furnace using proprietary technology purpose-built to provide industrial strength, partial-pressure and vacuum-enabled sintering in an office-friendly package. Sintering is a critical step for powder metallurgy-based metal additive manufacturing processes. Our furnace, which is designed to achieve temperatures up to 1,400 degrees Celsius and can fit through ADA-compliant doors, enables Studio System and Shop System customers with minimal additive manufacturing experience or materials expertise to process high-density, complex metal parts entirely in-house without third-party equipment required. We also provide a range of consumables and materials optimized for use with our additive manufacturing systems and designed to enable high-quality parts.

Global distribution capabilities

We have developed an industry-leading global distribution network for our metal and composite additive manufacturing solutions consisting of over 265 resellers covering over 60 countries around the world and within a short drive of a significant portion of worldwide manufacturing sector locations. Our resellers, who have extensive experience across digital modeling, 3D printing, and metal manufacturing processes, provide marketing, sales, application engineering, and local support services for end users across an array of vertical markets. They also bring an existing base of customers into which we can drive awareness of and ultimately sell our additive manufacturing solutions.

Visionary and experienced management team

Our management team has deep operational experience bringing emerging technologies to market across the hardware and software sectors. In engineering, we are led by accomplished and visionary technologists across the additive manufacturing, robotics, and materials science industries, including a lead inventor of binder jetting and an industry authority in powder metallurgy. Our commercialization efforts are managed by individuals with prior successes in building and growing indirect, channel-driven sales organizations.

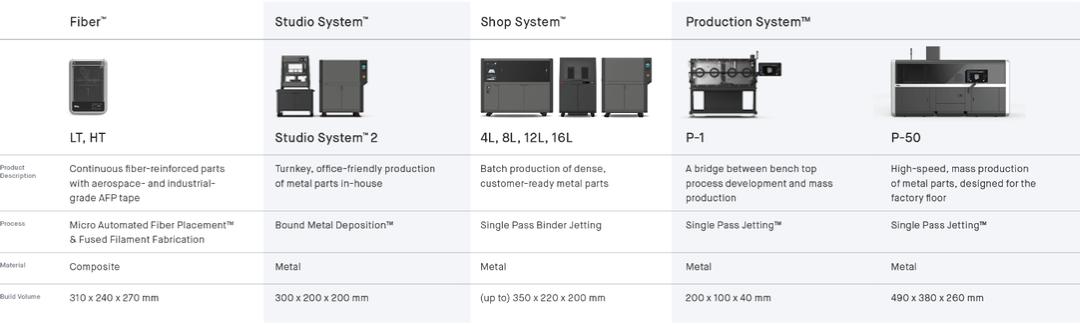

Our Product Platforms

Production System

Created by leading inventors of binder jetting and single-pass inkjet technology, Production System technology is designed to be the fastest way to 3D print metal parts at scale. The Production System platform consists of two printer models. The P-1, which began commercial shipments in the fourth quarter of 2020, is a small form factor solution for process and materials development and serial production applications. The P-50, which is scheduled to begin commercial shipments in 2021 and is operational at select early customers today, is a large form factor mass production solution for end-use parts.

Both the Production System P-1 and P-50 leverage our patented SPJ technology, which can achieve print speeds up to 12,000 cubic centimeters per hour at a 65-micron printed layer height. SPJ represents a significant step forward from conventional binder jetting, which uses multiple carriages to complete the steps required to print each layer, including depositing, spreading, and compacting a thin layer of powder in a “build box” and then depositing and drying liquid binding agent, or binder, in the regions that will form parts. The sequential nature of this conventional process adds time per layer and reduces productivity. SPJ consolidates

11