| The powerhouse in industrial additive manufacturing May 25, 2023 |

| 2 Disclaimer 2 Cautionary Statement Regarding Forward-Looking Statements This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. No Offer or Solicitation This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements relating to the proposed transaction between Stratasys Ltd. (“Stratasys”) and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems. These risks, as well as other risks related to the proposed transaction, will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form F-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Form 6-K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Additional Information about the Transaction and Where to Find It In connection with the proposed transaction, Stratasys intends to file with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings. Participants in the Solicitation Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above. |

| 3 RIC FULOP Chairman and CEO Desktop Metal Today’s presenters DR. YOAV ZEIF CEO Stratasys Chairman Combined Company CEO and Director Combined Company |

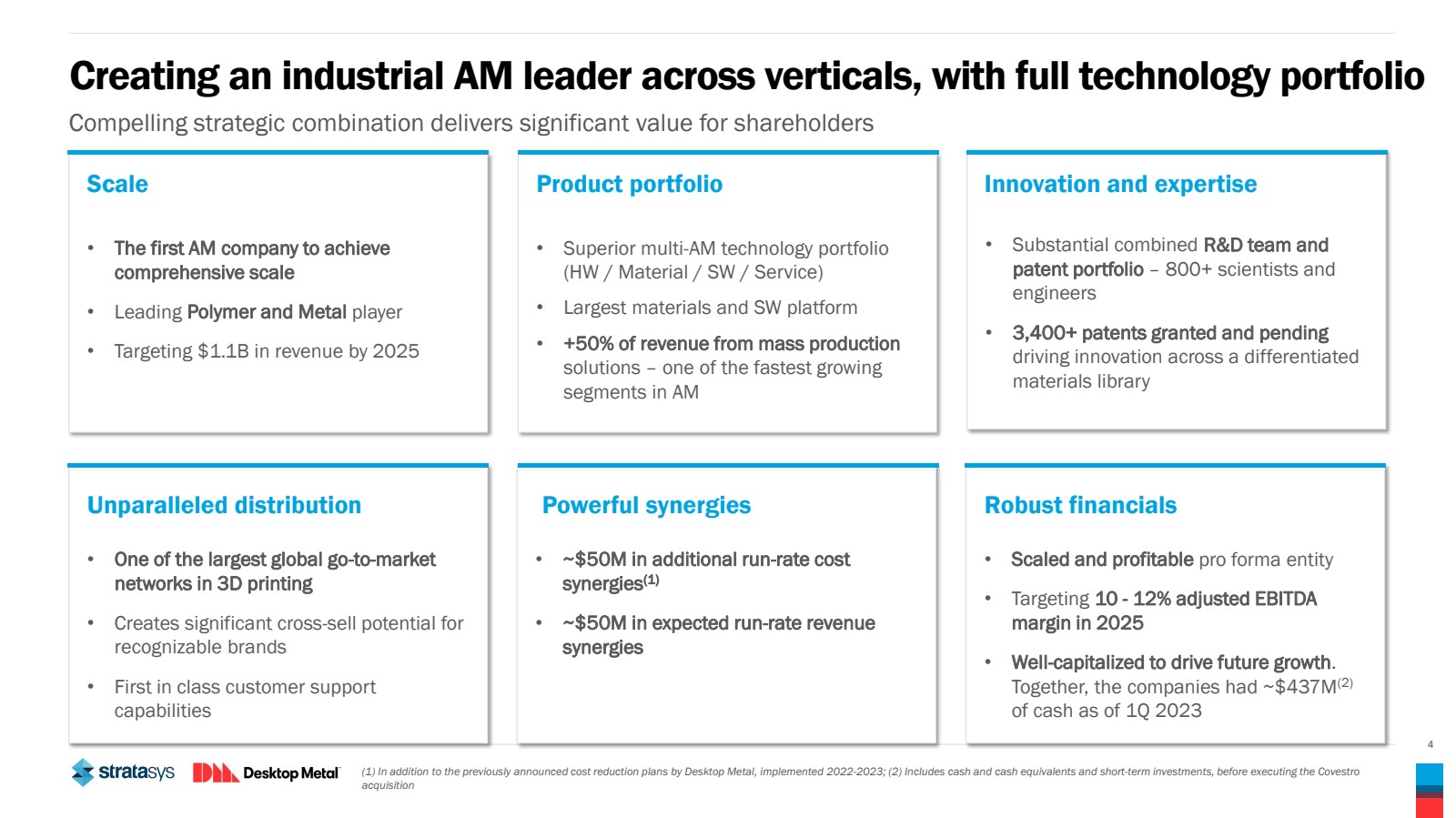

| 4 • Scaled and profitable pro forma entity • Targeting 10 - 12% adjusted EBITDA margin in 2025 • Well-capitalized to drive future growth. Together, the companies had ~$437M(2) of cash as of 1Q 2023 • ~$50M in additional run-rate cost synergies(1) • ~$50M in expected run-rate revenue synergies • One of the largest global go-to-market networks in 3D printing • Creates significant cross-sell potential for recognizable brands • First in class customer support capabilities Robust financials • Substantial combined R&D team and patent portfolio – 800+ scientists and engineers • 3,400+ patents granted and pending driving innovation across a differentiated materials library • Superior multi-AM technology portfolio (HW / Material / SW / Service) • Largest materials and SW platform • +50% of revenue from mass production solutions – one of the fastest growing segments in AM Creating an industrial AM leader across verticals, with full technology portfolio Compelling strategic combination delivers significant value for shareholders • The first AM company to achieve comprehensive scale • Leading Polymer and Metal player • Targeting $1.1B in revenue by 2025 Scale Product portfolio Innovation and expertise Unparalleled distribution Powerful synergies (1) In addition to the previously announced cost reduction plans by Desktop Metal, implemented 2022-2023; (2) Includes cash and cash equivalents and short-term investments, before executing the Covestro acquisition |

| 5 Driving manufacturing transformation together The first industrial AM company covering the full manufacturing lifecycle from design to mass production in both polymers and metal A leader in polymer 3D printing A leader in mass production of metal, ceramics and restorative dental 3D printing |

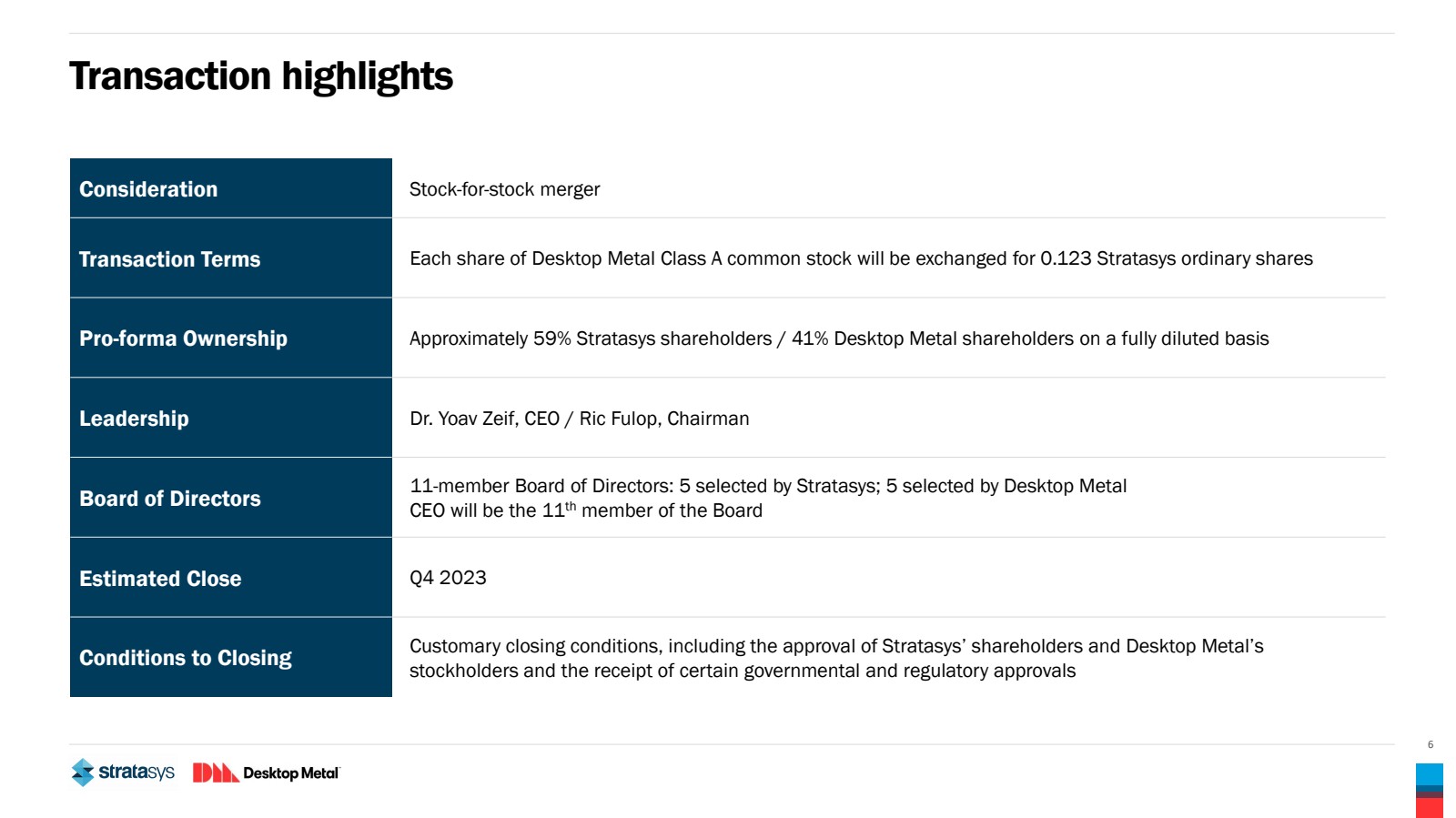

| 6 Transaction highlights Consideration Stock-for-stock merger Transaction Terms Each share of Desktop Metal Class A common stock will be exchanged for 0.123 Stratasys ordinary shares Pro-forma Ownership Approximately 59% Stratasys shareholders / 41% Desktop Metal shareholders on a fully diluted basis Leadership Dr. Yoav Zeif, CEO / Ric Fulop, Chairman Board of Directors 11-member Board of Directors: 5 selected by Stratasys; 5 selected by Desktop Metal CEO will be the 11th member of the Board Estimated Close Q4 2023 Conditions to Closing Customary closing conditions, including the approval of Stratasys’ shareholders and Desktop Metal’s stockholders and the receipt of certain governmental and regulatory approvals |

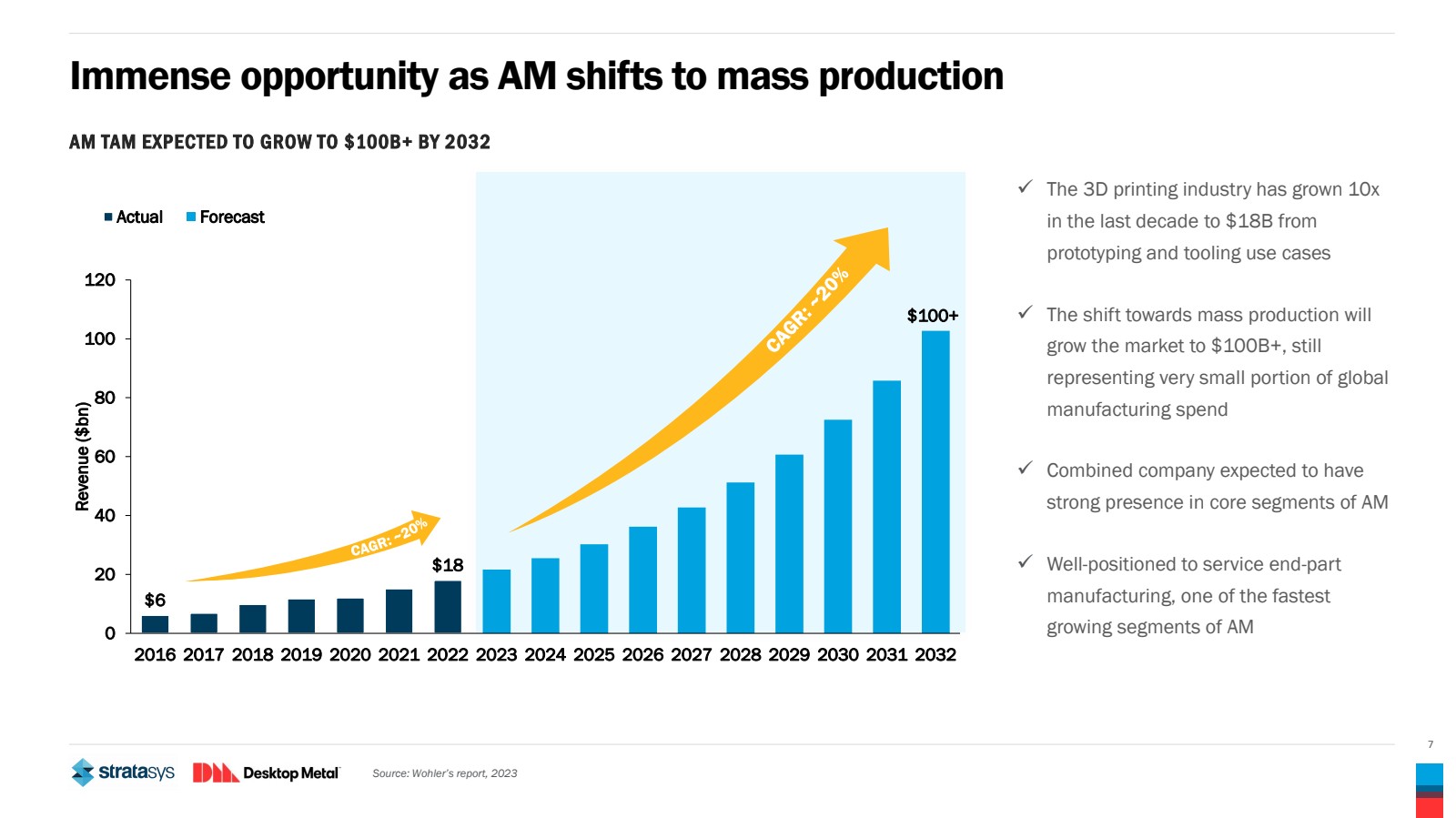

| 7 Immense opportunity as AM shifts to mass production ✓ The 3D printing industry has grown 10x in the last decade to $18B from prototyping and tooling use cases ✓ The shift towards mass production will grow the market to $100B+, still representing very small portion of global manufacturing spend ✓ Combined company expected to have strong presence in core segments of AM ✓ Well-positioned to service end-part manufacturing, one of the fastest growing segments of AM AM TAM EXPECTED TO GROW TO $100B+ BY 2032 Source: Wohler’s report, 2023 $6 $18 $100+ 0 20 40 60 80 100 120 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 Revenue ($bn) Actual Forecast |

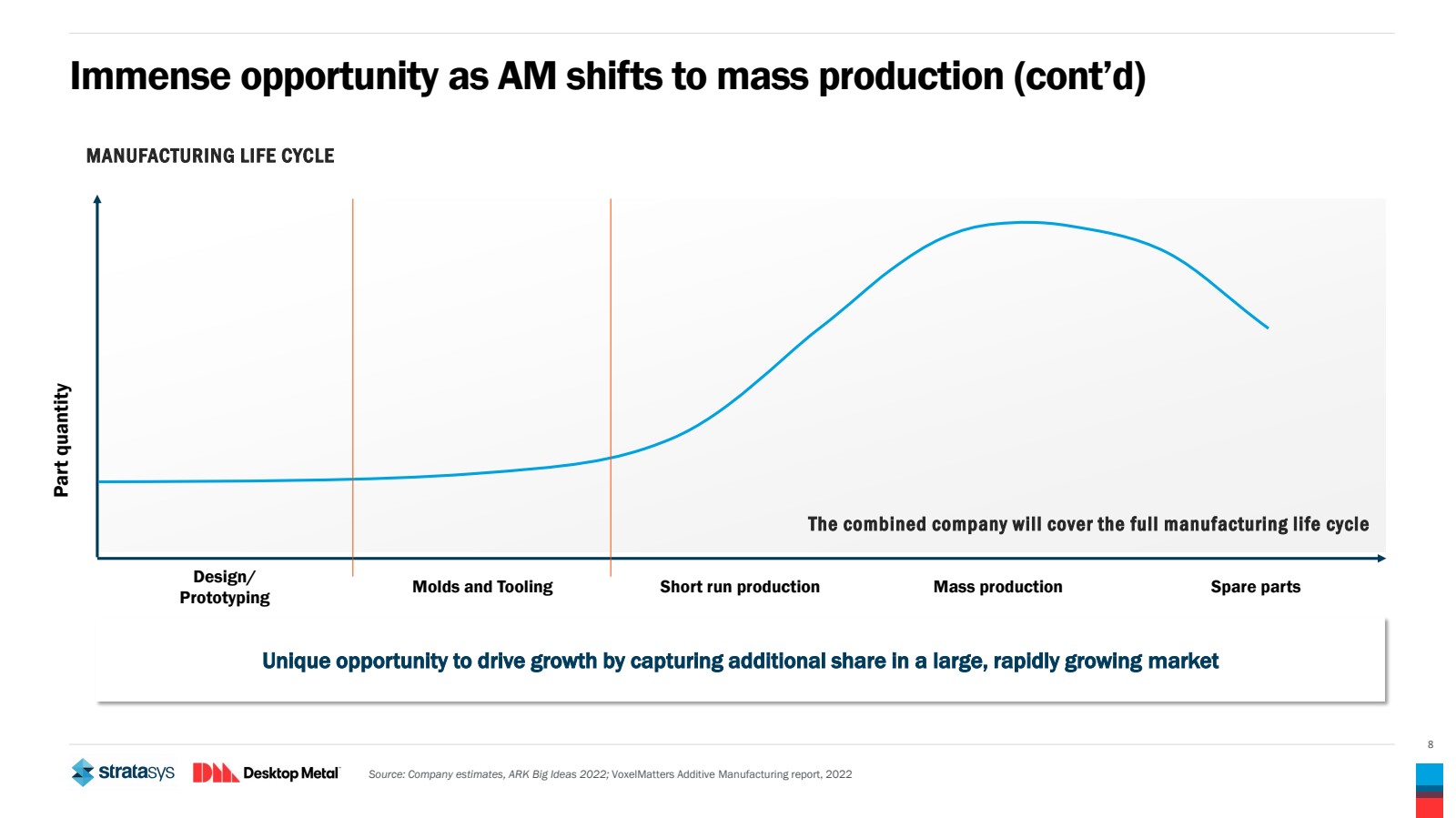

| 8 Immense opportunity as AM shifts to mass production (cont’d) Part quantity MANUFACTURING LIFE CYCLE Source: Company estimates, ARK Big Ideas 2022; VoxelMatters Additive Manufacturing report, 2022 Unique opportunity to drive growth by capturing additional share in a large, rapidly growing market Design/ Prototyping Molds and Tooling Short run production Mass production Spare parts The combined company will cover the full manufacturing life cycle |

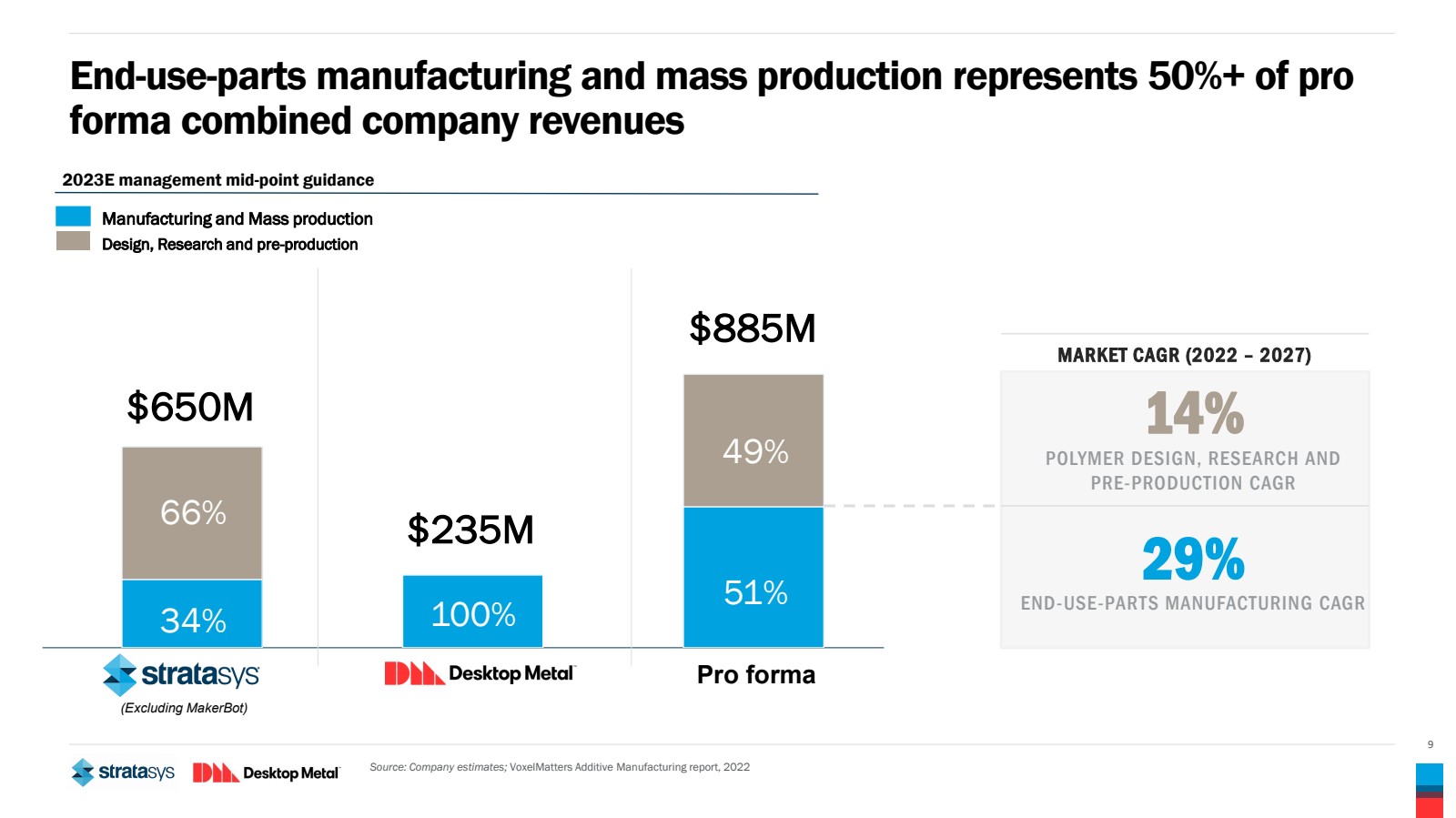

| 9 End-use-parts manufacturing and mass production represents 50%+ of pro forma combined company revenues 14% POLYMER DESIGN, RESEARCH AND PRE-PRODUCTION CAGR MARKET CAGR (2022 – 2027) 29% END-USE-PARTS MANUFACTURING CAGR Source: Company estimates; VoxelMatters Additive Manufacturing report, 2022 Pro forma $650M $235M $885M (Excluding MakerBot) 2023E management mid-point guidance Manufacturing and Mass production Design, Research and pre-production 34% 66% 51% 49% 100% |

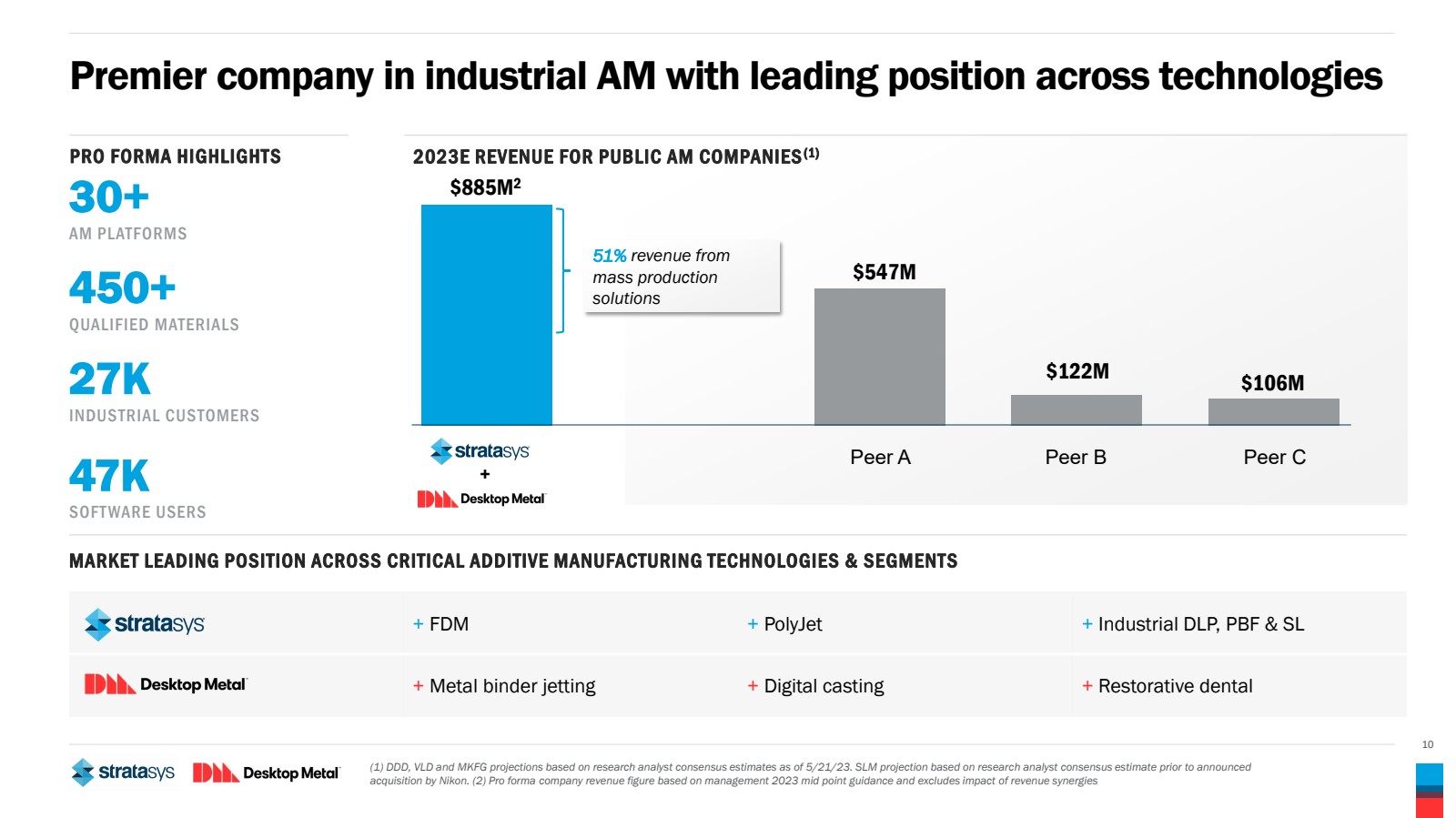

| 10 Premier company in industrial AM with leading position across technologies + FDM + PolyJet + Industrial DLP, PBF & SL + Metal binder jetting + Digital casting + Restorative dental (1) DDD, VLD and MKFG projections based on research analyst consensus estimates as of 5/21/23. SLM projection based on research analyst consensus estimate prior to announced acquisition by Nikon. (2) Pro forma company revenue figure based on management 2023 mid point guidance and excludes impact of revenue synergies 2023E REVENUE FOR PUBLIC AM COMPANIES(1) PRO FORMA HIGHLIGHTS MARKET LEADING POSITION ACROSS CRITICAL ADDITIVE MANUFACTURING TECHNOLOGIES & SEGMENTS + $885M2 $547M $122M $106M 51% revenue from mass production solutions 30+ AM PLATFORMS 450+ QUALIFIED MATERIALS 27K INDUSTRIAL CUSTOMERS 47K SOFT WARE USERS Peer A Peer B Peer C |

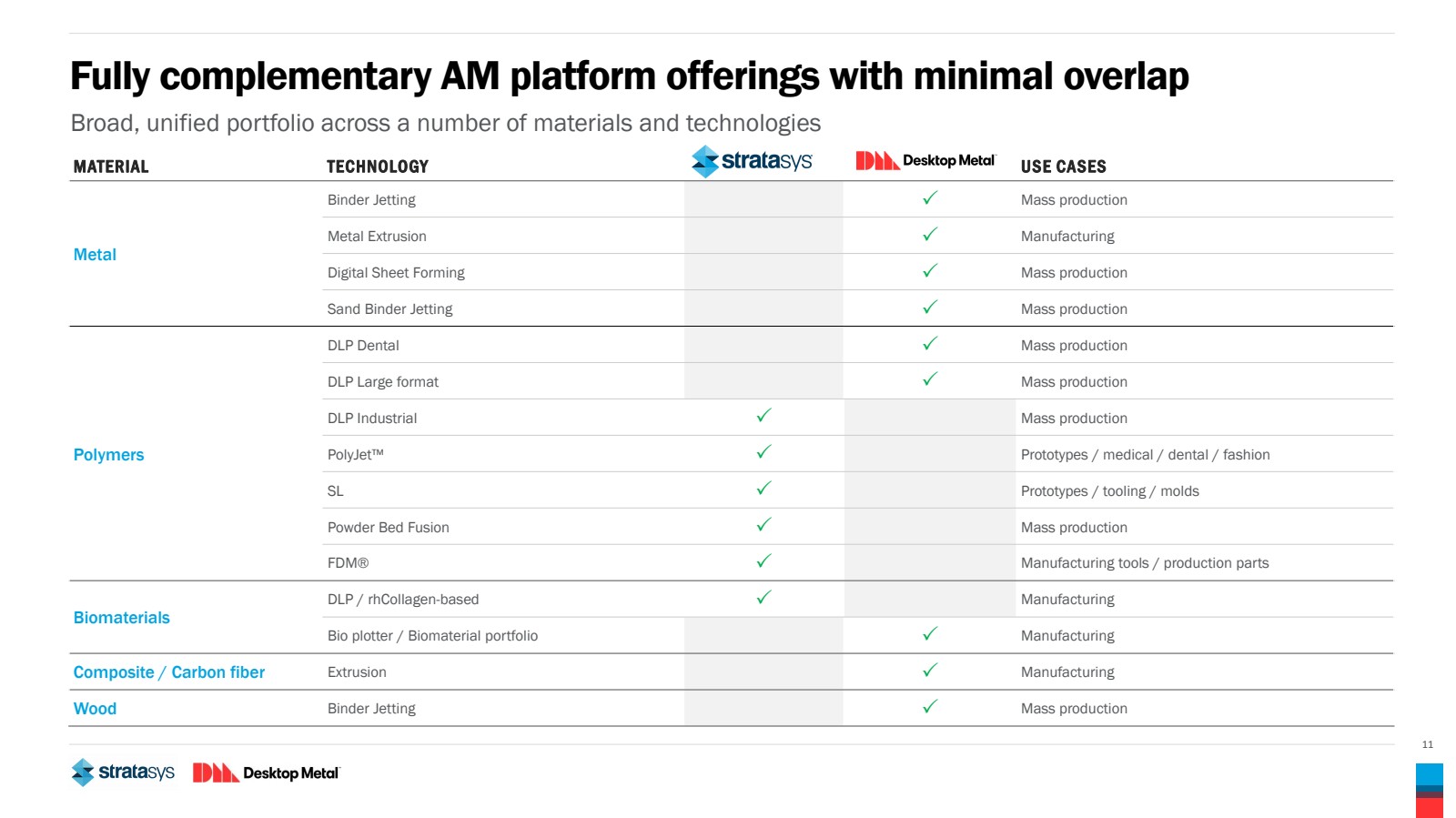

| 11 Fully complementary AM platform offerings with minimal overlap Broad, unified portfolio across a number of materials and technologies MATERIAL TECHNOLOGY USE CASES Metal Binder Jetting Mass production Metal Extrusion Manufacturing Digital Sheet Forming Mass production Sand Binder Jetting Mass production Polymers DLP Dental Mass production DLP Large format Mass production DLP Industrial Mass production PolyJet™ Prototypes / medical / dental / fashion SL Prototypes / tooling / molds Powder Bed Fusion Mass production FDM® Manufacturing tools / production parts Biomaterials DLP / rhCollagen-based Manufacturing Bio plotter / Biomaterial portfolio Manufacturing Composite / Carbon fiber Extrusion Manufacturing Wood Binder Jetting Mass production |

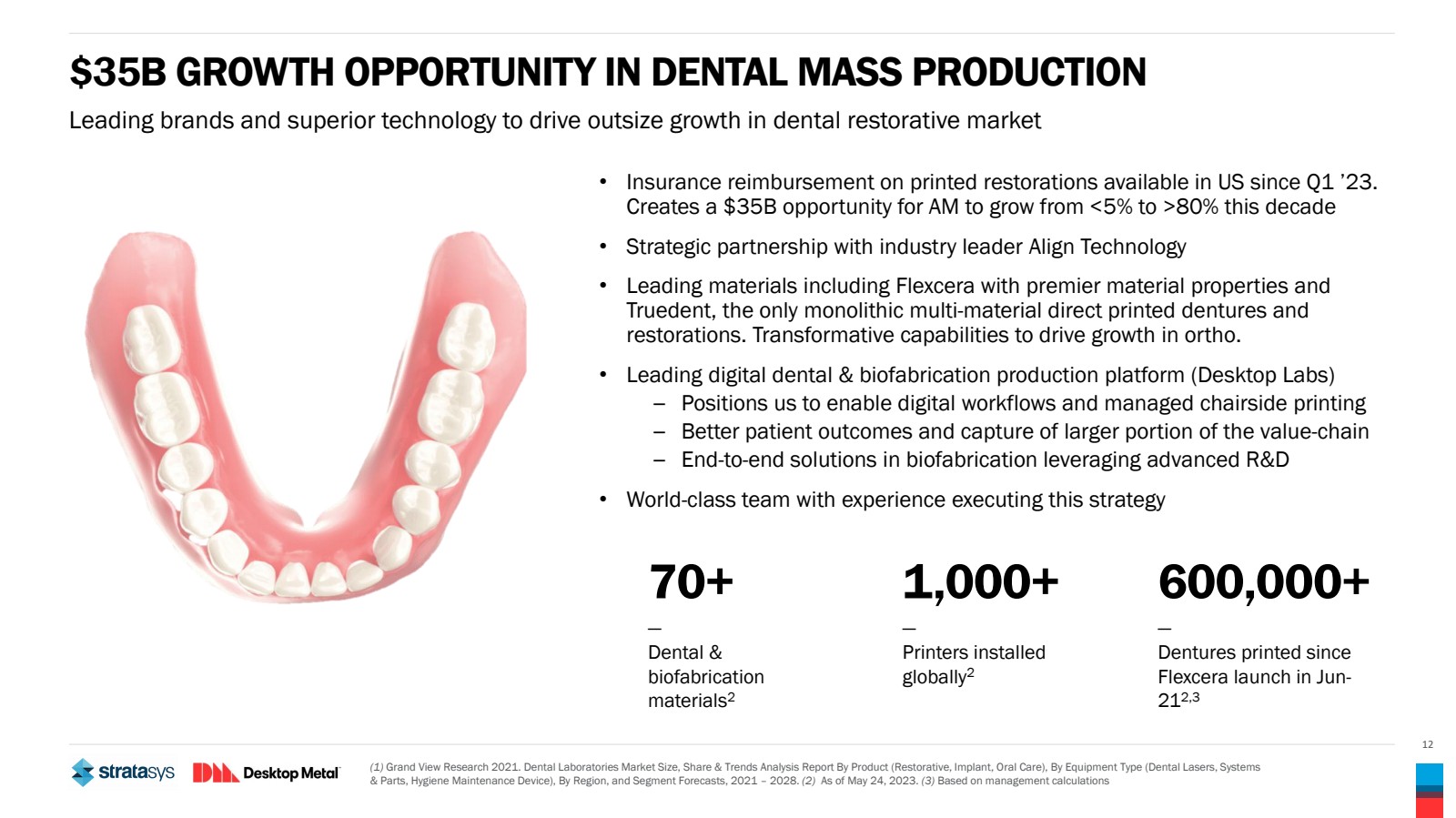

| 12 $35B GROWTH OPPORTUNITY IN DENTAL MASS PRODUCTION Leading brands and superior technology to drive outsize growth in dental restorative market 1,000+ — Printers installed globally2 600,000+ — Dentures printed since Flexcera launch in Jun-212,3 70+ — Dental & biofabrication materials2 • Insurance reimbursement on printed restorations available in US since Q1 ’23. Creates a $35B opportunity for AM to grow from <5% to >80% this decade • Strategic partnership with industry leader Align Technology • Leading materials including Flexcera with premier material properties and Truedent, the only monolithic multi-material direct printed dentures and restorations. Transformative capabilities to drive growth in ortho. • Leading digital dental & biofabrication production platform (Desktop Labs) – Positions us to enable digital workflows and managed chairside printing – Better patient outcomes and capture of larger portion of the value-chain – End-to-end solutions in biofabrication leveraging advanced R&D • World-class team with experience executing this strategy (1) Grand View Research 2021. Dental Laboratories Market Size, Share & Trends Analysis Report By Product (Restorative, Implant, Oral Care), By Equipment Type (Dental Lasers, Systems & Parts, Hygiene Maintenance Device), By Region, and Segment Forecasts, 2021 – 2028. (2) As of May 24, 2023. (3) Based on management calculations |

| 13 $100B GROWTH OPPORTUNITY IN METAL, CARBIDES AND CERAMICS Bringing true mass production to metal additive manufacturing • The industry’s leading global position in binder jet with the highest throughput systems, over 15 print platforms covering 1L to 1,800L print volumes and more than +45 materials qualified • Fastest 3D printing for metals, technical ceramics and carbides - up to 100X the speed of legacy technology(1) • Largest and growing base of +1,200 customers • Adoption at scale in large markets like automotive and consumer electronics • Strong traction in aerospace with mass production of parts and components flying in aerospace platforms from Airbus (319 neo), Rolls Royce Trent Engine and airframes from Sikorsky, Lockheed Martin and Northop Grumman • High penetration in mass production of carbide cutting tools with leaders like Sandvik and Kennametal • Leadership in 3D printing of nuclear materials via binder jet, an enabling technology for TRISO based SMRs and NTP • Best in class technology for mass production of technical ceramics like Silicon Carbide • Highly patented differentiated technology Images courtesy of BMW and FreeForm Technologies; (1) Based on published speeds of binder jetting and laser powder bed fusion systems comparable to the Production System™ P-50 and using comparable materials and processing parameters. |

| 14 SSYS and DM are already transforming polymer mass-production Select applications in mass-production SPARE PARTS (ANYTHING ANYWHERE) INDUSTRIAL ACCURATE PARTS (E.G., CONNECTORS) INDUSTRIAL REPLACEMENT OF INJECTION MOLDING FOAM SOLUTION FOR LARGE PARTS IN AEROSPACE & AUTOMOTIVE |

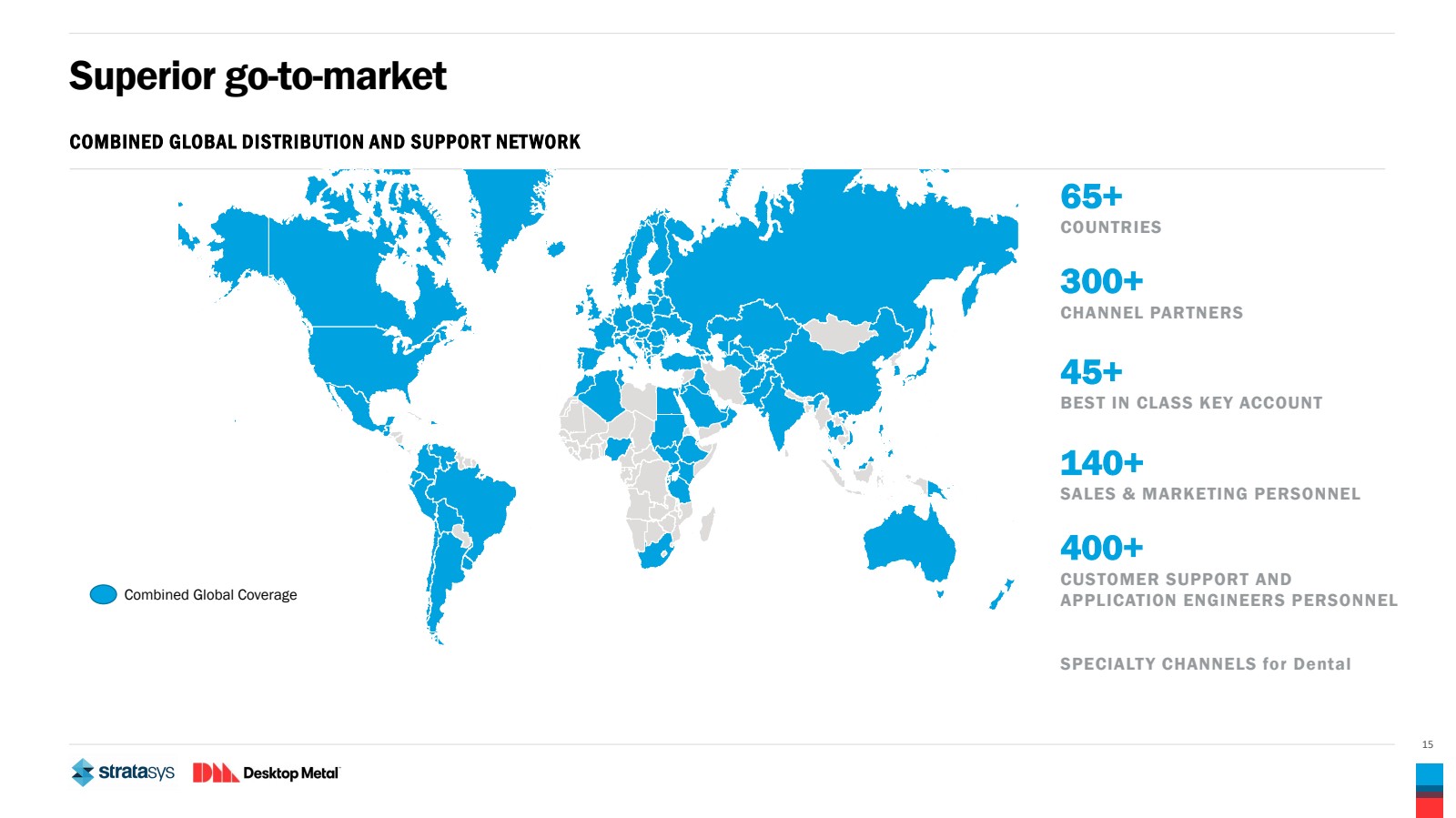

| 15 Superior go-to-market COMBINED GLOBAL DISTRIBUTION AND SUPPORT NET WORK Combined Global Coverage 65+ COUNTRIES 300+ CHANNEL PARTNERS 45+ BEST IN CLASS KEY ACCOUNT 140+ SALES & MARKETING PERSONNEL 400+ CUSTOMER SUPPORT AND APPLICATION ENGINEERS PERSONNEL SPECIALTY CHANNELS for Dental |

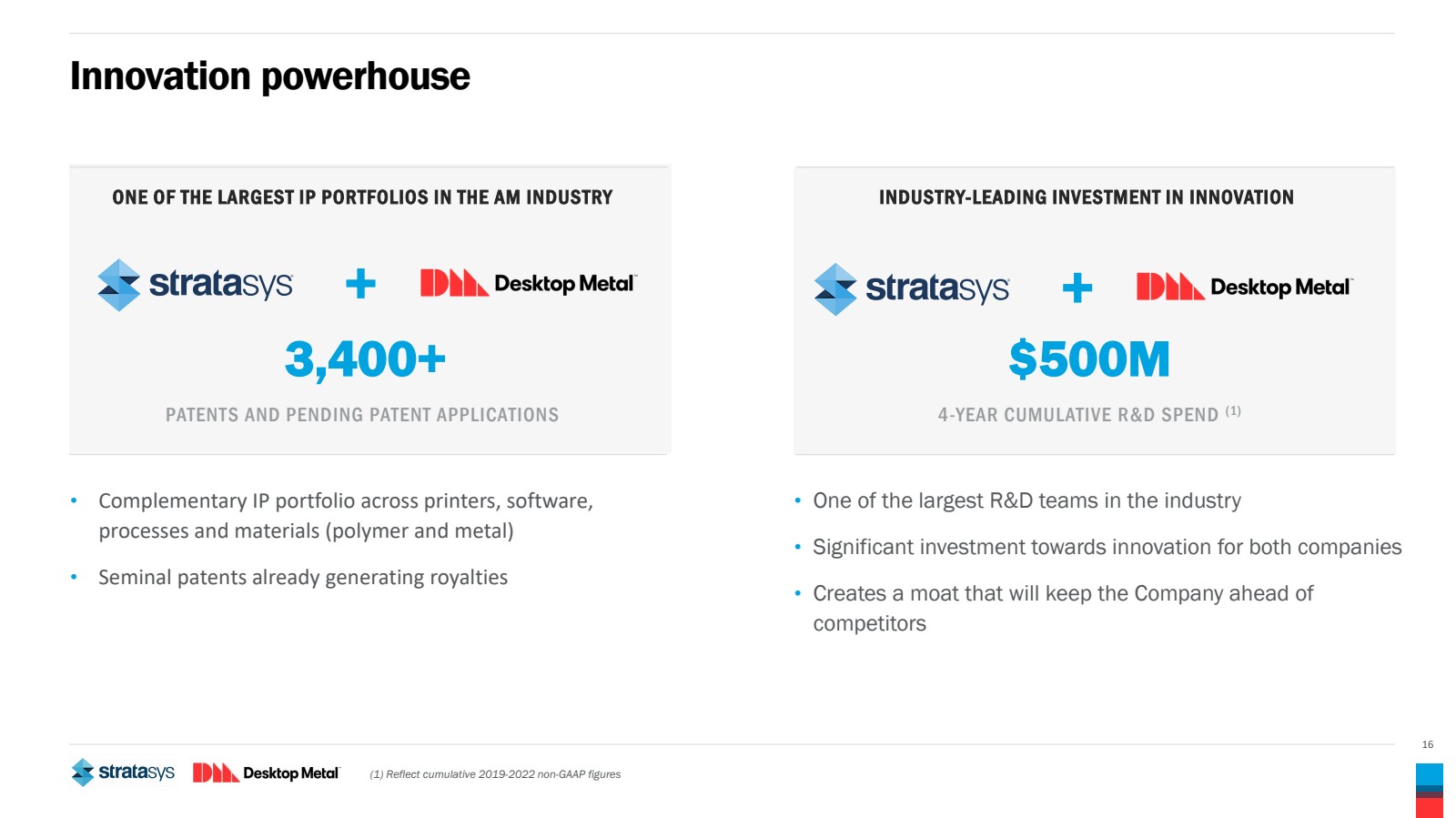

| 16 • One of the largest R&D teams in the industry • Significant investment towards innovation for both companies • Creates a moat that will keep the Company ahead of competitors Innovation powerhouse • Complementary IP portfolio across printers, software, processes and materials (polymer and metal) • Seminal patents already generating royalties ONE OF THE LARGEST IP PORTFOLIOS IN THE AM INDUSTRY INDUSTRY-LEADING INVESTMENT IN INNOVATION 3,400+ PATENTS AND PENDING PATENT APPLICATIONS $500M (1) Reflect cumulative 2019-2022 non-GAAP figures 4-YEAR CUMULATIVE R&D SPEND (1) + + |

| 17 Consumer products Includes final goods for households or personal use, as well as parts that aid in the manufacturing of final goods Selected customers across end markets Aerospace Includes aviation, space flight, and defense technologies Automotive Includes automotive OEMs, tier 1 to tier n’s, as well as bus, trucks, and motorcycles Medical & Dental Includes other products for diverse medical, dentistry and orthodontics Heavy industry Includes all parts related to machinery and manufacturing not included in the other verticals Innovative solutions for clients at the cutting edge |

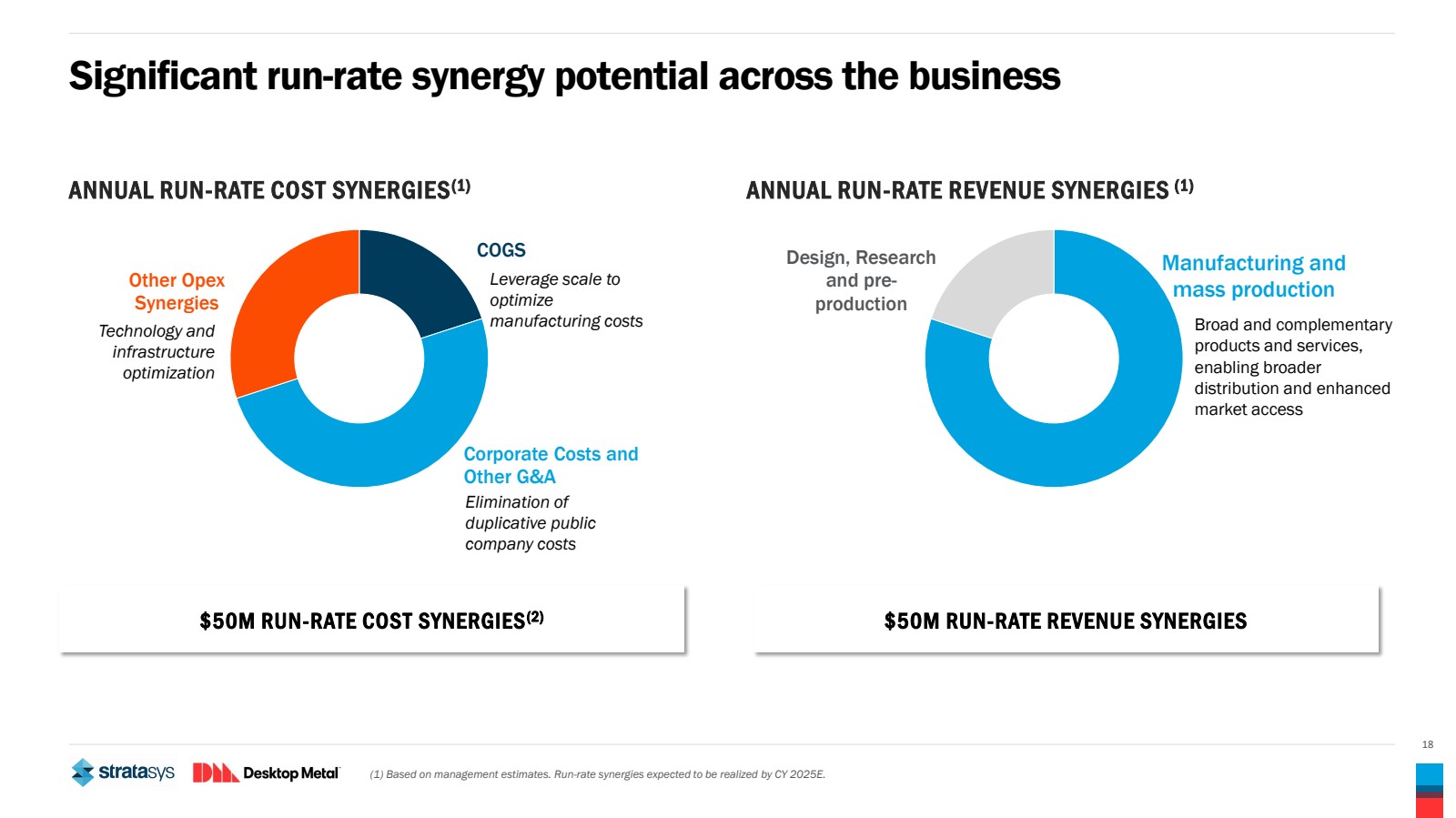

| 18 Significant run-rate synergy potential across the business ANNUAL RUN-RATE REVENUE SYNERGIES (1) ANNUAL RUN-RATE COST SYNERGIES(1) COGS Corporate Costs and Other G&A Other Opex Synergies $50M RUN-RATE COST SYNERGIES(2) Manufacturing and mass production Design, Research and pre-production $50M RUN-RATE REVENUE SYNERGIES (1) Based on management estimates. Run-rate synergies expected to be realized by CY 2025E. Broad and complementary products and services, enabling broader distribution and enhanced market access Leverage scale to optimize manufacturing costs Elimination of duplicative public company costs Technology and infrastructure optimization |

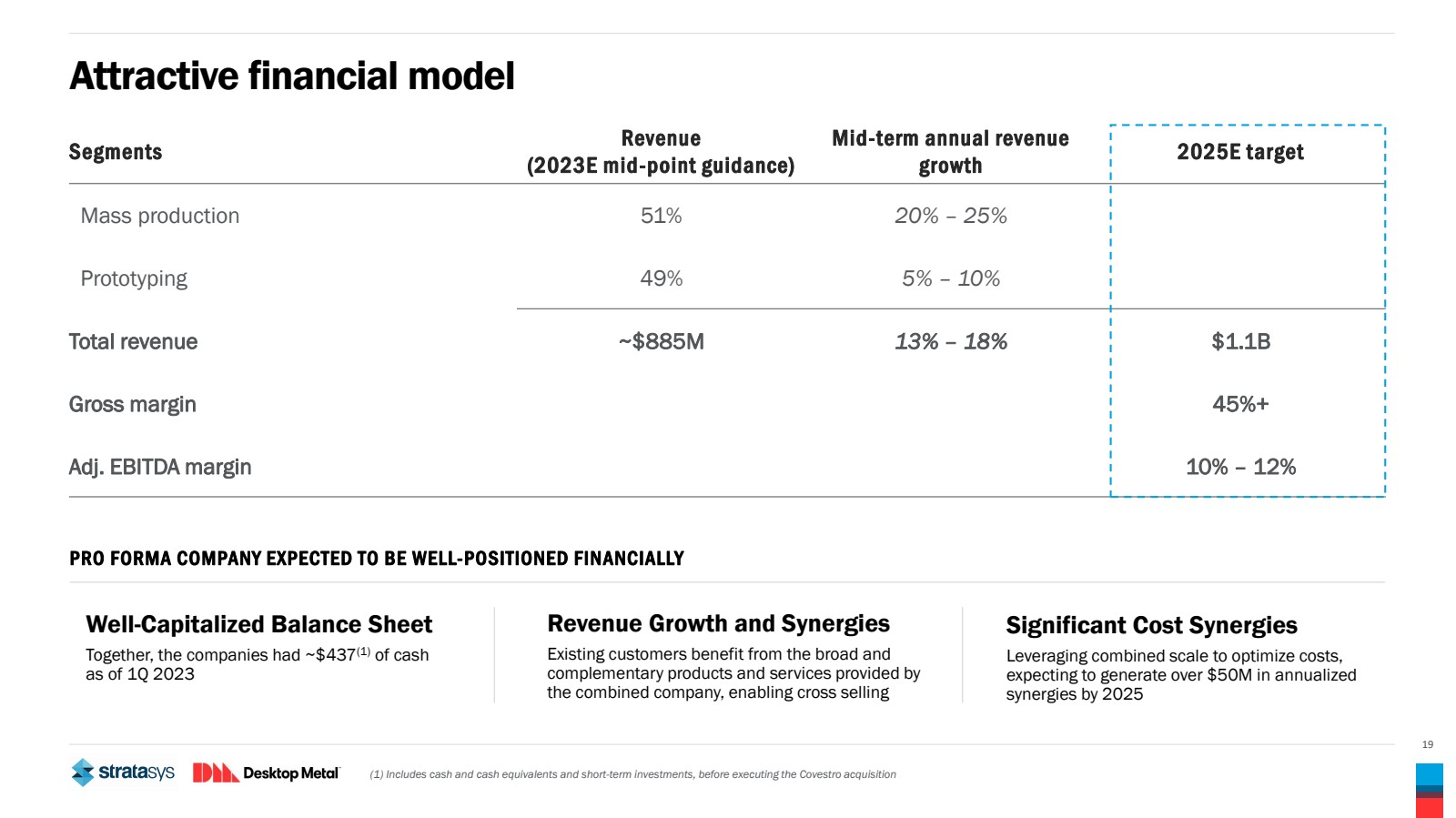

| 19 Segments Revenue (2023E mid-point guidance) Mid-term annual revenue growth 2025E target Mass production 51% 20% – 25% Prototyping 49% 5% – 10% Total revenue ~$885M 13% – 18% $1.1B Gross margin 45%+ Adj. EBITDA margin 10% – 12% Attractive financial model Well-Capitalized Balance Sheet Together, the companies had ~$437(1) of cash as of 1Q 2023 PRO FORMA COMPANY EXPECTED TO BE WELL-POSITIONED FINANCIALLY Revenue Growth and Synergies Existing customers benefit from the broad and complementary products and services provided by the combined company, enabling cross selling Significant Cost Synergies Leveraging combined scale to optimize costs, expecting to generate over $50M in annualized synergies by 2025 (1) Includes cash and cash equivalents and short-term investments, before executing the Covestro acquisition |

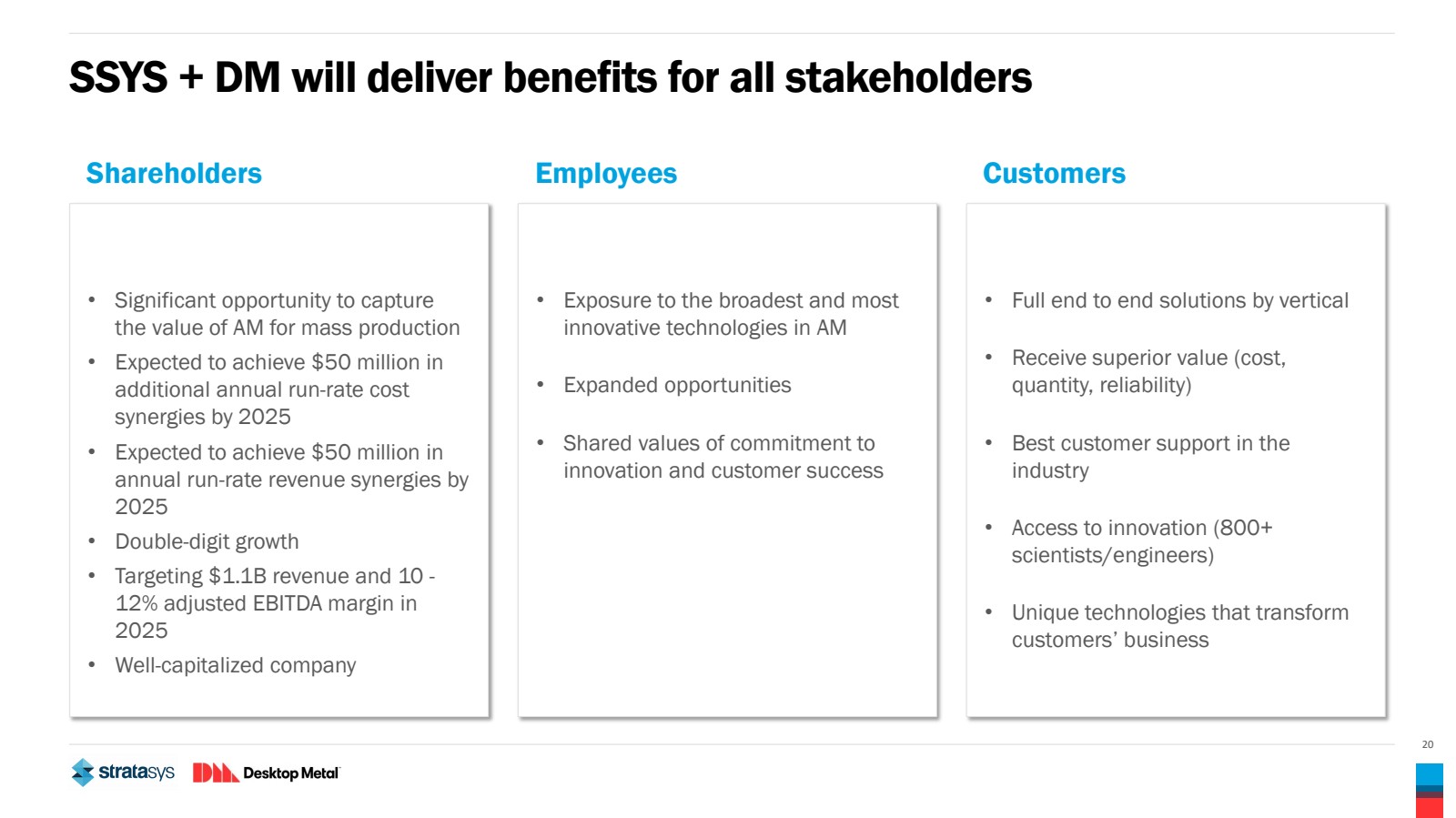

| 20 SSYS + DM will deliver benefits for all stakeholders • Significant opportunity to capture the value of AM for mass production • Expected to achieve $50 million in additional annual run-rate cost synergies by 2025 • Expected to achieve $50 million in annual run-rate revenue synergies by 2025 • Double-digit growth • Targeting $1.1B revenue and 10 - 12% adjusted EBITDA margin in 2025 • Well-capitalized company • Exposure to the broadest and most innovative technologies in AM • Expanded opportunities • Shared values of commitment to innovation and customer success • Full end to end solutions by vertical • Receive superior value (cost, quantity, reliability) • Best customer support in the industry • Access to innovation (800+ scientists/engineers) • Unique technologies that transform customers’ business Shareholders Employees Customers |

| Q&A May 25, 2023 |