, on the first day of each calendar month, estimated payments on account of Taxes, such monthly amounts to be sufficient to provide Landlord, by the time real estate tax payments are due and payable to any governmental authority responsible for collection of same, a sum equal to the Tenant’s Percentage of Taxes, as reasonably estimated by Landlord from time to time on the basis of the most recent tax data available. The initial calculation of the monthly estimated payments shall be based upon the Initial Estimate of Tenant’s Percentage of Taxes for the Tax Year and upon quarterly payments being due to the governmental authority on August 1, November 1, February 1 and May 1, and shall be made when the Commencement Date has been determined. If the total of such monthly remittances for any Tax Year is greater than the Tenant’s Percentage of Taxes for such Tax year, Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.1. the difference; if the total of such remittances is less than the Tenant’s Percentage of Taxes for such Tax Year, Tenant shall pay the difference to Landlord at least ten (10) days prior to the date or dates within such Tax Year that any Taxes become due and payable to the governmental authority (but in any event no earlier than ten (10) business days following a written notice to Tenant, which notice shall set forth the manner of computation of Tenant’s Percentage of Taxes). This section shall survive the expiration or earlier termination of the Lease.

If, after Tenant shall have made reimbursement to Landlord pursuant to this subsection 4.2.1, Landlord shall receive a refund of any portion of Taxes paid by Tenant with respect to any Tax Year during the term hereof as a result of an abatement of such Taxes by legal proceedings, settlement or otherwise (without either party having any obligation to undertake any such proceedings), Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.1, the Tenant’s Percentage of the refund (less the proportional, pro rata expenses, including attorneys’ fees and appraisers’ fees, incurred by Landlord in connection with obtaining any such refund), as relates to Taxes paid by Tenant to Landlord with respect to any Tax Year for which such refund is obtained.

In the event this Lease shall commence, or shall end (by reason of expiration of the term or earlier termination pursuant to the provisions hereof), on any date other than the first or last day of the Tax Year, or should the Tax Year or period of assessment of real estate taxes be changed or be more or less than one (1) year, as the case may be, then the amount of Taxes which may be payable by Tenant as provided in this subsection 4.2.1 shall be appropriately apportioned and adjusted.

The term “Taxes” shall mean all taxes, assessments, betterments and other charges and impositions (including, but not limited to, fire protection service fees

15

and similar charges) levied, assessed or imposed at any time during the term by any governmental authority upon or against the Property, or taxes in lieu thereof, and additional types of taxes to supplement real estate taxes due to legal limits imposed thereon. Taxes shall not include: excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal and state income taxes, and other taxes applied or measured by Landlord’s general or net income (as opposed to rents, receipts, or income attributable to operations at the Building), nor any item included as Operating Costs, nor any items paid by Tenant under subsection 4.2.2. If, at any time during the term of this Lease, any tax or excise on rents or other taxes, however described, are levied or assessed against Landlord with respect to the rent reserved hereunder, either wholly or partially in substitution for, or in addition to, real estate taxes assessed or levied on the Property, such tax or excise on rents shall be included in Taxes; however, Taxes shall not include franchise, estate, inheritance, succession, capital levy, transfer, income or excess profits taxes assessed on Landlord. Taxes shall include any estimated payment made by Landlord on account of a fiscal tax period for which the actual and final amount of taxes for such period has not been determined by the governmental authority as of the date of any such estimated payment.

4.2.2 Personal Property Taxes. Tenant shall pay all taxes charged, assessed or imposed upon the personal property of Tenant in or upon the Premises.

4.2.3 Operating Costs. Tenant covenants to pay to Landlord the Tenant’s Percentage of Operating Costs (as hereinafter defined) incurred by Landlord in any fiscal year of Landlord (“Landlord’s Fiscal Year”). Tenant shall remit to Landlord, on the first day of each calendar month, estimated payments on account of Operating Costs, such monthly amounts to be sufficient to provide Landlord, by the end of the Landlord’s Fiscal Year, a sum equal to the Operating Costs, as reasonably estimated by Landlord from time to time. The initial monthly estimated payments shall be in an amount equal to 1/12th of the Initial Estimate of Tenant’s Percentage of Operating Costs for the Landlord’s Fiscal Year. If, at the expiration of the year in respect of which monthly installments of Operating Costs shall have been made as aforesaid, the total of such monthly remittances is greater than the actual Operating Costs for such year, Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.3, the difference; if the total of such remittances is less than the Operating Costs for such year, Tenant shall pay the difference to Landlord within twenty (20) days from the date Landlord shall furnish to Tenant an itemized statement of the Operating Costs, prepared, allocated and computed in accordance with generally accepted accounting principles. Any reimbursement for Operating Costs due and payable by Tenant with respect to periods of less than twelve (12) months shall be equitably prorated. This section shall survive the expiration or earlier termination of the Lease.

The term “Operating Costs” shall mean all costs and expenses incurred for the operation, cleaning, maintenance, repair and upkeep of the Property, and the portion of such costs and expenses with regard to the common areas, facilities, services and amenities of the Park which is equitably allocable to the Property, including, without limitation, all costs of maintaining and repairing the Property and the Park (including snow removal, landscaping and grounds maintenance, operation, repair and maintenance of parking lots (including lighting), sidewalks, walking paths, access roads and driveways, Property signage, repair and maintenance of the Building roof; security, operation and repair of the base Building heating and air-conditioning equipment, common area lighting and any other base Building equipment or systems) and of all repairs and replacements (other than repairs or replacements for which Landlord has received full reimbursement from contractors, other tenants of the Building or from others) necessary to keep the Property and the Park in good working order, repair, appearance and condition; all costs, including material and equipment costs, for cleaning and janitorial services to the Building (including window cleaning of the Building); all costs of any reasonable insurance carried by Landlord relating to the Property; all costs related to provision of heat (including oil, electric, and/or gas),

16

cooling, and water (including sewer charges), refuse disposal and other utilities to the Building (exclusive of reimbursement to Landlord for any of same received as a result of direct billing to any tenant of the Building); payments under all service contracts relating to the foregoing; all compensation, fringe benefits, payroll taxes and workmen’s compensation insurance premiums related thereto with respect to any employees of Landlord or its affiliates engaged in the operation, security and maintenance of the Property and the Park; attorneys’ fees and disbursements (exclusive of any such fees and disbursements incurred in tax abatement proceedings or the preparation of leases) and auditing and other professional fees and expenses; and a management fee in line with market rates for comparable properties providing comparable services and amenities in the Burlington, Massachusetts geographic market area. Park-wide expenses shall be equitably allocated by Landlord.

Notwithstanding any provision of this Lease to the contrary, the following items shall be excluded from Operating Costs:

(a) leasing commissions, fees and costs, advertising and promotional expenses and other costs incurred in procuring tenants or in selling the Building, the Property or the Park;

(b) legal fees or other expenses incurred in connection with enforcing leases with tenants in the Park or in selling or financing the Building, the Property or the Park;

(c) costs of renovating or otherwise improving or decorating space for any tenant or other occupant of the Park, including Tenant, or relocating any tenant;

(d) financing costs including interest and principal amortization of debts and the costs of providing the same;

(e) depreciation;

(f) rental on ground leases or other underlying leases and the costs of providing the same;

(g) wages, bonuses and other compensation of employees above the grade of Senior Property Manager and fringe benefits other than insurance plans and tax qualified benefit plans;

(h) costs of any cleanup, containment, abatement, removal or remediation of Hazardous Materials (as defined in Article 11) to the extent such were either (i) on the Property on the Date of this Lease; or (ii) introduced onto the Property by Landlord;

(i) costs of any items for which Landlord is or is entitled to be paid or reimbursed by insurance;

(j) charges for electricity, water, or other utilities, services or goods and applicable taxes for which Tenant or any other tenant, occupant, person or other party is obligated to reimburse Landlord or to pay to third parties;

(k) costs of any HVAC, janitorial or other services provided to tenants other than Tenant on an extra cost basis after regular business hours;

(l) the cost of installing, operating and maintaining any cafeteria or child or daycare center;

(m) cost of any work or service performed on an extra cost basis for any tenant in the Building or the Property to a materially greater extent or in a materially more favorable manner than furnished generally to the tenants and other occupants;

17

(n) cost of any work or services performed for any facility other than the Building, the Property or the Park;

(o) any cost representing an amount paid to a person, firm, corporation or other entity related to Landlord that is in excess of the amount which would have been paid in the absence of such relationship;

(p) lease payments for rental equipment (other than equipment for which depreciation is properly charged as an expense) that would constitute a capital expenditure if the equipment were purchased;

(q) late fees or charges incurred by Landlord due to late payment of expenses, except to the extent attributable to Tenant’s actions or inactions;

(r) Taxes or taxes on Landlord’s business (such as income, excess profits, franchise, capital stock, estate, inheritance, etc.);

(s) charitable or political contributions;

(t) reserve funds;

(u) all other items for which another party compensates or pays so that Landlord shall not recover any item of cost more than once;

(v) any cost associated with operating an on or off-site management office for the Park, except to the extent included in the management fee permitted hereby;

(w) Landlord’s general overhead and any other expenses not directly attributable to the operation and management of the Building, the Property or the Park (e.g. the activities of Landlord’s officers and executives or professional development expenditures), except to the extent included in the management fee permitted hereby;

(x) costs and expenses incurred in connection with compliance with or contesting or settlement of any claimed violation of law or requirements of law, except to the extent attributable to Tenant’s actions or inactions;

(y) costs of mitigation or impact fees or subsidies (however characterized), imposed or incurred prior to the date of the Lease or imposed or incurred solely as a result of another tenant’s or tenants’ use of the Park or their respective premises;

(z) any costs or expense incurred by Landlord in connection with the maintenance, repair, or replacement of space leased to other tenants in the Park; and

(aa) capital expenditures, except as specifically provided for below.

If, during the term of this Lease, Landlord shall replace any capital items or make any capital expenditures which (a) are intended to reduce Operating Costs or (b) are required to comply with laws enacted after the date of this Lease, or (c) are required to replace worn-out items as may be necessary to maintain the Building in good working order, repair and condition and not to enhance the Building over and above its current appearance and condition (collectively called “capital expenditures”), the total amount of which is not properly included in Operating Costs for the Landlord’s Fiscal Year in which they were made, there shall nevertheless be included in Operating Costs for each such fiscal year in which and after such capital expenditure is made the annual charge-off of such capital expenditure. (Annual charge-off shall be determined by (i) dividing the original cost of the capital expenditure by the number of years of useful life thereof [The useful life shall be reasonably determined by Landlord in accordance with generally accepted accounting principles and practices in effect at the time of

18

acquisition of the capital item.]; and (ii) adding to such quotient an interest factor computed on the unamortized balance of such capital expenditure based upon an interest rate reasonably determined by Landlord as being the interest rate then being charged for long-term mortgages by institutional lenders on like properties within the locality in which the Building is located.) Provided, further, that if Landlord reasonably concludes on the basis of engineering estimates that a particular capital expenditure will effect savings in Operating Costs and that such annual projected savings will exceed the annual charge-off of capital expenditure computed as aforesaid, then and in such events, the annual charge-off shall be determined by dividing the amount of such capital expenditure by the number of years over which the projected amount of such savings shall fully amortize the cost of such capital item or the amount of such capital expenditure; and by adding the interest factor, as aforesaid.

If during any portion of any year for which Operating Costs are being computed, the Building was not fully occupied by tenants or if not all of such tenants were paying fixed rent or if Landlord was not supplying all tenants with the services, amenities or benefits being supplied hereunder, actual Operating Costs incurred shall be reasonably extrapolated by Landlord to the estimated Operating Costs that would have been incurred if the Building were fully occupied by tenants and all such tenants were then paying fixed rent or if such services were being supplied to all tenants, and such extrapolated amount shall, for the purposes of this Section 4.2.3, be deemed to be the Operating Costs for such year.

Tenant shall have the right to examine, copy and audit Landlord’s books and records establishing the Operating Costs set forth in this Section 4.2.3 of this Lease, for the Landlord’s Fiscal Year immediately preceding Landlord’s year-end reconciliation statement of Operating Costs for the specific Landlord’s Fiscal Year in question. Tenant shall give Landlord at least 30 days prior written notice (the “Audit Notice”) of its intention to examine and audit such books and records, and such examination and audit shall take place at Landlord’s or Landlord’s building manager’s office no later than 120 days following Tenant’s receipt of any year-end reconciliation statement and shall be completed no later than ninety (90) days following the date Tenant was first given access to Landlord’s books and records. No subtenant shall have any right to conduct an audit. As a condition to performing any such inspection, Tenant and its examiners may be required to execute and deliver to Landlord an agreement to keep confidential any information which Tenant and the examining party discover about the Building in connection with such examination, except for disclosures required by law, court order or regulatory authorities, or to Tenant’s attorneys, accountants, auditors, or potential purchasers of the Tenant company. Tenant agrees to use for such audit a certified public accountant or an accounting firm that is not being paid on a contingency fee basis. All costs of the examination and audit shall be borne by Tenant. If, pursuant to the audit, the payments made for such year by Tenant exceed Tenant’s required payment on account thereof for such year, such overpayment shall be credited against Rent next due, or refunded to Tenant if the term of this Lease has then expired and Tenant has no further obligation to Landlord; but, if the payments made by Tenant for such year are less than Tenant’s required payment as established by the examination and audit, Tenant shall pay the deficiency to Landlord within thirty (30) days after conclusion of the examination and audit. If there is any dispute over the results of the audit, Landlord shall have ninety (90) days following receipt of the audit results to obtain an audit from an accountant of Landlord’s choice, at Landlord’s cost and expense. In the event that Landlord’s and Tenant’s accountants shall be unable to reconcile the results which thirty (30) days following completion of Landlord’s accountants’ review, then, both accountants shall mutually agree upon a third accountant whose determination shall be conclusive. The cost of any such third accountant shall be shared equally between Landlord and Tenant.

4.2.4 Insurance. Tenant shall, at its expense, as Additional Rent, take out and maintain from the time Tenant first occupies the Premises for any purpose and throughout the Term the following insurance protecting Landlord:

19

4.2.4.1 Commercial general liability insurance and commercial excess liability insurance on a “follow form” basis and/or umbrella naming Landlord, Tenant, and Landlord’s managing agent and any mortgagee of which Tenant has been given notice as insureds or additional insureds on a primary and non-contributory basis, in amounts which shall, at the beginning of the term, be at least equal to the limits set forth in Section 1.1; and, which, from time to time during the term, shall be for such higher limits, if any, as are customarily carried in the area in which the Premises are located on property similar to the Premises and used for similar purposes; and workmen’s compensation insurance with statutory limits covering all of Tenant’s employees working on the Premises covering the state in which the employee was hired, works and resides; and Employers liability insurance with minimum limits of Five Hundred Thousand Dollars ($500,000.00) each accident, bodily injury by accident; Five Hundred Thousand Dollars ($500,000.00) each employee, bodily injury by disease; and Five Hundred Thousand Dollars ($500,000.00) policy limit, bodily injury by disease.

4.2.4.2 Special Risk property insurance with the usual extended coverage endorsements covering all of Tenant’s furniture, furnishings, fixtures and equipment and Tenant’s Work, and business interruption insurance, with extra expense coverage.

4.2.4.3 Automobile liability insurance for all owned, leased, non-owned and hired vehicles. The minimum limit of liability shall be One Million Dollars ($1,000,000.00) each accident, combined single limit for bodily injury and property damage naming Landlord as an additional insured on a primary and non-contributory basis.

4.2.4.4 All such policies shall be obtained from responsible companies having a policy rating of A- or better; X or better, as set forth in the most current issue of the Best’s Key Rating Guide and which are qualified to do business and in good standing in Massachusetts. Tenant agrees to furnish Landlord with certificates evidencing all such insurance prior to the beginning of the term hereof and evidencing renewal thereof at least thirty (30) days prior to the expiration of any such policy. Tenant shall provide at least thirty (30) days prior written notice to Landlord should any of the policies required herein be cancelled. In the event provision for any such insurance is to be by a blanket insurance policy, the policy shall allocate a specific and sufficient amount of coverage to the Premises.

4.2.4.5 All insurance which is carried by either party with respect to the Building, Premises or to furniture, furnishings, fixtures, or equipment therein or alterations or improvements thereto, workmen’s compensation insurance, and all liability insurance, whether or not required, shall include provisions which either designate the other party as one of the insured or deny to the insurer acquisition by subrogation of rights of recovery against the other party to the extent such rights have been waived by the insured party prior to occurrence of loss or injury, insofar as, and to the extent that, such provisions may be effective without making it impossible to obtain insurance coverage from responsible companies qualified to do business in the state in which the Premises are located. Each party shall be entitled to have certificates of any policies containing such provisions. Each party hereby waives all rights of recovery against the other for loss or injury against which the waiving party is protected by insurance containing said provisions, reserving, however, any rights with respect to any excess of loss or injury over the amount recovered by such insurance. Tenant shall not acquire as insured under any insurance carried on the Premises, which shall include all tenant improvements (including Tenant’s Work), any right to participate in the adjustment of loss or to receive insurance proceeds and agrees upon request promptly to

20

endorse and deliver to Landlord any checks or other instruments in payment of loss in which Tenant is named as payee.

4.2.4.6 In addition to the above requirements, all contractors employed by Tenant shall maintain Worker’s Compensation Insurance in accordance with statutory requirements, and Employers Liability with limits not less than $1,000,000, Commercial General Liability (including completed operations coverage), Automobile Liability and Follow form Umbrella or Excess Liability Insurance in amounts at least equal to the limits set forth in Section 1.1. All such policies, with the exception of the Workers’ Compensation, shall be endorsed to provide additional insured status to Tenant and Landlord and Landlord’s managing agent and any mortgagee, on a primary and non-contributory basis. All policies shall be endorsed providing waiver of subrogation in favor of Landlord and Tenant. Tenant shall submit certificates evidencing such coverage to Landlord prior to the commencement of Tenant’s Work and any future alterations performed by Tenant’s contractors. Tenant shall also list Landlord and Tenant’s contractor as insureds on Tenant’s Builder’s Risk Policy.

4.2.5 Utilities. A. Commencing as of the Rent Commencement Date, Tenant shall contract for and pay directly to the applicable public utility company all costs and charges for telephone service and for separately metered gas furnished or consumed on the Premises.

B. Commencing as of the date that is the earlier of the Rent Commencement Date and the date that Landlord installs the requisite submeter for such utility, Tenant shall pay directly to Landlord, as Additional Rent, estimated charges (the “Utilities Charges”) on account of Tenant’s consumption of electricity in the Premises for its lights, outlets, and HVAC systems and otherwise used by Tenant in connection with the Premises, and for water used by Tenant for ordinary cleaning, lavatory and toilet facilities or otherwise in the Premises. Landlord shall reasonably estimate the amount of Utilities Charges payable by Tenant per month and shall notify Tenant prior to the Commencement Date of the initial estimate of Utilities Charges to be paid by Tenant. Tenant shall pay the Utilities Charges on the first day of each calendar month included in the Term, in the same manner as Tenant pays Fixed Rent pursuant to Section 4.1 above. Following Landlord s receipt of utility provider invoices, Landlord will reconcile the estimated Utilities Charges paid by Tenant with the actual amounts owing from Tenant based on the number of kilowatt hours of electricity used in connection with the Premises for the preceding month as registered on the sub-meters for the Premises, and based upon sub-meter readings for water used by Tenant for ordinary cleaning, lavatory and toilet facilities or otherwise in the Premises. If it is determined Tenant has been overcharged, then such overpayment will be credited against Tenant’s account for the following month. If Tenant has underpaid, then Landlord will invoice Tenant for the amount owed and Tenant shall pay such amount within twenty (20) days after billing. Landlord reserves the right to adjust the monthly Utilities Charges from time to time based on the most current data available for Tenant’s electrical and water consumption in connection with the Premises, and Tenant shall thereafter pay the adjusted Utilities Charges to Landlord until further notice.

C. Tenant shall pay all charges for telephone and other utilities or services not supplied by Landlord, whether designated as a charge, tax, assessment, fee or otherwise, all such charges to be paid as the same from time to time become due. Except as otherwise provided in Article 5, it is understood and agreed that Tenant shall make its own arrangements for the installation or provision of all such utilities and that Landlord shall be under no obligation to furnish any utilities to the Premises and shall not be liable for any interruption or failure in the supply of any such utilities to the Premises.

4.3 Late Payment of Rent. If any installment of Fixed Rent or other sum due Landlord is paid

21

after the date the same was due, and if on a prior occasion in the twelve (12) month period prior to the date such installment was due an installment of rent was paid after the same was due, then Tenant shall pay Landlord a late payment fee equal to five (5%) percent of the overdue payment. In addition, if any installment of rent or other sum due Landlord is not paid when due, such installment shall bear interest from the date due until paid, at the rate of 8% per year not to exceed the highest rate permitted by law.

4.4 Letter of Credit. The performance of Tenant’s obligations under this Lease shall be secured by a letter of credit throughout the term hereof in accordance with and subject to the following terms and conditions:

4.4.1 Amount of Letter of Credit. (a) Concurrently with Tenant’s execution and delivery of this Lease, Tenant shall deliver to Landlord an irrevocable standby letter of credit (the “Original Letter of Credit”) which shall be (i) in the form of Exhibit H attached to this Lease (the “Form LC”) or another form acceptable to Landlord, (ii) issued by Silicon Valley Bank or another commercial bank that is reasonably satisfactory to Landlord upon which presentment may be made in Boston, Massachusetts, (iii) in the amount equal to the Letter of Credit Amount, and (iv) for a term of at least 1 year, subject to the provisions of Section 4.4.2 below. The Original Letter of Credit, any Additional Letters(s) of Credit (as defined below) and Substitute Letter(s) of Credit (as defined below) are referred to herein as the “Letter of Credit.”