Filed by Stratasys Ltd.

(Commission File No. 001-35751)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Desktop Metal, Inc. (Commission File No. 001-38835)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of May 2023

Commission File Number 001-35751

STRATASYS LTD.

(Translation of registrant’s name into English)

| c/o

Stratasys, Inc. 7665 Commerce Way Eden Prairie, Minnesota 55344 |

1

Holtzman Street, Science Park P.O. Box 2496 Rehovot, Israel 76124 | |

| (Addresses of principal executive offices) | ||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

CONTENTS

Announcement of Merger Transaction

On May 25, 2023, Stratasys Ltd. (“Stratasys” or the “Company”) and Desktop Metal, Inc. (“Desktop Metal”) issued a joint press release announcing, among other things, the execution of an Agreement and Plan of Merger (the “Merger Agreement”), dated as of May 25, 2023, by and among Stratasys, Desktop Metal and Tetris Sub Inc., a Delaware corporation and wholly-owned subsidiary of Stratasys (“Merger Sub”), pursuant to which, subject to the terms and conditions of the Merger Agreement, Merger Sub will merge with and into Desktop Metal, with Desktop Metal surviving the merger as a wholly-owned subsidiary of Stratasys (the “Merger”).

Subject to the terms and conditions of the Merger Agreement, Stratasys will issue to the stockholders of Desktop Metal as consideration in the Merger 0.123 of the Company’s ordinary shares in exchange for each share of Desktop Metal common stock held by them immediately prior to the Merger.

The parties expect the transaction to close in the fourth quarter of 2023, subject to the receipt of required regulatory approvals, including expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and approval of the Committee on Foreign Investment in the United States, as well as approvals of the shareholders of Stratasys and stockholders of Desktop Metal, and other customary closing conditions.

The Merger Agreement provides each of Stratasys and Desktop Metal with certain termination rights and, under certain circumstances, may require Stratasys or Desktop Metal to pay a termination fee.

A copy of the joint press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The Company also intends to provide supplemental information regarding the proposed transaction in connection with an investor conference call it will host with Desktop Metal on May 25, 2023 to discuss the Merger. A copy of the materials disseminated in connection with the investor conference call is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Rights Plan Amendment

On July 24, 2022, the Board of Directors (the “Board”) of Stratasys approved the issuance of one special purchase right (a “Right”) for each ordinary share, par value 0.01 New Israeli Shekels per share, of the Company outstanding at the close of business on August 4, 2022, to the shareholders of record on that date, and adopted a shareholder rights plan, as set forth in the Rights Agreement dated as of July 25, 2022 (the “Rights Agreement”), by and between the Company and Continental Stock Transfer & Trust Company, as rights agent (the “Rights Agent”).

On May 25, 2023, in connection with the execution and delivery of the Merger Agreement, the Company entered into the First Amendment to Rights Agreement (the “Amendment” and together with the Rights Agreement, the “Amended Rights Agreement”), by and between the Company and the Rights Agent.

The Amendment, which was approved by the Board, extends the expiration date of the Rights Agreement to the later of (a) July 24, 2023 and (b) the conclusion of the Sun Shareholders’ Meeting (as defined in the Merger Agreement) (unless such Sun Shareholders’ Meeting has been validly adjourned or postponed, in which case at the final adjournment or postponement thereof) or such time as the Merger Agreement has been terminated in accordance with its terms. The Rights are in all respects subject to and governed by the provisions of the Amendment, which is attached hereto as Exhibit 4.1 and incorporated herein by reference, and the Rights Agreement, which was included as an exhibit in the Company’s Form 8-A filing, dated July 25, 2022. The description of the Rights is incorporated herein by reference to the description set forth in the Company’s Report of Foreign Private Issuer on Form 6-K filed on May 1, 2023 and the Company’s Report of Foreign Private Issuer on Form 6-K filed on July 25, 2022, and is qualified in its entirety by reference to the full text of the Rights Agreement and the Amendment.

1

The Rights Agreement is described in the Company’s Report of Foreign Private Issuer on Form 6-K filed on May 1, 2023, and described and included as an exhibit to the Company’s Report of Foreign Private Issuer on Form 6-K filed on July 25, 2022. The Amendment is filed as Exhibit 4.1 hereto and is incorporated by reference herein. The foregoing descriptions of the Rights Agreement, the Amendment and the Rights are qualified entirely by reference to such reports and exhibits.

Incorporation by Reference

The contents of this Form 6-K, excluding Exhibits 99.1 and 99.2 hereto, are incorporated by reference into the Company’s registration statements on Form S-8, SEC file numbers 333-190963, 333-236880, 333-253694, 333-262951 and 333-262952, filed by the Company with the Securities and Exchange Commission (the “SEC”) on September 3, 2013, March 4, 2020, March 1, 2021, February 24, 2022 and February 24, 2022, respectively, and Form F-3, SEC file numbers 333-251938 and 333-253780, filed by the Company with the SEC on January 7, 2021 and March 2, 2021, respectively, as amended, and shall be a part thereof from the date on which this Form 6-K is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

Forward-Looking Statements

This Form 6-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements relating to the proposed transaction between Stratasys and Desktop Metal, including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the SEC, and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells, or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems.

2

These risks, as well as other risks related to the proposed transaction, will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that will be filed by Stratasys with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form F-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Form 6-K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Report on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, Stratasys intends to file with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above.

3

Exhibit Index

The following exhibits are furnished as part of this Form 6-K:

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| STRATASYS LTD. | ||

| Dated: May 25, 2023 | By: | /s/ Eitan Zamir |

| Name: | Eitan Zamir | |

| Title: | Chief Financial Officer | |

5

Exhibit 4.1

FIRST AMENDMENT

TO

RIGHTS AGREEMENT

THIS FIRST AMENDMENT TO RIGHTS AGREEMENT (this “Amendment”), dated as of May 25, 2023, by and between STRATASYS LTD., an Israeli company (the “Company”), and CONTINENTAL STOCK TRANSFER & TRUST COMPANY, a New York corporation, as rights agent (the “Rights Agent”), amends the Rights Agreement, dated as of July 25, 2022, between the Company and the Rights Agent (the “Agreement”). Capitalized terms used herein and not otherwise defined shall have the meaning ascribed to such term in the Agreement.

WHEREAS, the Company and the Rights Agent have executed and entered into the Agreement;

WHEREAS, Section 28 of the Agreement provides, among other things, that the Company may from time to time, and the Rights Agent shall, if directed by the Company, supplement or amend this Agreement without the approval of any holders of Right Certificates to make any other provisions with respect to the Rights which the Company may deem necessary or desirable (provided, among other things, that, from and after such time as any Person becomes an Acquiring Person, certain conditions must be met);

WHEREAS, to the knowledge of the Company, no Person has become an Acquiring Person;

WHEREAS, the Board of Directors of the Company deems it is advisable and in the best interests of the Company and its shareholders to amend certain provisions of the Agreement as set forth herein;

WHEREAS, the Company has provided an Officer’s Certificate in compliance with the terms of Section 28 of the Agreement, attached hereto as Exhibit A; and

WHEREAS, pursuant to and in accordance with Section 28 of the Agreement, the Company desires to amend the Agreement as set forth below.

NOW, THEREFORE, in consideration of the foregoing and the mutual agreements set forth herein, and intending to be legally bound, there parties hereto amend the Agreement is hereby amended as follows:

1. Amendments.

(a) The following is added as a new definition in Section 1 of the Agreement:

“Merger Agreement” shall mean that certain Agreement and Plan of Merger, dated as of May 25, 2023, by and among the Company, Tetris Sub Inc., and Desktop Metal, Inc.

(b) Paragraph (a) of Section 7 of the Agreement is amended in its entirety to read as follows:

(a) The registered holder of any Right Certificate may exercise the Rights evidenced thereby (except as otherwise provided herein), in whole or in part, at any time after the Issuance Date, upon surrender of the Right Certificate, with the form of election to purchase on the reverse side thereof properly completed and duly executed, to the Rights Agent at the principal office of the Rights Agent, together with payment of the Purchase Price for each Ordinary Share as to which the Rights are exercised, at or prior to the earliest of (i) the later of (x) the Close of Business on July 24, 2023 and (y) the conclusion of the Sun Shareholders’ Meeting (as defined in the Merger Agreement) (unless such Sun Shareholders’ Meeting has been validly adjourned or postponed, in which case at the final adjournment or postponement thereof) or, if earlier, such time as the Merger Agreement shall have been terminated in accordance with its terms (such later date, the “Final Expiration Date”), (ii) the time at which the Rights are redeemed as provided in Section 23 hereof (the “Redemption Date”), or (iii) the time at which such Rights are exchanged as provided in Section 24 hereof.

(c) Exhibit A to the Agreement is amended as follows:

| i) | The following is added on page A-1 following the phrase “provisions and conditions of the Agreement, dated as of July 25, 2022” and prior to the parenthetical for the defined term, “Agreement”: |

as may be amended from time to time

| ii) | The reference to “July 24, 2023” on page A-1 is removed and replaced with “the Final Expiration Date (as such term is defined in the Agreement)”. |

(d) Exhibit B to the Agreement is amended as follows:

| i) | The first sentence of the second paragraph on page B-1 is to be removed and replaced with the following: |

Our Board adopted the Rights Agreement, dated July 25, 2022 (as it may be amended from time to time, the “Rights Agreement”), to protect shareholders from coercive or otherwise unfair takeover tactics.

| ii) | The text following the heading “Expiration” on page B-2 is to be removed and replaced with: |

The Rights Agreement will expire on the later of (1) July 24, 2023 and (2) the conclusion of the Sun Shareholders’ Meeting (as defined in the Agreement and Plan of Merger, dated as of May 25, 2023, by and among the Company, Tetris Sub Inc., and Desktop Metal, Inc. (the “Merger Agreement”) (unless such Sun Shareholders’ Meeting has been validly adjourned or postponed, in which case at the final adjournment or postponement thereof) or such time as the Merger Agreement shall have been terminated in accordance with its terms (or earlier to the extent provided in the Rights Agreement).

-2-

2. Effect of this Amendment. It is the intent of the parties that this Amendment constitutes an amendment of the Agreement as contemplated by Section 28 thereof. This Amendment shall be deemed effective as of the date hereof as if executed by both parties hereto on such date. Except as expressly provided in this Amendment, the terms of the Agreement remain in full force and effect.

3. Counterparts. This Amendment may be executed in any number of counterparts and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute one and the same instrument.

4. Governing Law. This Amendment shall be deemed to be a contract made under the laws of the State of Israel and for all purposes shall be governed by and construed in accordance with the laws of such state applicable to contracts to be made and performed entirely within such state, other than with respect to the duties and rights of the Rights Agent under Sections 18-21 hereunder which shall be governed by and construed in accordance with the laws of the State of New York.

5. Severability. If any term, provision, covenant or restriction of this Amendment is held by a court of competent jurisdiction or other authority to be invalid, illegal or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Amendment shall remain in full force and effect and shall in no way be affected, impaired or invalidated.

6. Descriptive Headings. The captions herein are included for convenience of reference only, do not constitute a part of this Amendment and shall be ignored in the construction and interpretation hereof.

7. Further Assurances. Each of the parties to this Amendment will cooperate and take such action as may be reasonably requested by the other party in order to carry out the provisions and purposes of this Amendment, the Agreement and any transactions contemplated hereunder and thereunder.

[Signature Page Follows]

-3-

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date set forth above.

| STRATASYS LTD. | |||

| By: | /s/ Yoav Zeif | ||

| Name: | Yoav Zeif | ||

| Title: | Chief Executive Officer | ||

| By: | /s/ Eitan Zamir | ||

| Name: | Eitan Zamir | ||

| Title: | Chief Financial Officer | ||

| CONTINENTAL STOCK TRANSFER & TRUST COMPANY | |||

| By: | /s/ Margaret B. Lloyd | ||

| Name: | Margaret B. Lloyd | ||

| Title: | Vice President | ||

[Signature Page to First Amendment to Rights Agreement]

EXHIBIT A

OFFICER’S CERTIFICATE

May 25, 2023

Pursuant to Section 28 of the Rights Agreement, dated as of July 25, 2022 (the “Rights Agreement”), by and between Stratasys Ltd., an Israeli company (the “Company”), and Continental Stock Transfer & Trust Company, a New York corporation, as rights agent (the “Rights Agent”), the undersigned officer of the Company does hereby certify that the First Amendment to Rights Agreement, to be entered into as of the date hereof by and between the Company and the Rights Agent, is in compliance with the terms of Section 28 of the Rights Agreement.

Ex-A

IN WITNESS WHEREOF, the undersigned hereby executes this Officer’s Certificate as of the date first above written.

| By: | /s/ Yoav Zeif | |

| Name: | Yoav Zeif | |

| Title: | Chief Executive Officer |

[Signature Page to Officer Certificate]

Exhibit 99.1

Stratasys to Combine with Desktop Metal in Approximately $1.8 Billion All-Stock Transaction

Merger Creates a Next-Generation Additive Manufacturing Company Delivering Industrial Polymer, Metal, Sand and Ceramic Solutions from Design to Mass Production

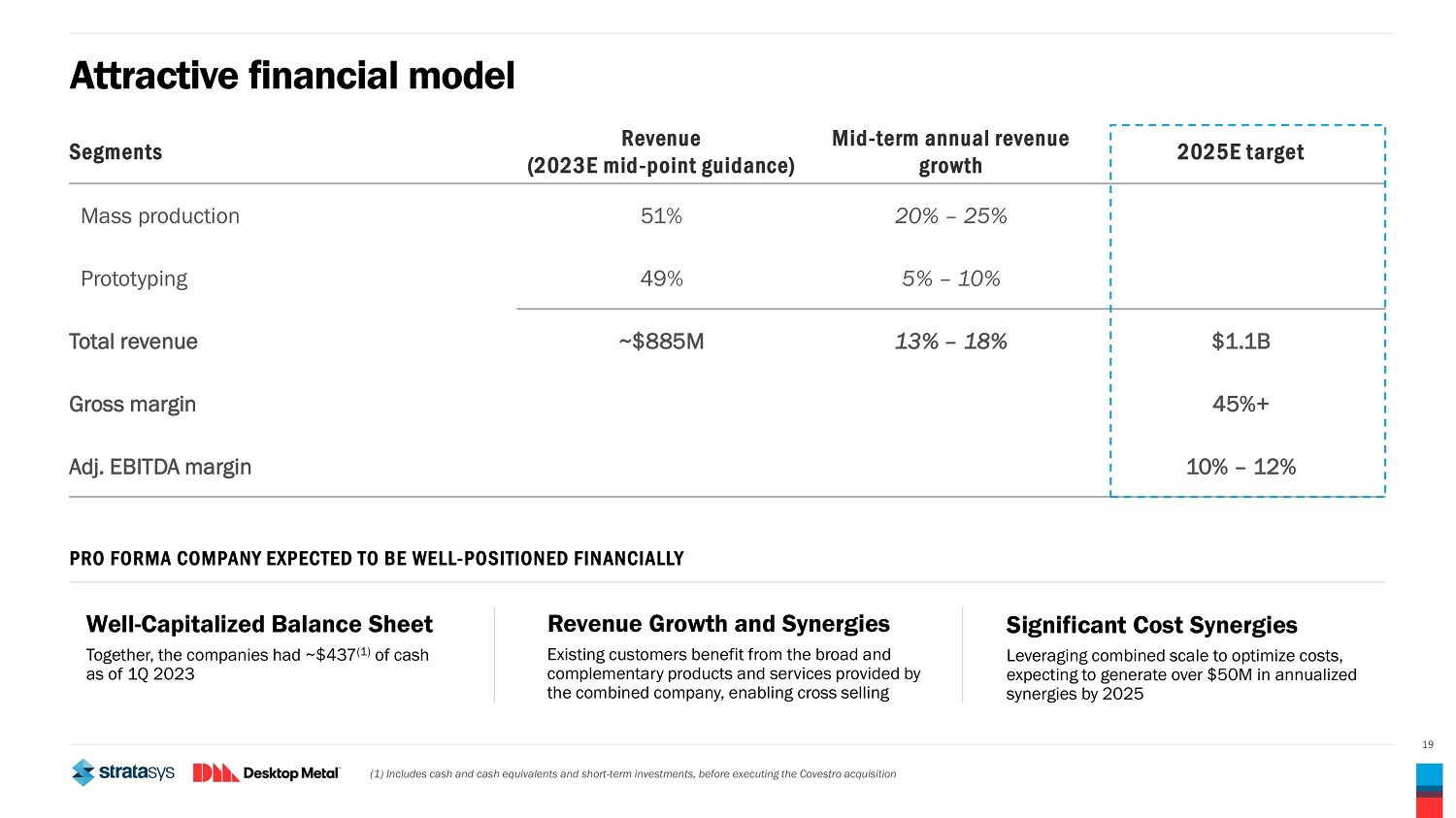

Combined Company Expected to Generate $1.1 Billion in Revenue with Adjusted EBITDA Margin of 10%-12% in 2025

Stratasys and Desktop Metal Reaffirm Previously Provided Guidance

Companies to Host Conference Call to Discuss Transaction Today at 8:30 A.M. ET

Visit www.NextGenerationAM.com for More Information

MINNEAPOLIS and REHOVOT, Israel, and BOSTON — May 25, 2023 — Stratasys Ltd. (Nasdaq: SSYS) (“Stratasys”) and Desktop Metal, Inc. (NYSE: DM) (“Desktop Metal”) today announced that they have entered into a definitive agreement whereby the companies will combine in an all-stock transaction valued at approximately $1.8 billion. The transaction unites the polymer strengths of Stratasys with the complementary industrial mass production leadership of Desktop Metal’s brands, creating an additive manufacturing company that is expected to be well-positioned to serve the evolving needs of customers in manufacturing.

Stratasys and Desktop Metal are expected to generate $1.1 billion in 2025 revenue, with significant upside potential in a total addressable market of more than $100 billion by 2032.

Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, Desktop Metal stockholders will receive 0.123 ordinary shares of Stratasys for each share of Desktop Metal Class A common stock. This represents a value of approximately $1.88 per share of Desktop Metal Class A common stock based on the closing price of a Stratasys ordinary share of $15.26 on May 23, 2023. Following the closing of the transaction, which is expected to occur in the fourth quarter of 2023, existing Stratasys shareholders will own approximately 59% of the combined company, and legacy Desktop Metal stockholders will own approximately 41% of the combined company, in each case, on a fully diluted basis.

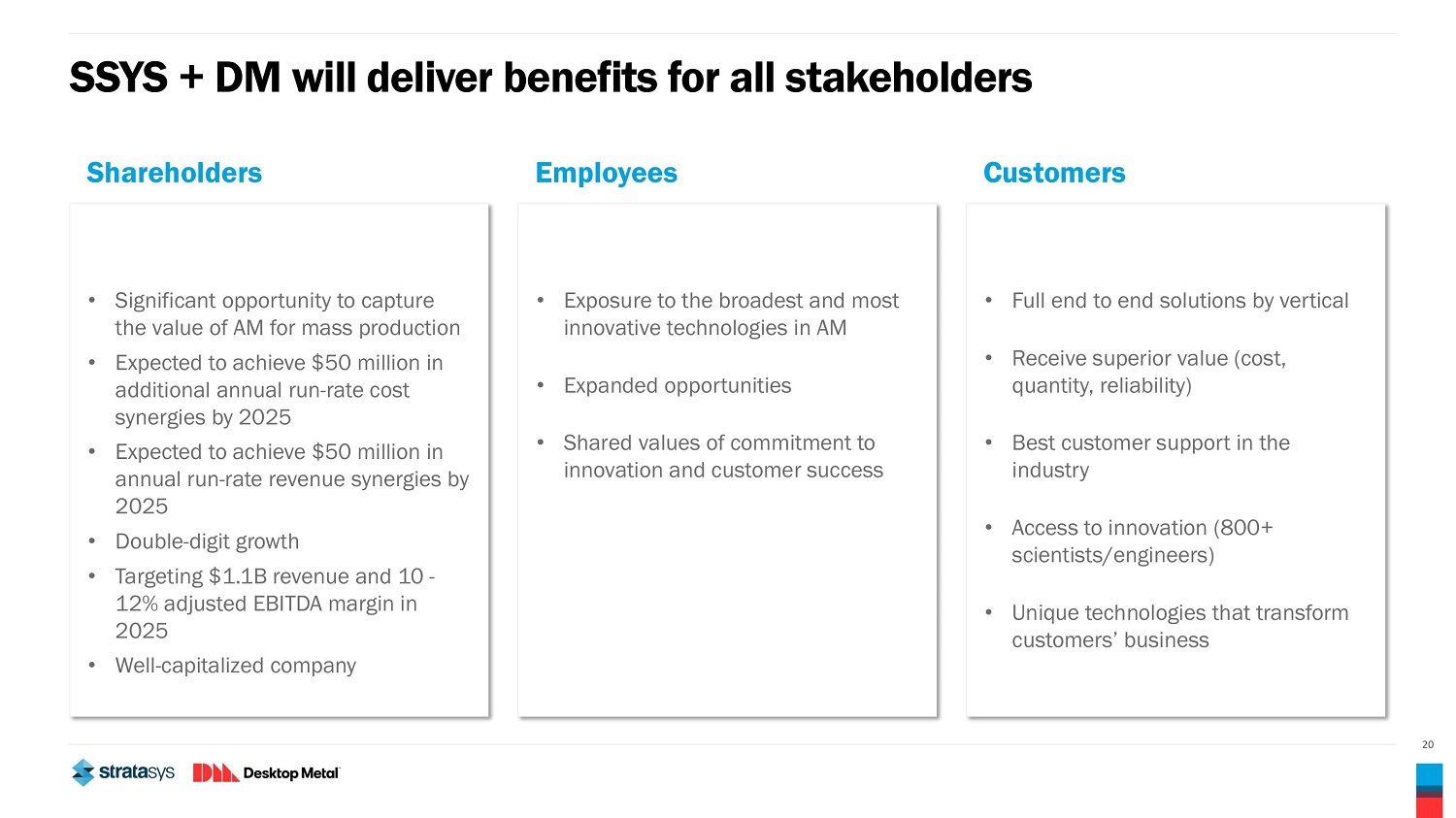

“Today is an important day in Stratasys’ evolution,” said Dr. Yoav Zeif, CEO of Stratasys. “The combination with Desktop Metal will accelerate our growth trajectory by uniting two leaders to create a premier global provider of industrial additive manufacturing solutions. With attractive positions across complementary product offerings, including aerospace, automotive, consumer products, healthcare and dental, as well as one of the largest and most experienced R&D teams, industry-leading go-to-market infrastructure and a robust balance sheet, the combined company will be committed to delivering ongoing innovation while providing outstanding service to customers. We look forward to building on the complementary strengths of the combined business and leveraging the strong brand equity across the portfolio to deliver enhanced value to shareholders, customers and employees.”

“We believe this is a landmark moment for the additive manufacturing industry,” said Ric Fulop, Co-founder, Chairman and CEO of Desktop Metal. “The combination of these two great companies marks a turning point in driving the next phase of additive manufacturing for mass production. We are excited to complement our portfolio of production metal, sand, ceramic and dental 3D printing solutions with Stratasys’ polymer offerings. Together, we will strive to build an even more resilient offering with a diversified customer base across industries and applications in order to drive long-term sustainable growth. We look forward to combining with Stratasys to deliver profitability while driving further innovation for a larger customer base and providing expanded opportunities for our employees.”

Compelling Strategic and Financial Benefits of the Transaction

| ● | Combined Company Creates Greater Opportunities for Growth: The transaction establishes a uniquely scaled additive manufacturing company that is expected to be one of the largest companies in the industry, targeting $1.1 billion in 2025 revenue. In addition, there are significant opportunities as additive manufacturing increases its offerings in mass production, with expected industry growth to more than $100 billion by 2032. |

| ● | Brings Together Complementary Portfolios: Bringing together Stratasys’ and Desktop Metal’s additive manufacturing platform offerings, the combined company will have a broad product portfolio and attractive positions across multiple additive manufacturing technologies and solutions. Upon close, more than 50% of pro forma combined company revenue is expected to be derived from end-use-parts manufacturing and mass production, one of the fastest growing segments in additive manufacturing. The combined company is expected to offer customers end to end solutions from designing, prototyping and tooling to mass production and aftermarket operations across the entire manufacturing lifecycle. |

| ● | Unites Robust Innovation and Technology Expertise: The transaction brings together complementary IP portfolios with more than 3,400 patents and pending patent applications. Together, Stratasys and Desktop Metal have invested over $500 million in R&D over the last four fiscal years. In addition, the combined company will have one of the largest R&D and engineering teams in the industry with over 800 scientists and engineers focused on driving innovation across a differentiated materials library. |

| ● | Diversifies Customer Base Across Industries and Applications: This combination brings together complementary products and technologies that cover a wide range of industry verticals and use cases. The combined company is expected to have superior global go-to-market capabilities with enhanced market access for recognizable brands, backed up by premier customer support capabilities. With more than 27,000 industrial customers, the combined company will have a large customer base across industries, materials and applications to drive significant recurring revenue from consumables. |

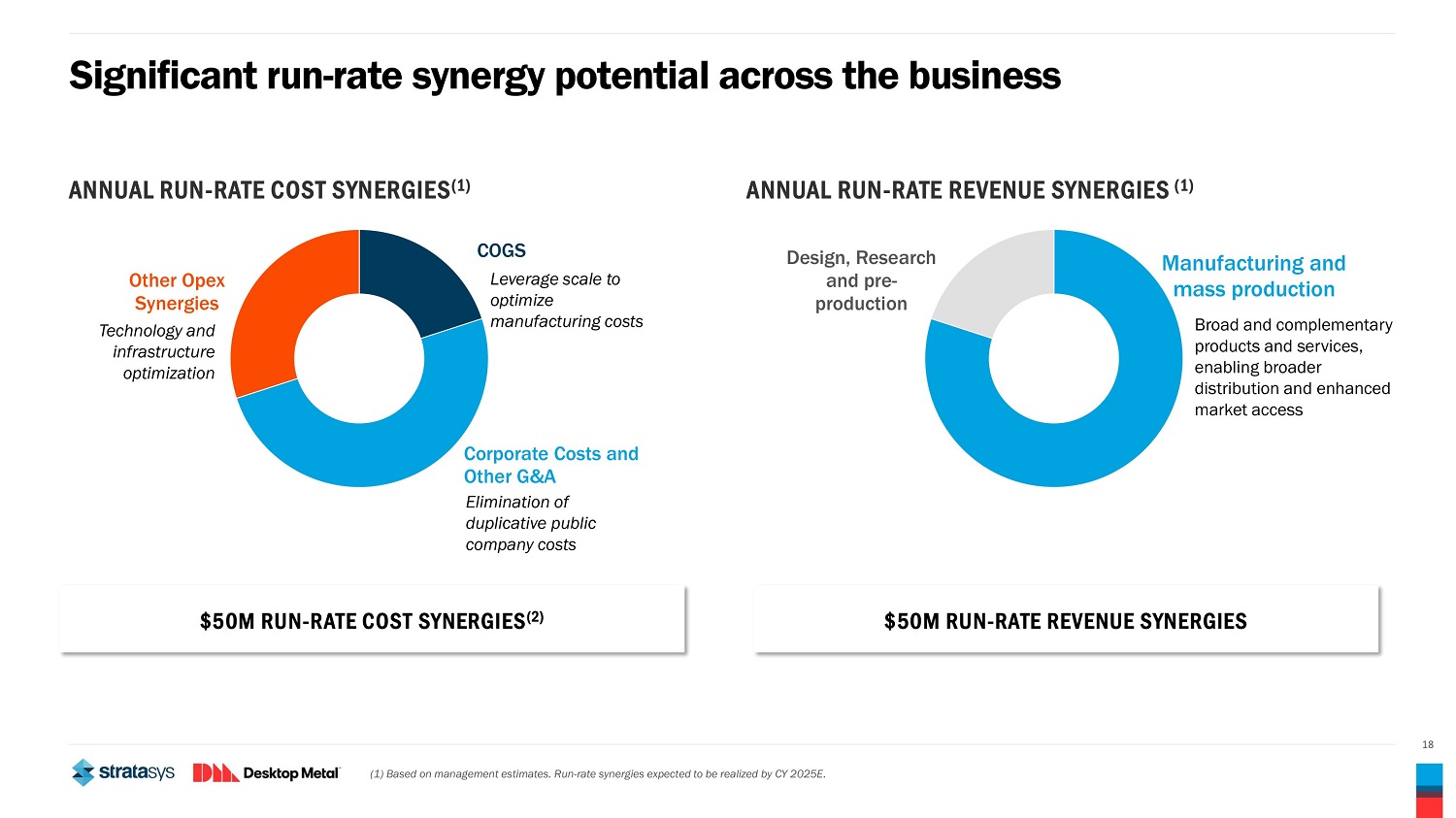

| ● | Creates Opportunities for Meaningful Synergies: The combined company is expected to generate approximately $50 million in additional annual run-rate cost synergies by 2025, due primarily to cost reductions in sales, general and administrative expenses, supply chain management and optimization of operational processes. The combined company is expected to generate an additional $50 million in annual run-rate revenue synergies by 2025 from enhanced market access.1 |

| 1 | Based on management estimates. Run-rate synergies expected to be realized by CY 2025E. |

2

| ● | Increases Financial Strength: The combined company is targeting 10%-12% adjusted EBITDA margins in 2025. Together, Stratasys and Desktop Metal had $437 million2 of cash and cash equivalents as of the first quarter of 2023, and this transaction accelerates the combined company’s financial flexibility through a well-capitalized balance sheet to drive future growth. |

Leadership and Governance

Following the close of the transaction, Dr. Zeif will lead the combined company as Chief Executive Officer together with Mr. Fulop as Chairman of the Board. Upon completion of the transaction, the combined company’s Board of Directors will be comprised of 11 members, five of whom will be selected by Stratasys, and five of whom will be selected by Desktop Metal, plus Dr. Zeif as CEO. Stratasys Chairman Dov Ofer will serve as lead independent director of the combined company.

Timing to Close and Approvals

The transaction, which is expected to be completed in the fourth quarter of 2023, is subject to customary closing conditions, including the approval of Stratasys’ shareholders and Desktop Metal’s stockholders and the receipt of certain governmental and regulatory approvals.

Shareholder Rights Plans

In connection with the transaction, Stratasys entered into an amendment to its existing shareholder rights plan (as amended, the “Stratasys Rights Plan”), pursuant to which the expiration date has been extended to the later of (a) July 24, 2023 and (b) the conclusion of the extraordinary general meeting of Stratasys’ shareholders for the purpose of seeking approval of Stratasys’ shareholders of the transactions contemplated by the merger agreement (unless such meeting has been validly adjourned or postponed, in which case at the final adjournment or postponement thereof) or such time as the merger agreement has been terminated in accordance with its terms. The extension of the expiration date of the Stratasys Rights Plan is intended to ensure that all shareholders have a meaningful opportunity to vote on the approval of the transaction and preserve for all shareholders the long-term value of the company in the event of a takeover or acquisition of a controlling stake without the payment of a control premium. The Stratasys Rights Plan will not prevent any person from making a superior proposal pursuant to the terms of the merger agreement.

Also in connection with the transaction, the Desktop Metal board intends to adopt a limited duration shareholder rights plan (the “Desktop Metal Rights Plan”). The Desktop Metal Rights Plan will be designed to assist the Desktop Metal board in maximizing shareholder value in connection with the transaction. The Desktop Metal Rights Plan, like the Stratasys Rights Plan, will not prevent any person from making a superior proposal pursuant to the terms of the merger agreement.

| 2 | Before executing the Covestro acquisition. |

3

Additional details about the amendment to the Stratasys Rights Plan will be included in a Form 6-K to be filed by Stratasys with the SEC. Additional details about the Desktop Metal Rights Plan will be included in a Current Report on Form 8-K to be filed by Desktop Metal with the U.S. Securities and Exchange Commission (the “SEC”).

Stratasys and Desktop Metal Guidance

Stratasys today reaffirmed the guidance provided on May 16, 2023 when the company reported its first quarter earnings results, including its medium-term financial forecast. Desktop Metal also reaffirmed full year 2023 guidance provided with its first quarter earnings results on May 10, 2023.

Conference Call and Webcast

Stratasys and Desktop Metal will host a joint conference call and webcast today at 8:30 A.M. ET to discuss the details of the transaction.

The companies have posted a presentation regarding the transaction on the Investor Relations sections of their websites.

The investor conference call will be available via live webcast on

Stratasys’ investor relations website at investors.stratasys.com and on Desktop Metal’s investor relations website at ir.desktopmetal.com,

or directly at the following web address:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=TAE4tFjn.

To participate by telephone, the U.S. toll-free number is 877-524-8416 and the international dial-in is +1 412-902-1028. Investors are advised to dial into the call at least ten minutes prior to the call to register. The webcast will be available for six months at investors.stratasys.com and ir.desktopmetal.com, or by accessing the above-provided web address.

Stratasys and Desktop Metal have also launched a website, www.NextGenerationAM.com, where the presentation and other materials related to the transaction are available.

Advisors

J.P. Morgan Securities LLC is acting as exclusive financial advisor to Stratasys and Meitar Law Offices and Wachtell, Lipton, Rosen & Katz are serving as legal counsel. Stifel is acting as exclusive financial advisor to Desktop Metal and Latham & Watkins LLP and Shibolet & Co. are serving as legal counsel.

4

About Stratasys

Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products, healthcare, fashion and education. Through smart and connected 3D printers, polymer materials, a software ecosystem, and parts on demand, Stratasys solutions deliver competitive advantages at every stage in the product value chain. The world’s leading organizations turn to Stratasys to transform product design, bring agility to manufacturing and supply chains, and improve patient care.

To learn more about Stratasys, visit www.stratasys.com, the Stratasys blog, Twitter, LinkedIn, or Facebook. Stratasys reserves the right to utilize any of the foregoing social media platforms, including the Company’s websites, to share material, non-public information pursuant to the SEC’s Regulation FD. To the extent necessary and mandated by applicable law, Stratasys will also include such information in its public disclosure filings.

Stratasys is a registered trademark and the Stratasys signet is a trademark of Stratasys Ltd. and/or its subsidiaries or affiliates. All other trademarks are the property of their respective owners.

About Desktop Metal

Desktop Metal (NYSE:DM) is driving Additive Manufacturing 2.0, a new era of on-demand, digital mass production of industrial, medical, and consumer products. Our innovative 3D printers, materials, and software deliver the speed, cost, and part quality required for this transformation. We’re the original inventors and world leaders of the 3D printing methods we believe will empower this shift, binder jetting and digital light processing. Today, our systems print metal, polymer, sand and other ceramics, as well as foam and recycled wood. Manufacturers use our technology worldwide to save time and money, reduce waste, increase flexibility, and produce designs that solve the world’s toughest problems and enable once-impossible innovations. Learn more about Desktop Metal and our #TeamDM brands at www.desktopmetal.com.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements relating to the proposed transaction between Stratasys Ltd. (“Stratasys”) and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems.

5

These risks, as well as other risks related to the proposed transaction, will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form F-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Form 6-K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, Stratasys intends to file with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

6

Participants in the Solicitation

Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above.

Contacts

Stratasys

Investor Relations

Yonah Lloyd

CCO / VP Investor Relations

Yonah.Lloyd@stratasys.com

U.S. Media

Ed Trissel / Joseph Sala / Kara Brickman

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Israel Media

Rosa Coblens

VP Sustainability, Public Relations IL & Global Internal Communications

Rosa.Coblens@stratasys.com

Yael Arnon

Scherf Communications

yaela@scherfcom.com

+972527202703

Desktop Metal

Investor Relations

Jay Gentzkow

jaygentzkow@desktopmetal.com

(781) 730-2110

Media Relations

Sarah Webster

sarahwebster@desktopmetal.com

(313) 715-6988

7

The powerhouse in industrial additive manufacturing May 24, 2023

2 Disclaimer Cautionary Statement Regarding Forward - Looking Statements This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. No Offer or Solicitation This communication contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward - looking statements include statements relating to the proposed transaction between Stratasys Ltd. (“Stratasys”) and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward - looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward - looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward - looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20 - F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10 - K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro - economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly - launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems. These risks, as well as other risks related to the proposed transaction, will be included in the registration statement on Form F - 4 and joint proxy statement/prospectus that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form F - 4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20 - F and Form 10 - K, respectively, and Stratasys’ Form 6 - K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10 - Q. The forward - looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward - looking statements to reflect subsequent events or circumstances, except as required by law. Additional Information about the Transaction and Where to Find It In connection with the proposed transaction, Stratasys intends to file with the SEC a registration statement on Form F - 4 that will include a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys . Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction . This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec - filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec - filings/all - sec - filings. Participants in the Solicitation Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20 - F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above.

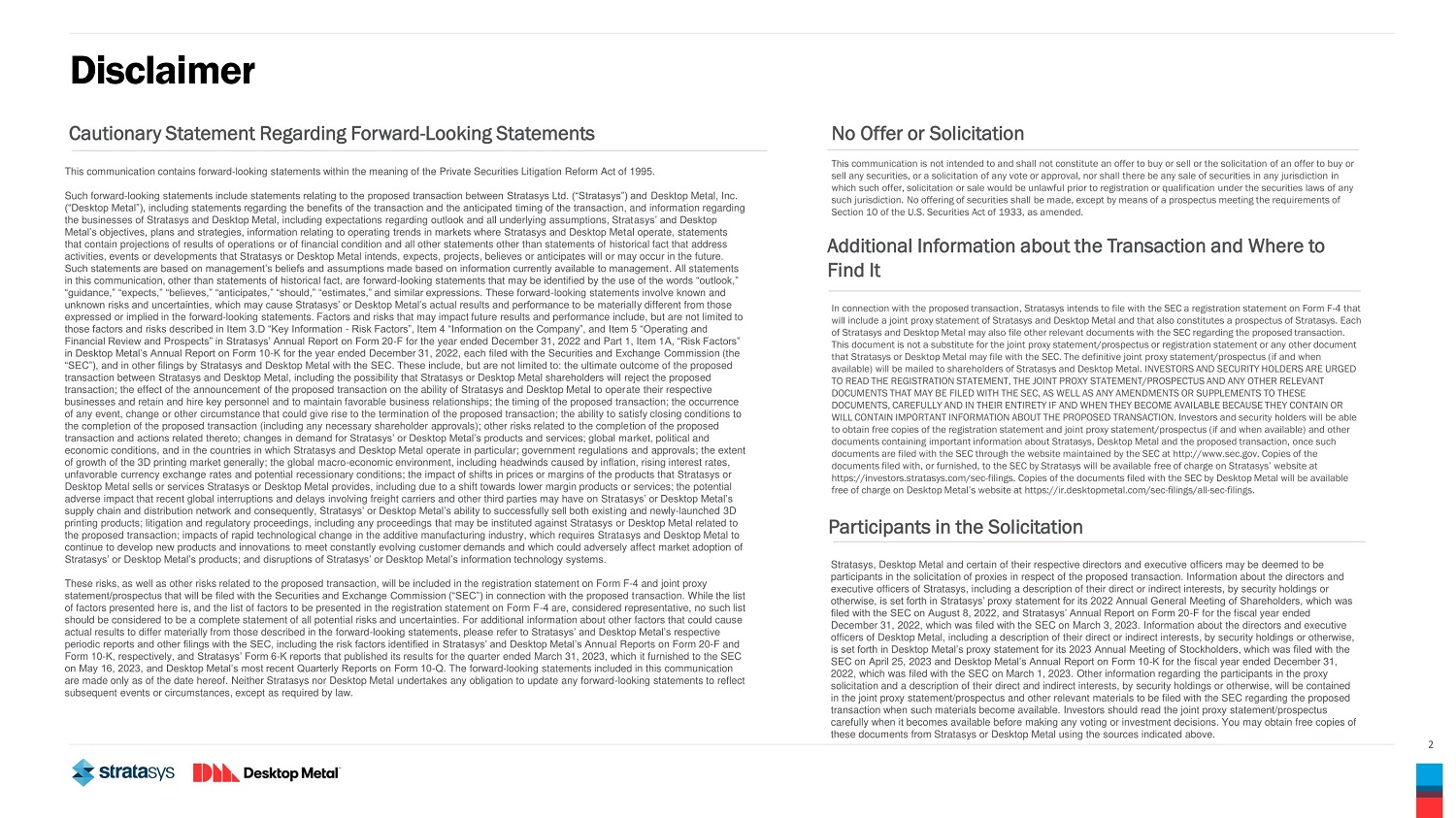

3 RIC FULOP Chairman and CEO Desktop Metal Today’s presenters DR. YOAV ZEIF CEO Stratasys Chairman Combined Company CEO and Director Combined Company

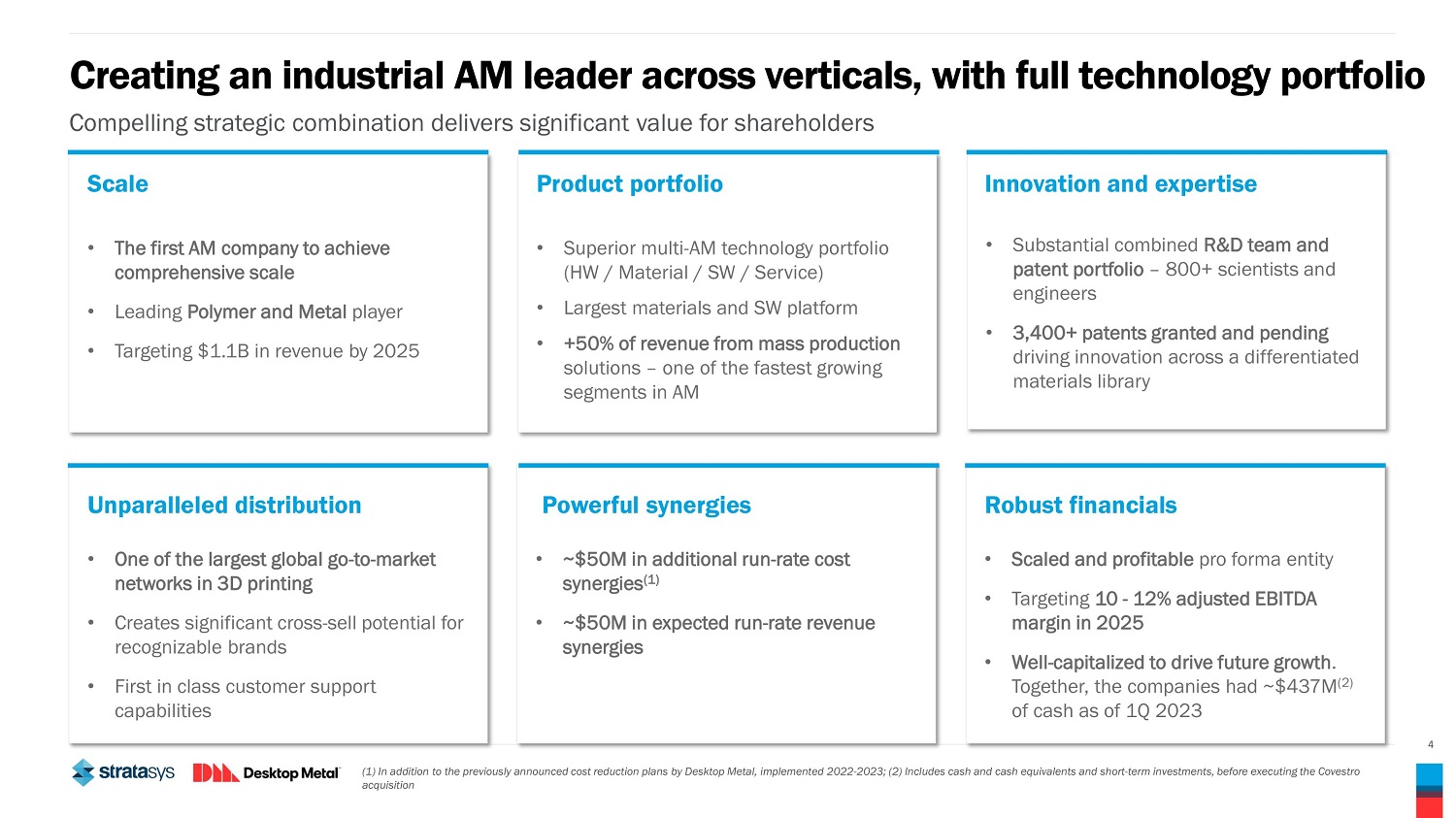

Unparalleled distribution • One of the largest global go - to - market networks in 3D printing • Creates significant cross - sell potential for recognizable brands • First in class customer support capabilities Powerful synergies • ~$50M in additional run - rate cost synergies (1) • ~$50M in expected run - rate revenue synergies Robust financials • Scaled and profitable pro forma entity • Targeting 10 - 12% adjusted EBITDA margin in 2025 • Well - capitalized to drive future growth. Together, the companies had ~$437M (2) of cash as of 1Q 2023 4 (1) In addition to the previously announced cost reduction plans by Desktop Metal, implemented 2022 - 2023; (2) Includes cash and cash equivalents and short - term investments, before executing the Covestro acquisition Innovation and expertise • Substantial combined R&D team and patent portfolio – 800+ scientists and engineers • 3,400+ patents granted and pending driving innovation across a differentiated materials library Product portfolio • Superior multi - AM technology portfolio (HW / Material / SW / Service) • Largest materials and SW platform • +50% of revenue from mass production solutions – one of the fastest growing segments in AM Creating an industrial AM leader across verticals, with full technology portfolio Compelling strategic combination delivers significant value for shareholders Scale • The first AM company to achieve comprehensive scale • Leading Polymer and Metal player • Targeting $1.1B in revenue by 2025

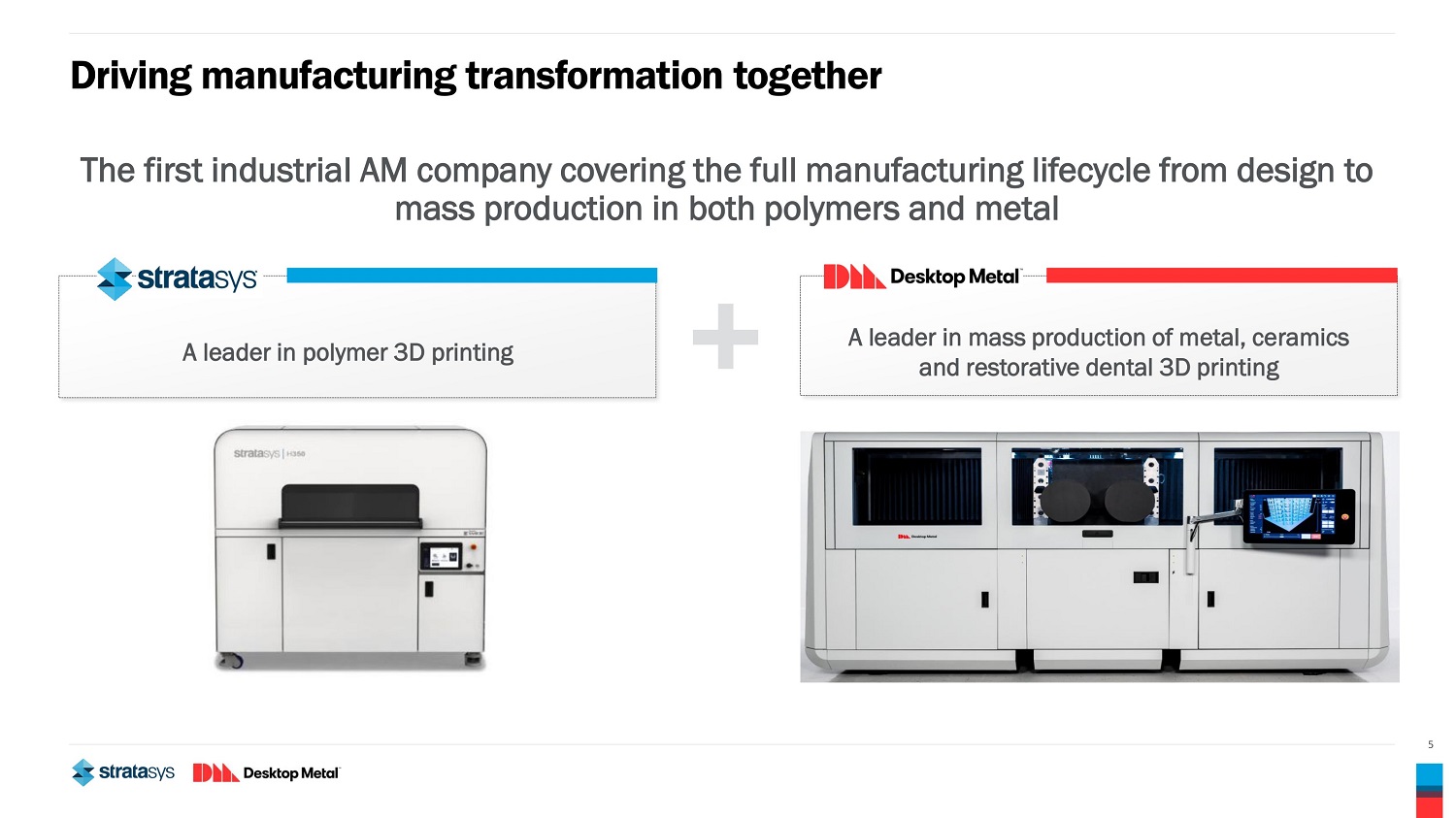

5 Driving manufacturing transformation together The first industrial AM company covering the full manufacturing lifecycle from design to mass production in both polymers and metal A leader in polymer 3D printing A leader in mass production of metal, ceramics and restorative dental 3D printing

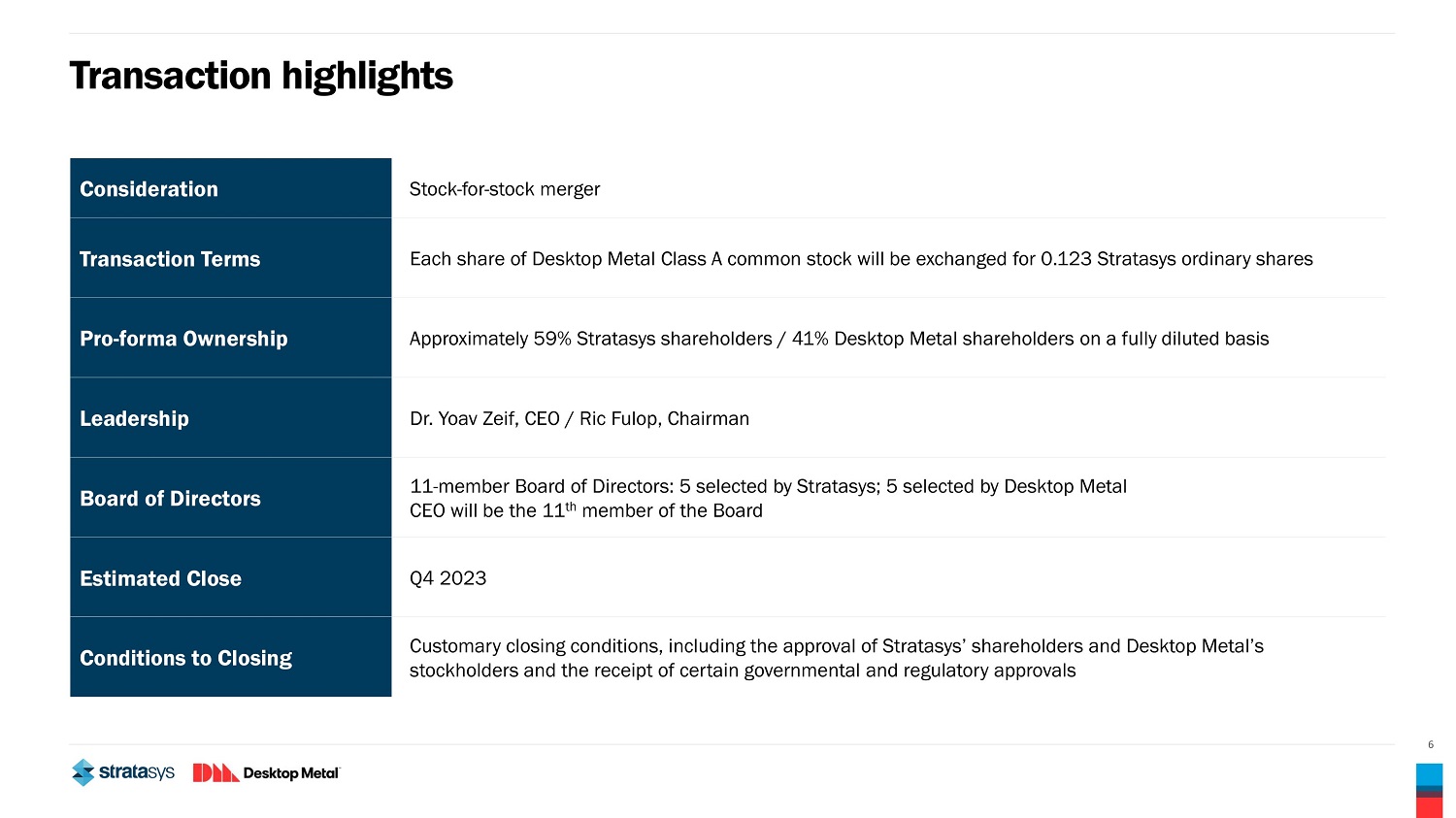

6 Transaction highlights Consideration Stock - for - stock merger Transaction Terms Each share of Desktop Metal Class A common stock will be exchanged for 0.123 Stratasys ordinary shares Pro - forma Ownership Approximately 59% Stratasys shareholders / 41% Desktop Metal shareholders on a fully diluted basis Leadership Dr. Yoav Zeif, CEO / Ric Fulop, Chairman Board of Directors 11 - member Board of Directors: 5 selected by Stratasys; 5 selected by Desktop Metal CEO will be the 11 th member of the Board Estimated Close Q4 2023 Conditions to Closing Customary closing conditions, including the approval of Stratasys’ shareholders and Desktop Metal’s stockholders and the receipt of certain governmental and regulatory approvals

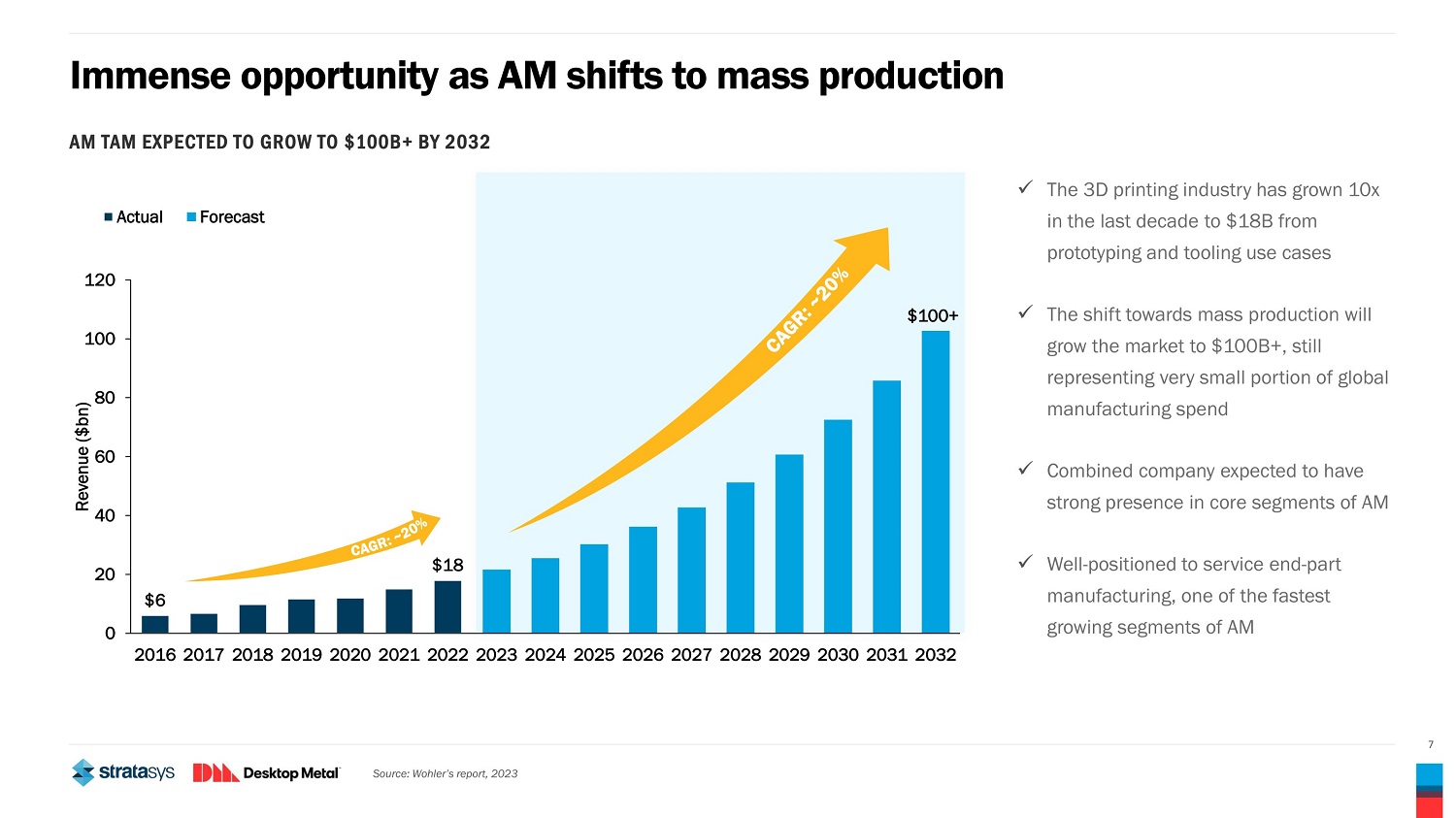

7 Immense opportunity as AM shifts to mass production x The 3D printing industry has grown 10x in the last decade to $18B from prototyping and tooling use cases x The shift towards mass production will grow the market to $100B+, still representing very small portion of global manufacturing spend x Combined company expected to have strong presence in core segments of AM x Well - positioned to service end - part manufacturing, one of the fastest growing segments of AM AM TAM EXPECTED TO GROW TO $100B+ BY 2032 Source: Wohler’s report, 2023 $6 $18 $100+ 0 20 40 60 80 100 120 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 Revenue ($bn) Actual Forecast

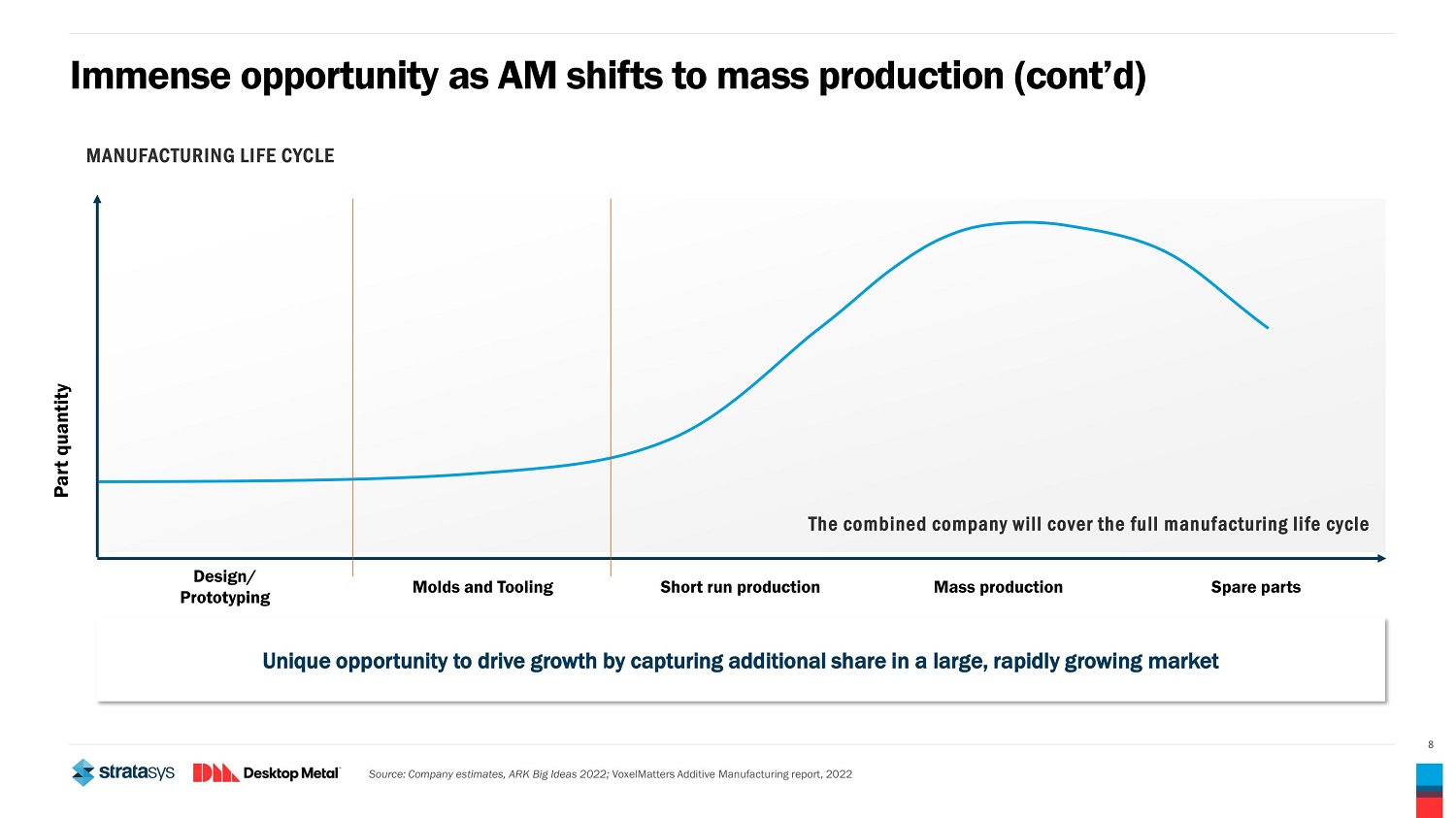

8 Immense opportunity as AM shifts to mass production (cont’d) Part quantity MANUFACTURING LIFE CYCLE Source: Company estimates, ARK Big Ideas 2022; VoxelMatters Additive Manufacturing report, 2022 Unique opportunity to drive growth by capturing additional share in a large, rapidly growing market Design/ Prototyping Molds and Tooling Short run production Mass production Spare parts The combined company will cover the full manufacturing life cycle

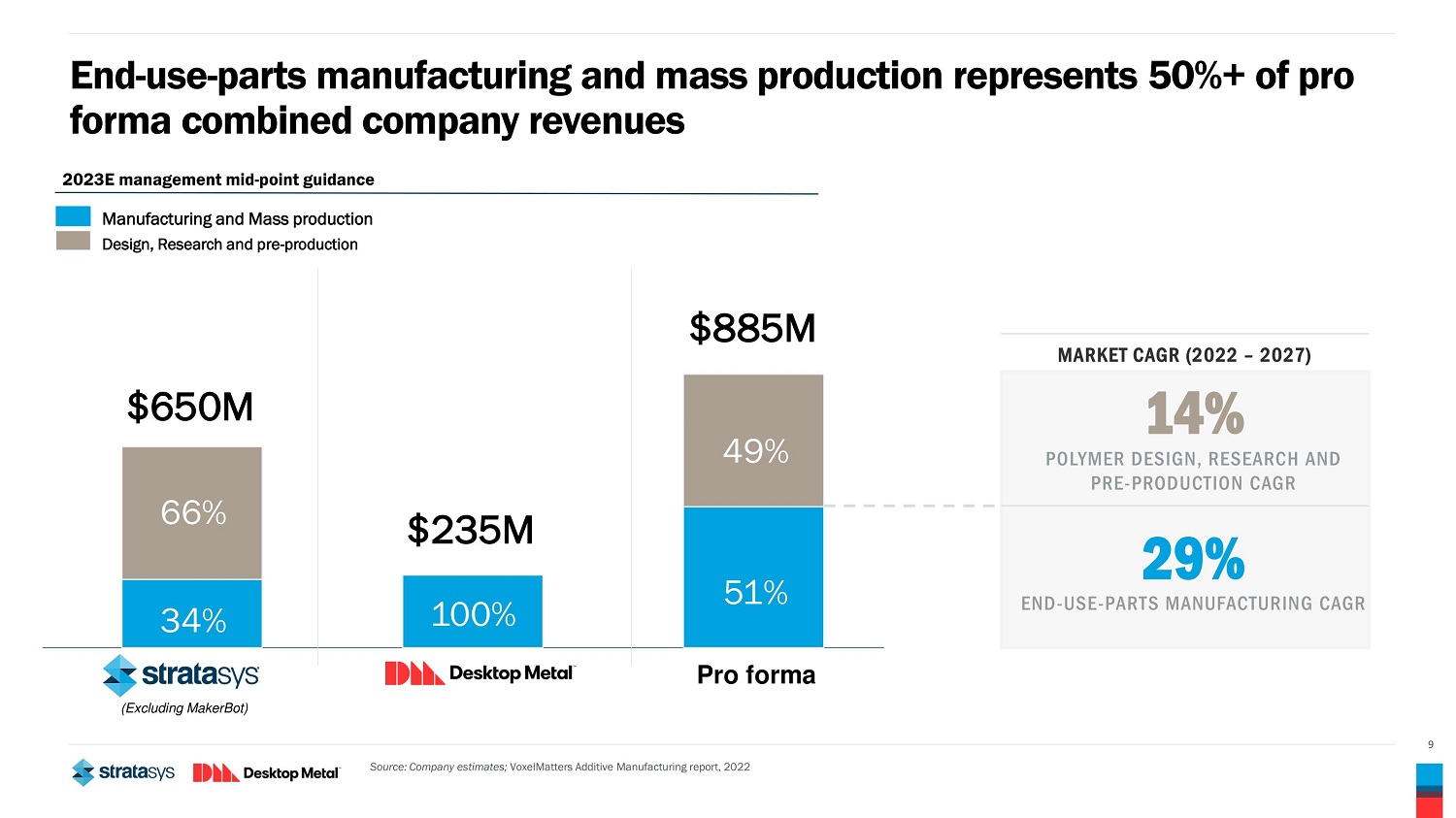

9 14% POLYMER DESIGN, RESEARCH AND PRE - PRODUCTION CAGR MARKET CAGR (2022 – 2027) 29% END - USE - PARTS MANUFACTURING CAGR Source: Company estimates; VoxelMatters Additive Manufacturing report, 2022 Pro forma $650M $235M (Excluding MakerBot) End - use - parts manufacturing and mass production represents 50%+ of pro forma combined company revenues 2023E management mid - point guidance Manufacturing and Mass production Design, Research and pre - production $885M 34% 66% 51% 49% 100%

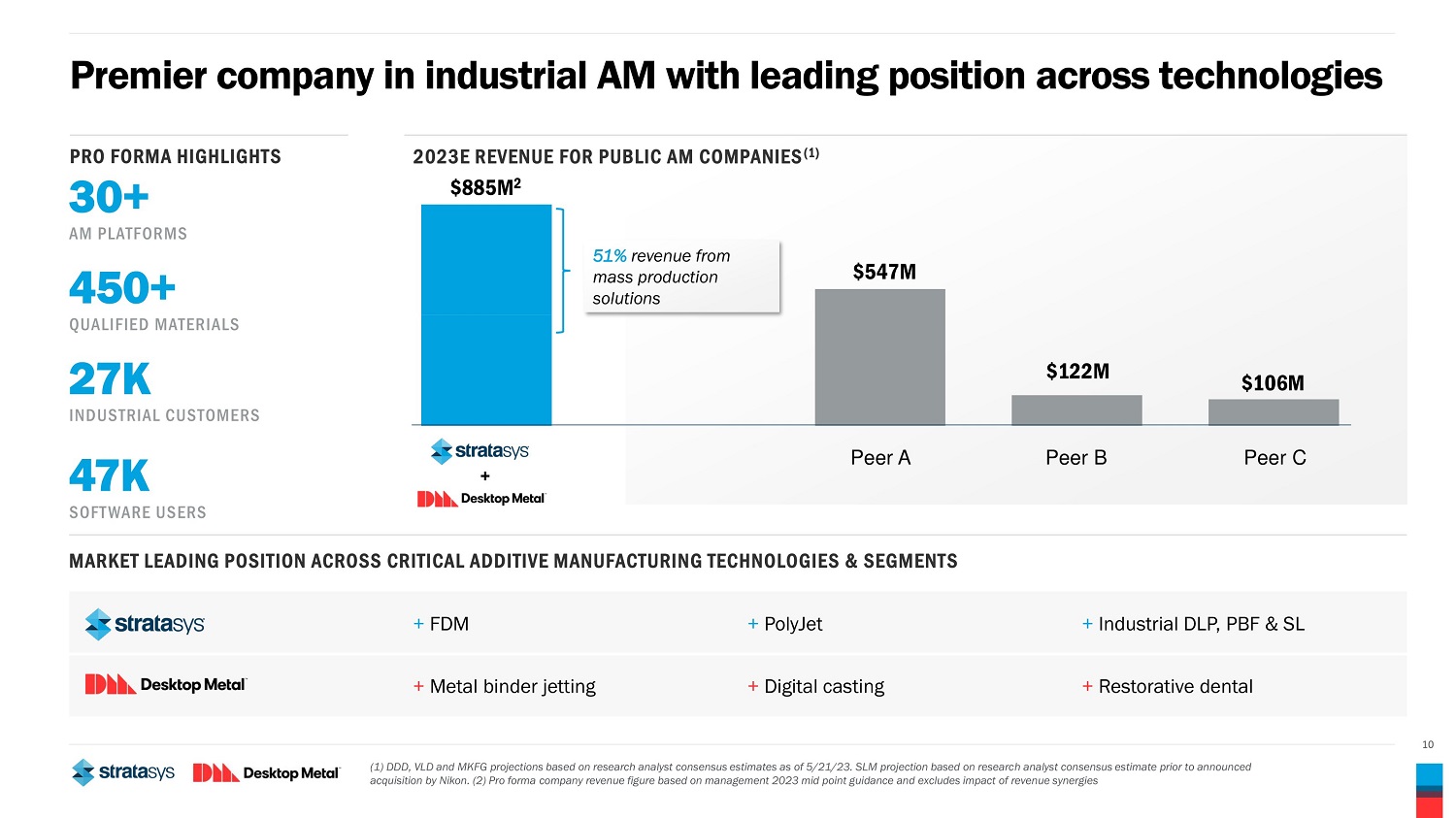

10 Premier company in industrial AM with leading position across technologies + FDM + PolyJet + Industrial DLP, PBF & SL + Metal binder jetting + Digital casting + Restorative dental (1) DDD, VLD and MKFG projections based on research analyst consensus estimates as of 5/21/23. SLM projection based on research analyst consensus estimate prior to announced acquisition by Nikon. (2) Pro forma company revenue figure based on management 2023 mid point guidance and excludes impact of revenue synergies 2023E REVENUE FOR PUBLIC AM COMPANIES (1) PRO FORMA HIGHLIGHTS 30+ AM PLATFORMS MARKET LEADING POSITION ACROSS CRITICAL ADDITIVE MANUFACTURING TECHNOLOGIES & SEGMENTS + $885M 2 $547M $122M $106M 51% revenue from mass production solutions 450+ QUALIFIED MATERIALS 27K INDUSTRIAL CUSTOMERS 47K SOFTWARE USERS Peer A Peer B Peer C

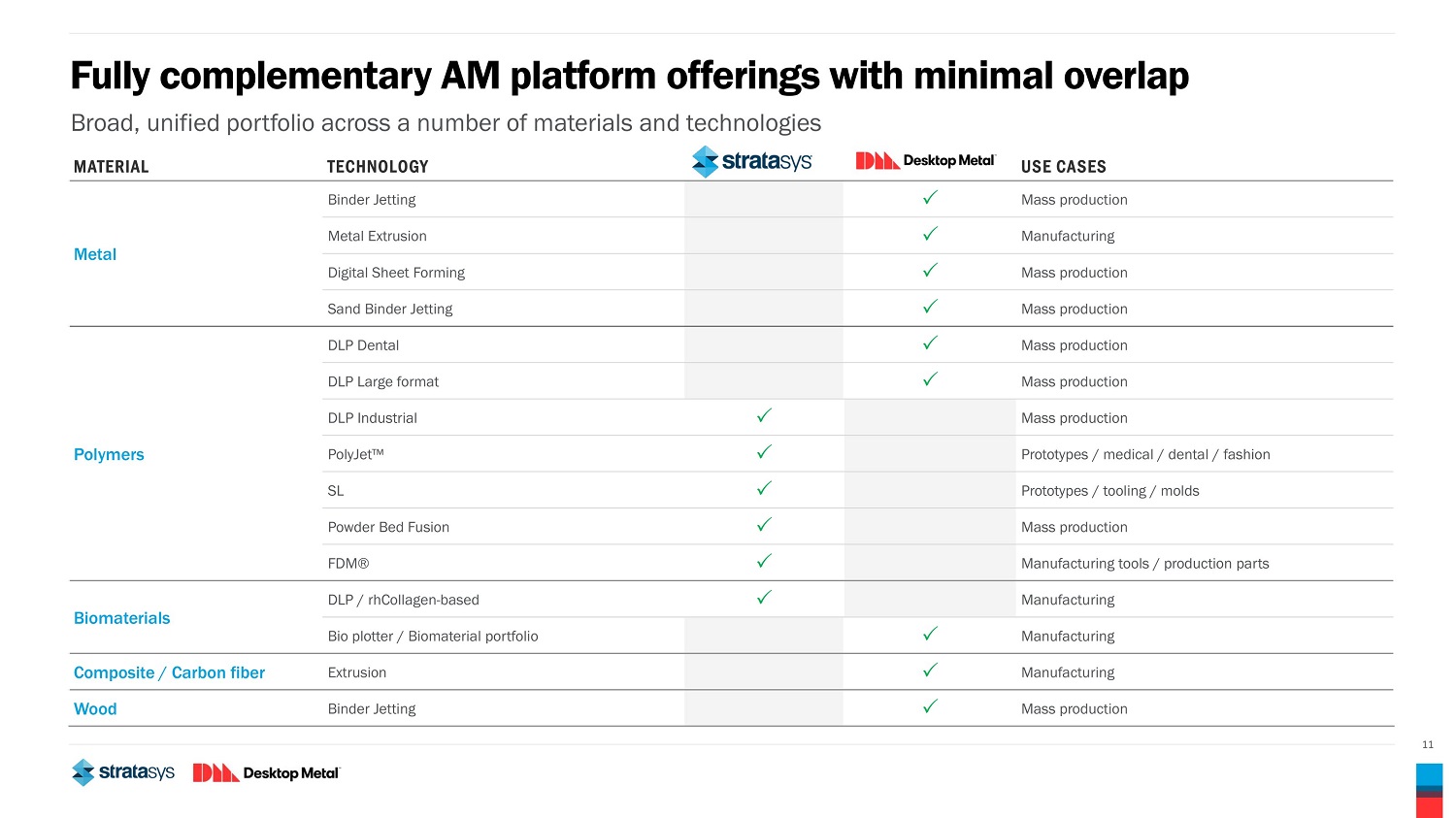

11 Fully complementary AM platform offerings with minimal overlap Broad, unified portfolio across a number of materials and technologies MATERIAL TECHNOLOGY USE CASES Metal Binder Jetting Mass production Metal Extrusion Manufacturing Digital Sheet Forming Mass production Sand Binder Jetting Mass production Polymers DLP Dental Mass production DLP Large format Mass production DLP Industrial Mass production PolyJet Œ Prototypes / medical / dental / fashion SL Prototypes / tooling / molds Powder Bed Fusion Mass production FDM® Manufacturing tools / production parts Biomaterials DLP / rhCollagen - based Manufacturing Bio plotter / Biomaterial portfolio Manufacturing Composite / Carbon fiber Extrusion Manufacturing Wood Binder Jetting Mass production

12 $35B GROWTH OPPORTUNITY IN DENTAL MASS PRODUCTION Leading brands and superior technology to drive outsize growth in dental restorative market 1,000+ — Printers installed globally 2 600,000 + — Dentures printed since Flexcera launch in Jun - 21 2,3 70+ — Dental & biofabrication materials 2 • Insurance reimbursement on printed restorations available in US since Q1 ’23. Creates a $35B opportunity for AM to grow from <5% to >80% this decade • Strategic partnership with industry leader Align Technology • Leading materials including Flexcera with premier material properties and Truedent, the only monolithic multi - material direct printed dentures and restorations. Transformative capabilities to drive growth in ortho. • Leading digital dental & biofabrication production platform (Desktop Labs) – Positions us to enable digital workflows and managed chairside printing – Better patient outcomes and capture of larger portion of the value - chain – End - to - end solutions in biofabrication leveraging advanced R&D • World - class team with experience executing this strategy (1) Grand View Research 2021. Dental Laboratories Market Size, Share & Trends Analysis Report By Product (Restorative, Implant, Oral Care), By Equipment Type (Dental Lasers, Systems & Parts, Hygiene Maintenance Device), By Region, and Segment Forecasts, 2021 – 2028. (2) As of May 24, 2023. (3) Based on management calculations

$100B GROWTH OPPORTUNITY IN METAL, CARBIDES AND CERAMICS Bringing true mass production to metal additive manufacturing • The industry’s leading global position in binder jet with the highest throughput systems, over 15 print platforms covering 1L to 1,800L print volumes and more than +45 materials qualified • Fastest 3D printing for metals, technical ceramics and carbides - up to 100X the speed of legacy technology (1) • Largest and growing base of +1,200 customers • Adoption at scale in large markets like automotive and consumer electronics • Strong traction in aerospace with mass production of parts and components flying in aerospace platforms from Airbus (319 neo), Rolls Royce Trent Engine and airframes from Sikorsky, Lockheed Martin and Northop Grumman • High penetration in mass production of carbide cutting tools with leaders like Sandvik and Kennametal • Leadership in 3D printing of nuclear materials via binder jet, an enabling technology for TRISO based SMRs and NTP • Best in class technology for mass production of technical ceramics like Silicon Carbide • Highly patented differentiated technology 13 Images courtesy of BMW and FreeForm Technologies; (1) Based on published speeds of binder jetting and laser powder bed fusion systems comparable to the Production System Œ P - 50 and using comparable materials and processing parameters.

14 SSYS and DM are already transforming polymer mass - production Select applications in mass - production SPARE PARTS (ANYTHING ANYWHERE) INDUSTRIAL ACCURATE PARTS (E.G., CONNECTORS) INDUSTRIAL REPLACEMENT OF INJECTION MOLDING FOAM SOLUTION FOR LARGE PARTS IN AEROSPACE & AUTOMOTIVE

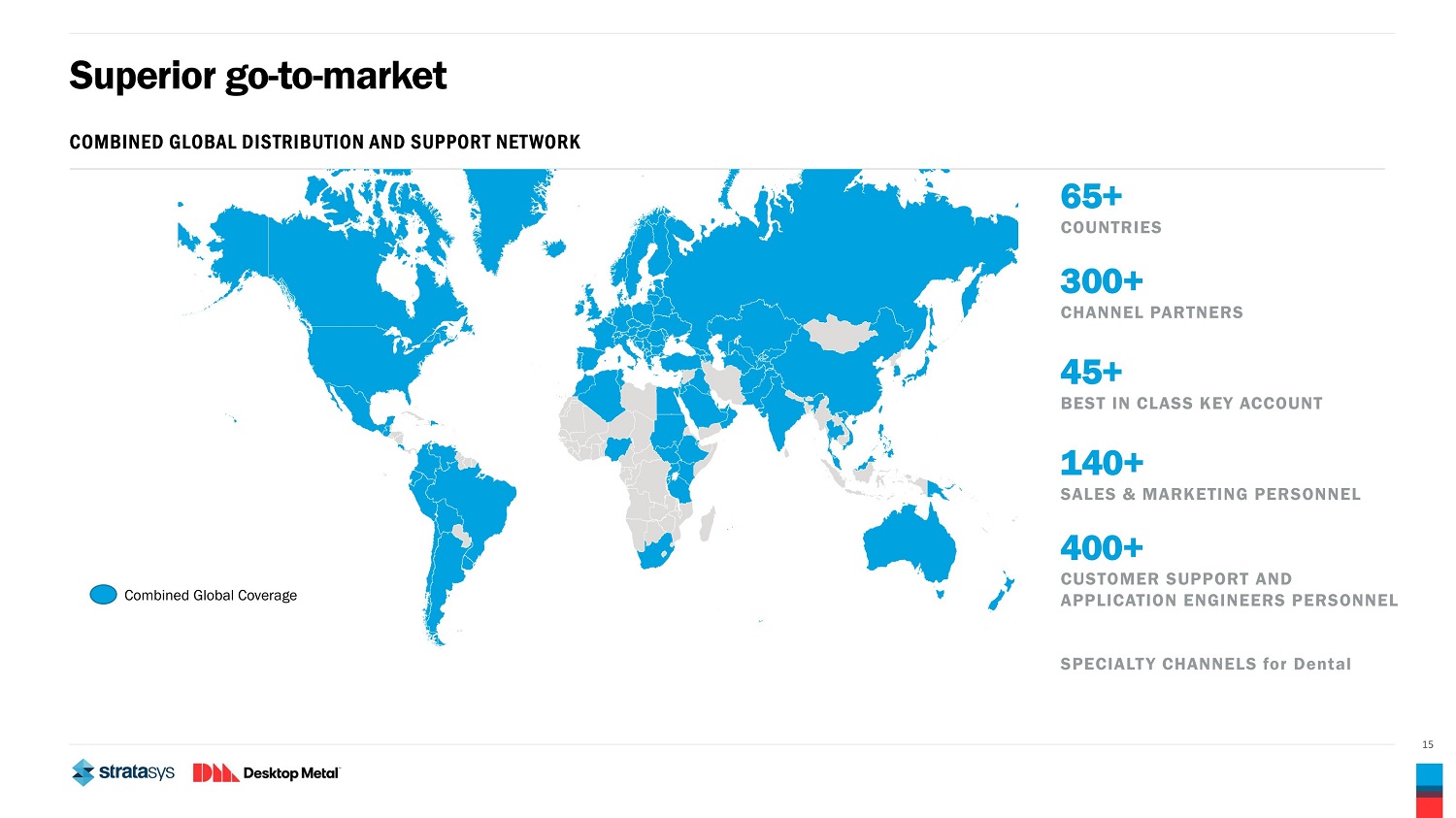

15 Superior go - to - market COMBINED GLOBAL DISTRIBUTION AND SUPPORT NETWORK Combined Global Coverage 65+ COUNTRIES 300+ CHANNEL PARTNERS 45+ BEST IN CLASS KEY ACCOUNT 140+ SALES & MARKETING PERSONNEL 400+ CUSTOMER SUPPORT AND APPLICATION ENGINEERS PERSONNEL SPECIALTY CHANNELS for Dental

16 • One of the largest R&D teams in the industry • Significant investment towards innovation for both companies • Creates a moat that will keep the Company ahead of competitors Innovation powerhouse • Complementary IP portfolio across printers, software, processes and materials (polymer and metal) • Seminal patents already generating royalties ONE OF THE LARGEST IP PORTFOLIOS IN THE AM INDUSTRY + 3,400+ PATENTS AND PENDING PATENT APPLICATIONS INDUSTRY - LEADING INVESTMENT IN INNOVATION + $500M 4 - YEAR CUMULATIVE R&D SPEND (1) (1) Reflect cumulative 2019 - 2022 non - GAAP figures

17 Consumer products Includes final goods for households or personal use, as well as parts that aid in the manufacturing of final goods Selected customers across end markets Aerospace Includes aviation, space flight, and defense technologies Automotive Includes automotive OEMs, tier 1 to tier n’s, as well as bus, trucks, and motorcycles Medical & Dental Includes other products for diverse medical, dentistry and orthodontics Heavy industry Includes all parts related to machinery and manufacturing not included in the other verticals Innovative solutions for clients at the cutting edge

18 Significant run - rate synergy potential across the business ANNUAL RUN - RATE REVENUE SYNERGIES (1) ANNUAL RUN - RATE COST SYNERGIES (1) COGS Leverage scale to optimize manufacturing costs Corporate Costs and Other G&A Elimination of duplicative public company costs Other Opex Synergies Technology and infrastructure optimization $50M RUN - RATE COST SYNERGIES (2) Design, Research and pre - production Manufacturing and mass production Broad and complementary products and services, enabling broader distribution and enhanced market access $50M RUN - RATE REVENUE SYNERGIES (1) Based on management estimates. Run - rate synergies expected to be realized by CY 2025E.

19 Segments Revenue (2023E mid - point guidance) Mid - term annual revenue growth 2025E target Mass production 51% 20% – 25% Prototyping 49% 5% – 10% Total revenue ~$885M 13% – 18% $1.1B Gross margin 45%+ Adj. EBITDA margin 10% – 12% Attractive financial model Well - Capitalized Balance Sheet Together, the companies had ~$437 (1) of cash as of 1Q 2023 PRO FORMA COMPANY EXPECTED TO BE WELL - POSITIONED FINANCIALLY Revenue Growth and Synergies Existing customers benefit from the broad and complementary products and services provided by the combined company, enabling cross selling Significant Cost Synergies Leveraging combined scale to optimize costs, expecting to generate over $50M in annualized synergies by 2025 (1) Includes cash and cash equivalents and short - term investments, before executing the Covestro acquisition

20 SSYS + DM will deliver benefits for all stakeholders • Significant opportunity to capture the value of AM for mass production • Expected to achieve $50 million in additional annual run - rate cost synergies by 2025 • Expected to achieve $50 million in annual run - rate revenue synergies by 2025 • Double - digit growth • Targeting $1.1B revenue and 10 - 12% adjusted EBITDA margin in 2025 • Well - capitalized company • Exposure to the broadest and most innovative technologies in AM • Expanded opportunities • Shared values of commitment to innovation and customer success • Full end to end solutions by vertical • Receive superior value (cost, quantity, reliability) • Best customer support in the industry • Access to innovation (800+ scientists/engineers) • Unique technologies that transform customers’ business Shareholders Employees Customers

Q&A May 24, 2023