EXHIBIT G

LANDLORD’S CONSENT AND WAIVER

WHEREAS,(the “Tenant”) has or is about to enter into certain financing agreements with (the “Bank”) pursuant to which the Bank has been or may be granted a security interest in certain property of the Tenant; and

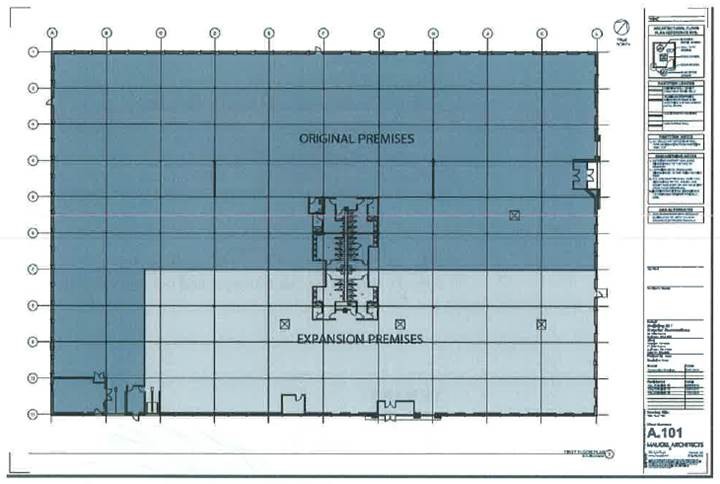

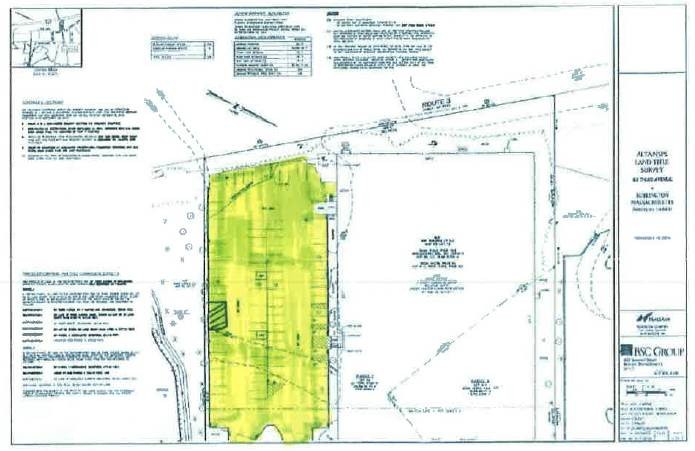

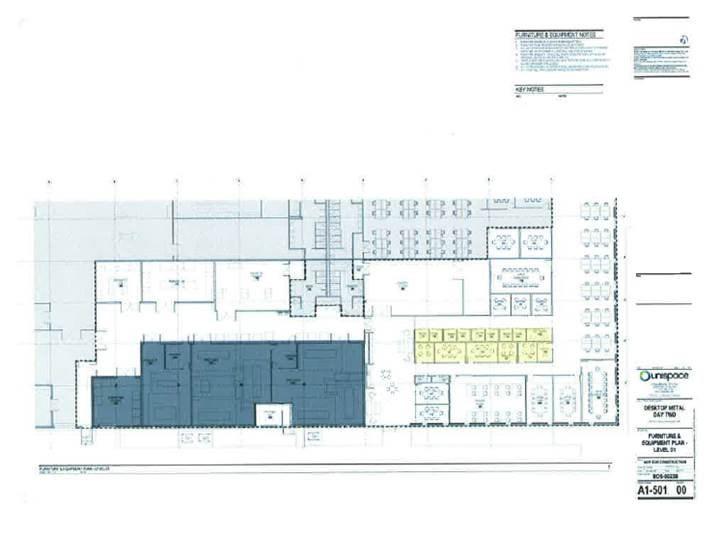

WHEREAS, Tenant is the tenant, pursuant to a lease agreement by and between Tenant and the undersigned (the “Landlord”) dated as of(the “Lease”), of certain demised premises contained in the building located at the following address:

and more particularly described in the Lease (the “Premises”);

NOW, THEREFORE, for valuable consideration, the Landlord agrees, for as long as Tenant remains indebted to the Bank, as follows:

(a)Landlord acknowledges and agrees that the personal property of Tenant (which for purposes hereof shall not include computer wiring, telephone wiring and systems, and demountable partitions) in which the Bank has been granted a security interest (the “Bank Collateral”) may from time to time be located on the Premises;

(b)Landlord subordinates, waives, releases and relinquishes unto the Bank, its successors or assigns, all right, title and interest, if any, which the Landlord may otherwise claim in and to the Bank Collateral, except as provided in subparagraph (d) hereinbelow;

(c)Upon providing the Landlord with at least five (5) business days’ prior written notice that Tenant is in default of its obligations to the Bank, the Bank shall then have the right to enter the Premises during business hours for the purpose of removing said Bank Collateral, provided (i) the Bank completes the removal of said Bank Collateral within ten (10) business days following said first written notice of default, and (ii) the Bank restores any part of the Premises which may be damaged by such removal to its condition prior to such removal in an expeditious manner not to exceed ten (10) business days following said first written notice of default;

(d)Upon receipt of written notice from Landlord of the expiration or earlier termination of the Lease, the Bank shall have ten (10) business days to enter the Premises during business hours, remove said Bank Collateral, and restore any part of the Premises which may be damaged by such removal to its condition prior to such removal. If the Bank fails to so remove the Bank Collateral, the Bank agrees that the Bank Collateral shall thereupon be deemed subject to the yield up provisions of the Lease, so the Landlord may treat the Bank Collateral as abandoned, deem it Landlord’s property, if Landlord so elects, and retain or remove and dispose of it, all as provided in the Lease;

(e)All notices and other communications under this Landlord’s Consent and Waiver shall be in writing, and shall be delivered by hand, by a nationally recognized commercial next day delivery service, or by certified or registered mail, return receipt requested, and sent to the following addresses:

| if to the Bank: | | |

| | |

| | | |

| Attention: | | |